Kraft Withdraws $143 Billion Offer for Unilever -- 2nd Update

February 19 2017 - 2:32PM

Dow Jones News

LONDON -- Kraft Heinz Co. dropped its $143-billion offer for

rival Unilever PLC, just a little more than 48 hours after making

an audacious bid to combine two of the world's biggest

packaged-food companies.

In a brief statement Sunday, Kraft said it "has amicably agreed

to withdraw its proposal."

A Kraft spokesman said the company's intention was to proceed on

a friendly basis, and that its interest was made public at "an

extremely early stage." After Unilever made clear it didn't want to

pursue a tie-up, the spokesman said, "it was best to step away

early so both companies can focus on their own independent plans to

generate value."

The U-turn is a big victory for Unilever Chief Executive Paul

Polman, who was digging in over the weekend to resist the

unsolicited offer. The deal faced steep hurdles from the start --

first among them a determination by Unilever's board and management

that the 18% premium Kraft offered to the company's value was

inadequate.

Mr. Polman was ramping up a defense, telling board members and

investors that Kraft's cost-cutting ethos could damage Unilever

brands and highlighting its lack of experience in personal-care and

household goods, according to people familiar with the matter.

While price remained key, Mr. Polman also wanted to protect

Unilever's reputation for promoting sustainability initiatives,

including environmental and human-rights efforts, according to

people familiar with the matter. Some investors have complained in

the past that Mr. Polman has spent too much time on those efforts,

instead of focusing on returns. Supporters say the efforts help,

including by attracting stronger talent.

In its statement, Kraft said it has the "utmost respect for the

culture, strategy and leadership" of Unilever.

Still, price remained the biggest factor, after Unilever

management rejected the $50-a-share cash-and-stock offer outright

Friday. Directors had been considering a board meeting as early as

this week, but serious discussions about Kraft's approach were

never likely without a higher price, according to one person

familiar with the matter.

Valuation aside, 3G Capital Partners LP, which orchestrated the

2015 merger of Kraft and Heinz with Warren Buffett, and remains

Kraft's biggest shareholder, faced a host of other hurdles that

made a deal more complicated to pull off. Unilever maintains a

complicated dual structure in the U.K. and the Netherlands that

gave governments, regulators, certain shareholders and other

players outsize say in whether a deal got done.

In the Netherlands, the company's European Works Council,

comprising worker representatives, must be kept apprised of deal

developments. It probably couldn't have prevented a deal from

happening. But with an election in the Netherlands being held next

month, labor opposition could have triggered closer scrutiny by the

government.

Meanwhile, two big institutional investors in the Netherlands

were set to play an important role, and their sentiment over the

deal was uncertain. Insurers NN Group NV and ASR Nederland NV,

which is majority owned by the Dutch government, together account

for about 20% of the voting rights in Unilever NV, the Dutch arm,

according to a person familiar with the holdings. That translates

into roughly 8% of the combined companies' voting rights.

In the U.K., the Leverhulme Trust, a research-focused charity,

owns over 5% of the British arm of the company, according to

FactSet. The trust was set up in 1925 by William Hesketh Lever, the

founder of Lever Bros., which merged with a Dutch margarine maker

to form Unilever. The trust's board includes Mr. Polman and two

former Unilever CEOs. A trust representative didn't immediately

respond to a request for comment.

(END) Dow Jones Newswires

February 19, 2017 14:17 ET (19:17 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

Unilever (LSE:ULVR)

Historical Stock Chart

From Mar 2024 to Apr 2024

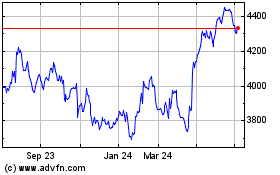

Unilever (LSE:ULVR)

Historical Stock Chart

From Apr 2023 to Apr 2024