Kraft Withdraws $143 Billion Offer for Unilever -- Update

February 19 2017 - 2:13PM

Dow Jones News

LONDON -- Kraft Heinz Co. dropped its $143-billion offer for

rival Unilever PLC, just a little more than 48 hours after making

an audacious bid to combine two of the world's biggest

packaged-food companies.

In a brief statement Sunday, Kraft said it "has amicably agreed

to withdraw its proposal."

A Kraft spokesman said the company's intention was to proceed on

a friendly basis, and that its interest was made public at "an

extremely early stage." After Unilever made clear it didn't want to

pursue a tie-up, the spokesman said, "it was best to step away

early so both companies can focus on their own independent plans to

generate value."

The U-turn is a big victory for Unilever Chief Executive Paul

Polman, who was digging in over the weekend to resist the

unsolicited offer. The deal faced steep hurdles from the start --

first among them a determination by Unilever's board and management

that the 18% premium Kraft offered to the company's value was

inadequate.

Mr. Polman was ramping up a defense, telling board members and

investors that Kraft's cost-cutting ethos could damage Unilever

brands and highlighting its lack of experience in personal-care and

household goods, according to people familiar with the matter.

(END) Dow Jones Newswires

February 19, 2017 13:58 ET (18:58 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

Unilever (LSE:ULVR)

Historical Stock Chart

From Mar 2024 to Apr 2024

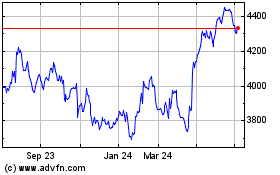

Unilever (LSE:ULVR)

Historical Stock Chart

From Apr 2023 to Apr 2024