LONDON MARKETS: FTSE 100 Edges Up, Reaches For A Weekly Win

July 21 2017 - 4:38AM

Dow Jones News

By Carla Mozee, MarketWatch

Vodafone rises on outlook, but oil majors lose ground

U.K. stocks notched small gains on Friday, putting Britain's

blue-chip benchmark on track for its best week in more than two

months, even as stock markets across Europe broadly fell.

Vodafone PLC was a standout as shares of the mobile telecoms

company drove higher, but oil majors lost ground ahead of a meeting

of the Organization of the Petroleum Exporting Countries.

The FTSE 100 index was up 0.1% at 7,493.78, with

consumer-related and health care shares rising. But technology,

commodity and financial stocks were on the decline.

A win Friday would be the London benchmark's third in a row. It

was on course for a weekly rise of 1.6%, which would be its

sharpest advance since the week ended May 12, FactSet data

showed.

U.K. stocks on Thursday marked their highest close since

mid-June

(http://www.marketwatch.com/story/ftse-100-lifted-as-unilever-advances-with-ecb-meeting-in-focus-2017-07-20),

in part as the pound fell against the dollar. U.K. officials

wrapped up round two of Brexit talks on Thursday, with British and

EU officials clashing over the U.K.'s bill for exiting

(http://www.marketwatch.com/story/uk-eu-clash-over-divorce-bill-as-round-2-of-brexit-talks-wrap-up-2017-07-20)

from the bloc.

Stock movers: Vodafone (VOD.LN) picked up 1.4% after the mobile

phone services provider reiterated its earnings outlook for the

full year

(http://www.marketwatch.com/story/vodafone-revenue-drops-on-forex-effects-2017-07-21).

Among other top advancers in London trade were British Airways

parent International Consolidated Airlines Group SA (IAG.LN) and

apparel and home furnishings seller Next PLC (NXT.LN) , rising 1.6%

and 0.8%, respectively.

On the downside, Paddy Power Betfair PLC fell 2.9% and British

Land Co. (BLND.LN) shed 0.9%.

OPEC ahead: Royal Dutch Shell PLC (RDSB.LN) and BP PLC (BP.LN)

were each off roughly 0.4% although oil prices were moving slightly

higher.

The oil market will be back in focus as OPEC oil ministers are

set to gather Monday for a monthly meeting to monitor producer

compliance with output quotas.

Read:How OPEC committee's coming meeting could make or break oil

prices

(http://www.marketwatch.com/story/how-opec-committees-coming-meeting-could-make-or-break-oil-prices-2017-07-20)

Bucking Europe: The FTSE 100 on Friday continued to outperform

European stocks (), which dropped Thursday as the euro rallied to a

two-year high above $1.16.

Read:Nobody told the euro that Mario Draghi was dovish

(http://www.marketwatch.com/story/nobody-told-the-euro-that-mario-draghi-was-dovish-2017-07-20)

Those moves came after European Central Bank President Mario

Draghi said the bank's bond-buying program will be discussed in the

"autumn," and as investors brushed past the dovish tone about

monetary stimulus that Draghi struck at his press conference.

On Friday, the pan-European Stoxx Europe 600 index was tilting

lower, while the euro continued to rally.

The pound fetched EUR1.1138 on Friday, slightly lower than

EUR1.1153 late Thursday in New York. Against the dollar, it was

changing hands at $1.2992, up from $1.2973.

A weaker pound can help shares of FTSE 100-listed multinational

companies that make most of their revenue and earnings in overseas

markets.

(END) Dow Jones Newswires

July 21, 2017 04:23 ET (08:23 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

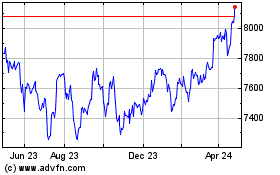

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

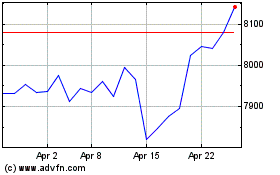

FTSE 100

Index Chart

From Apr 2023 to Apr 2024