Kraft Heinz Sales Hurt by Currency

May 04 2016 - 5:40PM

Dow Jones News

Kraft Heinz Co., run by the Brazilian private-equity firm 3G

Capital Partners LP, said Wednesday that sales fell 3.8%, mostly

because of currency headwinds.

Net sales declined 11.7% in Europe and 15.6% in the rest of the

world, on a pro forma basis, assuming Kraft had been acquired as of

December 30, 2013. Net sales in the U.S. were nearly flat, inching

up 0.2%.

Selling, general and administrative expenses dropped 12.8% to

$865 million, on a pro forma basis, helping the company beat

expectations for adjusted earnings and revenue.

"Our savings are coming in faster than anticipated, and we're

performing better where it matters most, with our customers and

consumers in the marketplace," Chief Executive Bernardo Hees said

in prepared remarks.

Shares of the company, down 5.3% over the past 12 months, rose

5% to $84.01 in after-hours trading.

Food companies have been scrambling to keep pace with shifting

consumer tastes as more people avoid processed food in favor of

fresher ingredients.

"Consumption trends in a number of our core categories remain

challenging, and we're entering a critical phase in our North

American supply chain integration," Mr. Hees said.

For the quarter ended April 3, Kraft Heinz earned $896 million,

or 73 cents a share, compared with $96 million, or 24 cents a

share, a year before the merger. On a pro forma basis, per-share

earnings rose to 73 cents from 46 cents.

Revenue fell 3.8% to $6.57 billion on a pro forma basis.

Analysts surveyed by Thomson Reuters expected earnings of 62

cents a share on revenue of $6.5 billion.

Kraft Heinz is run by 3G Capital, which bought Heinz in 2013

with the help of Warren Buffett's Berkshire Hathaway Inc.

The firm was a key architect of the merger between Kraft and

Heinz and is known for pushing its company to cut costs using a

method called zero-base budgeting, which calls for departments to

justify their budget at the start of each new period.

Write to Ezequiel Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

May 04, 2016 17:25 ET (21:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

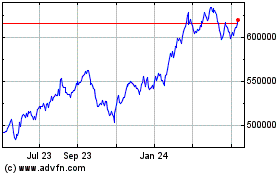

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

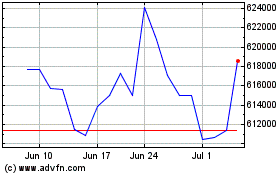

Berkshire Hathaway (NYSE:BRK.A)

Historical Stock Chart

From Apr 2023 to Apr 2024