LONDON MARKETS: FTSE 100 Ends At 5-week High After ECB Decision

December 08 2016 - 1:49PM

Dow Jones News

By Carla Mozee, MarketWatch

Benchmark keeps win streak alive; Article 50 hearings in final

day

U.K. stocks finished a five-week high Thursday, rising alongside

European equities after the European Central Bank said it would

continue to buying government bonds at an adjusted pace through

next year.

The FTSE 100 rose 0.4% to close at 6,931.55, its highest

settlement since Oct. 31, according to FactSet data. All but the

industrial sector finished with gains. The index marked a fourth

straight advance, the longest winning streak since late September.

On Wednesday, it jumped 1.8%.

(http://www.marketwatch.com/story/ftse-100-climbs-1-powered-by-mining-shares-2016-12-07)

Stocks had sagged early as investors waited to hear what the

European Central Bank would do with monetary policy at its last

meeting of 2016. During afternoon trade, the bank, led by President

Mario Draghi, decided to keep buying government bonds through

December 2017, but by EUR60 billion a month starting in April.

Right now, the ECB purchases EUR80 billion in bonds a month.

While London-listed blue-chips rose, stronger gains were seen in

the broader European equity market , with Germany's DAX 30 jumping

to its highest settlement of the year.

U.K. stocks have benefited from the ECB's bond buying in the

eurozone, as proceeds from selling debt have been used to buy

British equities and other assets. The eurozone is the U.K.'s

largest trading partner.

Read: European stocks at 11-month high, euro whipsawed as ECB

extends bond buying

(http://www.marketwatch.com/story/european-stocks-edge-higher-as-ecb-decision-looms-2016-12-08)

Among London-listed bank shares, Royal Bank of Scotland PLC

(RBS.LN) rose 1.4% and Lloyds Banking Group PLC (LLOY.LN) swung

higher to end up 0.8%. Barclays PLC (BCS) leapt 1.8% after

Jefferies upgraded the lender to hold from underperform.

But Asia-focused banks HSBC Holdings PLC (HSBA.LN) (HSBA.LN) and

Standard Chartered PLC (STAN.LN) fell 0.5% and 2.7%,

respectively.

The ECB also said it would now be able to buy debt yielding less

than its deposit rate of minus 0.4%, which widens the pool of

available bonds to purchase. Such purchases are an option, not a

necessity, Draghi said at a press conference.

"The prospect of tapered monthly purchases and lower-for-longer

negative yields means that the ECB's reflation channels have

shifted in favor of a weaker euro and higher equity markets, with

negative discount rates and a cheaper exchange rate clearly

benefiting stock valuations," wrote Lena Komileva, chief economist

at G+Economics, in a note.

Movers: Capita PLC shares (CPI.LN) tumbled 14%, with its biggest

decline since Sept. 30 spurred after the support services firm cut

its 2016 profit forecast

(http://www.marketwatch.com/story/capita-lowers-profit-guidance-starts-cost-cutting-2016-12-08)

and said it is selling some of its businesses that no longer fit

its core business strategy.

The planned disposal of its Assets Services division "may be due

to it being viewed as non-core, but it accounts for nearly 10% of

revenues, is one of the biggest contributors to underlying profits

(16%) and appears to be performing 'well,'" wrote Mike van Dulken,

Accendo Markets's head of research.

"Further government-inspired Brexit uncertainty and clients

shying away may also even mean that further profits warnings can't

be excluded either," he added.

Advertising firm WPP PLC (WPP.LN) ended 4.6% higher following a

ratings upgrade to buy from hold at Jefferies.

TUI AG rose 4.4% after the travel-services company posted a rise

in fiscal-year profit

(http://www.marketwatch.com/story/tui-profit-rises-trading-in-line-with-expecations-2016-12-08)

and its dividend. It also said trading is in line with expectations

over the winter.

Among midcaps, shares of William Hill PLC (WMH.LN) dropped 6%,

with The Times newspaper

(http://www.thetimes.co.uk/article/cut-betting-terminal-stake-to-2-mps-demand-kl6lkqjvj)

reporting that a cross-party group of U.K. lawmakers will demand

stricter controls on betting machines.

The pound was buying $1.2575, down from $1.2621 late Wednesday.

Thursday was the last day of hearings at the U.K.'s Supreme Courts,

where government lawyers are seeking to overturn a November ruling

that parliament must approve the start of negotiations over the

U.K.'s exit from the European Union.

The government argues that it has the authority to trigger the

so-called Article 50 process without having to seek approval from

lawmakers. A decision will come "as soon as possible," the BBC on

Thursday quoted Supreme Court President David Neuberger as saying

(http://www.bbc.co.uk/news/uk-politics-38247937).

(END) Dow Jones Newswires

December 08, 2016 13:34 ET (18:34 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

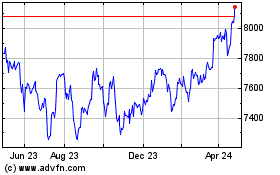

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

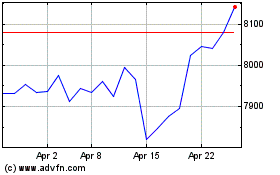

FTSE 100

Index Chart

From Apr 2023 to Apr 2024