Highlights

For the three months ended June 30, 2016, KNOT Offshore

Partners LP (“KNOT Offshore Partners” or the “Partnership”):

- Generated highest ever quarterly

revenues of $43.1 million, operating income of

$20.2 million and net income of $11.6 million.

- Generated highest ever quarterly

Adjusted EBITDA of $34.1 million.1

- Generated highest ever quarterly

distributable cash flow of $18.5 million1 with a distribution

coverage ratio of 1.23.1

- Achieved strong operational performance

with 99.9% utilization of the fleet.

In addition:

- On June 30, 2016, the Partnership

entered into an amended and restated senior secured credit

facility, which includes a new revolver facility tranche of $15

million, in order to further strengthen the balance sheet and

increase financial flexibility.

- On May 18, 2016, the Partnership’s

subordinated units, all of which were held by Knutsen NYK Offshore

Tankers (“Knutsen NYK”), were converted to common units on a

one-for one basis.

- Due to the increase in the price of the

Partnership’s common units from $16.40 on March 31, 2016 to $18.56

on June 30, 2016, the Partnership and the Partnership’s general

partner elected not to repurchase any common units under the common

unit repurchase program during the second quarter of 2016.

Subsequent events:

- On July 15, 2016, the Partnership

declared a cash distribution of $0.52 per unit with respect to the

quarter ended June 30, 2016 to be paid on August 15, 2016 to

unitholders of record as of the close of business on August 3,

2016.

Financial Results Overview

Total revenues were $43.1 million for the three months ended

June 30, 2016 (the “second quarter”) compared to $42.0 million for

the three months ended March 31, 2016 (the “first quarter”), an

increase of $1.1 million. The increase was mainly due to a full

quarter of earnings from the Bodil Knutsen as the vessel incurred

21 days of off-hire during the first quarter in connection with its

scheduled drydocking.

Vessel operating expenses for the second quarter of 2016 were

$8.0 million, compared to $7.6 million in the first quarter.

General and administrative expenses were $0.9 million for the

second quarter of 2016, a decrease of $0.4 million compared to the

first quarter of 2016 mainly due to year end close expenses in the

first quarter.

As a result, operating income for the second quarter of 2016 was

$20.2 million compared to $19.2 million in the first quarter

of 2016.

Net income for the three months ended June 30, 2016 was $11.6

million compared to $10.7 million for the three months ended

March 31, 2016. Net income was impacted by the recognition of

realized and unrealized losses on derivative instruments of

$3.2 million in the second quarter of 2016, consistent with

realized and unrealized losses on derivative instruments of $3.2

million in the first quarter of 2016. The unrealized non-cash

element of the mark-to-market losses was a $1.6 million loss

for the three months ended June 30, 2016 and a $2.3 million loss

for the three months ended March 31, 2016. Of the unrealized loss

for the second quarter of 2016, $1.5 million related to

mark-to-market losses on interest rate swaps due to a decrease in

long term interest rates.

Net income for the three months ended June 30, 2016 increased by

$4.7 million compared to net income for the three months ended June

30, 2015. The increase was primarily due to (i) an increase in

operating income of $2.8 million due to earnings from the Dan Sabia

and the Ingrid Knutsen being included in the Partnership’s results

of operations from June 15, 2015 and October 15, 2015,

respectively, (ii) a $6.2 million goodwill impairment charge

during the three months ended June 30, 2015 and (iii) a $4.5

million increase in total finance expense primarily caused by a

$3.2 million realized and unrealized loss on derivative instruments

in the three months ended June 30, 2016 compared to a $0.3 million

realized and unrealized gain on derivative instruments in the three

months ended June 30, 2015.

All ten of the Partnership’s vessels operated well throughout

the second quarter of 2016 with 99.9% utilization of the fleet.

Distributable cash flow was $18.5 million for the second quarter

of 2016, compared to $17.9 million for the first quarter of

2016. The increase in the distributable cash flow is mainly due to

increased earnings from the Bodil Knutsen as a result of its

drydocking during the first quarter. The distribution declared for

the second quarter of 2016 was $0.52 per unit, equivalent to an

annualized distribution of $2.08.

Amended and Restated Credit Facility

On June 30, 2016, the Partnership’s subsidiaries KNOT Shuttle

Tankers 18 AS, KNOT Shuttle Tankers 17 AS and Knutsen Shuttle

Tankers 13 AS, as borrowers, entered into an amended and restated

senior secured credit facility (the “Amended Senior Secured Loan

Facility”), which amended the Partnership’s original $240 million

senior syndicated secured loan facility secured by the shuttle

tankers Bodil Knutsen, Carmen Knutsen and Windsor Knutsen. The

Amended Senior Secured Loan Facility includes a new revolving

credit facility tranche of $15 million, bringing the total

revolving credit commitments under the facility to $35 million. The

new revolving credit facility matures in June 2019, bears interest

at LIBOR plus a fixed margin of 2.5% and has a commitment fee equal

to 40% of the margin of the revolving facility tranche calculated

on the daily undrawn portion of such tranche. The other material

terms from the original $240 million facility remain unaltered

including the margin on the existing $ 20 million revolver credit

facility which will remain at 2.125%

Financing and Liquidity

As of June 30, 2016, the Partnership had $55.7 million in

available liquidity which consisted of cash and cash equivalents of

$25.7 million and an undrawn revolving credit facility of

$30 million. The undrawn revolving credit facility is

available until June 10, 2019. The Partnership’s total interest

bearing debt outstanding as of June 30, 2016 was

$648.5 million ($652.0 million net of debt issuance cost). The

average margin paid on the Partnership’s outstanding debt during

the quarter ended June 30, 2016 was approximately 2.3% over

LIBOR.

As of June 30, 2016, the Partnership had entered into

foreign exchange forward contracts, selling a total notional amount

of $35.0 million against the NOK at an average exchange rate

of NOK 8.36 per 1.0 U.S. Dollar. These foreign

exchange forward contracts are economic hedges for certain vessel

operating expenses and general expenses in NOK.

As of June 30, 2016, the Partnership had entered into various

interest rate swap agreements for a total notional amount of

$407.7 million to hedge against the interest rate risks of its

variable rate borrowings. In March 2016, the Partnership extended

$125 million of interest swap agreements and in April 2016,

extended an additional $25 million of interest swap agreements.

These $150 million of interest rate swaps have an average interest

rate of 1.4% and extended the tenor of the Partnership’s existing

interest rate swaps by an average of 2.3 years from the second half

of 2018 to the second half of 2020. As of June 30, 2016, the

Partnership receives interest based on three or six month LIBOR and

pays a weighted average interest rate of 1.54% under its interest

rate swap agreements, which have an average maturity of

approximately 3.5 years. The Partnership does not apply hedge

accounting for derivative instruments, and its financial results

are impacted by changes in the market value of such financial

instruments.

As of June 30, 2016, the Partnership’s net exposure to floating

interest rate fluctuations on its outstanding debt was

approximately $218.6 million based on total interest bearing

debt outstanding of $652.0 million, less interest rate swaps

of $407.7 million and less cash and cash equivalents of

$25.7 million.

The Partnership’s outstanding interest bearing debt of

$652.0 million as of June 30, 2016 is repayable as

follows:

Annualrepayment

Balloonrepayment (US $ in thousands) Remainder of

2016 $ 30,042 $ — 2017 50,084 — 2018 48,495 154,927 2019 28,582

237,678 2020 17,650 — 2021 and thereafter 71,650

12,940 Total $ 246,503 $ 405,545

Outlook

To date, during the third quarter of 2016, utilization of the

Partnership’s fleet has been 100%. Operating income is expected to

be at same level as in the second quarter of 2016, as there is no

further scheduled off-hire for any of the Partnership’s vessels for

the remainder of 2016.

As of June 30, 2016, the Partnership’s fleet of ten vessels had

an average remaining fixed contract duration of 5.1 years. In

addition, the charterers of the Partnership’s time charter vessels

have options to extend their charters by an additional

2.5 years on average.

The Partnership has or expects to receive options to acquire

five vessels controlled by Knutsen NYK pursuant to the terms of the

omnibus agreement entered into in connection with the Partnerships

initial public offering (“IPO”). One of these vessels, the Raquel

Knutsen, delivered in 2015 and is chartered to Repsol Sinopec

Brazil under a time charter that expires in 2025, with options to

extend until 2030. Four vessels are under construction in South

Korea and China. As of June 30, 2016, the average remaining fixed

contract duration for these five vessels is 5.8 years. In addition,

the charterers have options to extend these charters by 11.2 years

on average.

Pursuant to the omnibus agreement, the Partnership also has the

option to acquire from Knutsen NYK any offshore shuttle tankers

that Knutsen NYK acquires or owns that are employed under charters

for periods of five or more years.

There can be no assurance that the Partnership will acquire any

vessels from Knutsen NYK.

The Board believes that there may be opportunities for growth of

the Partnership, which may include current identified acquisition

candidates, and that the demand for offshore shuttle tankers will

continue to grow over time based on identified projects. Future

developments will influenced by the rate of growth of offshore oil

production activities when the existing projects are completed.

The Board is pleased with the results of operations of the

Partnership for the quarter ended June 30, 2016.

About KNOT Offshore Partners LP

KNOT Offshore Partners owns operates and acquires shuttle

tankers under long-term charters in the offshore oil production

regions of the North Sea and Brazil. KNOT Offshore Partners owns

and operates a fleet of ten offshore shuttle tankers with an

average age of 4.6 years.

KNOT Offshore Partners is structured as a publicly traded master

limited partnership. KNOT Offshore Partners’ common units trade on

the New York Stock Exchange under the symbol “KNOP.”

The Partnership plans to host a conference call on Thursday,

August 11, 2016 at noon (Eastern Time) to discuss the results for

the second quarter of 2016, and invites all unitholders and

interested parties to listen to the live conference call by

choosing from the following options:

- By dialing 1-855-209-8259 or

1-412-542-4105, if outside North America.

- By accessing the webcast, which will be

available for the next seven days on the Partnership’s website:

www.knotoffshorepartners.com

August 10, 2016

KNOT Offshore Partners L.P.

Aberdeen, United Kingdom

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS

Three Months

Ended Six Months Ended (USD in thousands)

June30, 2016 March31, 2016

June30, 2015 June 30, 2016

June 30, 2015 Time charter and bareboat revenues (1) $

42,864 $ 41,826 $ 36,981 $ 84,690 $

73,052 Other income (2) 199 200 2 399 151

Total revenues 43,063 42,026

36,983 85,089 73,203 Vessel operating expenses

7,975 7,647 7,164 15,622 13,971 Depreciation 13,913 13,892 11,560

27,805 22,960 General and administrative expenses 948 1,308 984

2,256 2,052 Goodwill impairment charge — — 6,217 — 6,217

Total operating expenses 22,836 22,847

25,925 45,683 45,200 Operating income

20,227 19,179 11,058 39,406

28,003 Finance income (expense): Interest income 0 2

2 3 3 Interest expense (5,055 ) (5,029 ) (4,212 ) (10,084 ) (8,398

) Other finance expense (334 ) (267 ) (79 ) (601 ) (99 ) Realized

and unrealized gain (loss) on derivative instruments(3) (3,176 )

(3,184 ) 253 (6,360 ) (5,370 ) Net gain (loss) on foreign currency

transactions (82 ) (35 ) (132) (117 ) (60 )

Total finance

expense (8,646 ) (8,513 )

(4,168 ) (17,159 ) (13,924

) Income before income taxes 11,581

10,666 6,890 22,247 14,079 Income tax

benefit (expense) (3 ) (3 ) (3 ) (6 ) (6 )

Net income $

11,578 $

10,663 $

6,887 $

22,241 $

14,073 Weighted average units outstanding (in

thousands of units): Common units (4) 22,581 18,627 15,346

20,604 14,581 Subordinated units(4) 4,613 8,568 8,568 6,590 8,568

General partner units 559 559 488 559 472

- Time charter revenues for the second

and first quarter of 2016 include a non-cash item of approximately

$1.0 million and $1.3 million, respectively in reversal of contract

liability provision, income recognition of prepaid charter hire and

accrued income for the Carmen Knutsen based on average charter rate

for the fixed period. Time charter revenues for the second quarter

of 2015 include a non-cash item of approximately $0.9 million

in reversal of contract liability provision and income recognition

of prepaid charter hire.

- Other income for the second and first

quarter of 2016 is mainly related to guarantee income from Knutsen

NYK. Pursuant to the omnibus agreement, Knutsen NYK agreed to

guarantee the payments of the hire rate that is equal to or greater

than the hire rate payable under the initial charters of the Bodil

Knutsen and the Windsor Knutsen for a period of five years from the

closing date of the IPO. In October 2015, the Windsor Knutsen

commenced operating under a new BG Group time charter. The hire

rate for the new charter is below the initial charter hire rate and

the difference between the new hire rate and the initial rate is

paid by Knutsen NYK.

- The mark-to-market net loss related to

interest rate swaps and foreign exchange contracts for the three

months end June 30, 2016 includes realized losses of $1.6 million

and unrealized losses of $1.6 million. Of the net unrealized

loss for this quarter, a $0.1 million loss relates to foreign

exchange contracts and hedging operational costs in NOK.The

mark-to-market net loss related to interest rate swaps and foreign

exchange contracts for the three months ended March 31, 2016

includes realized losses of $0.9 million and unrealized losses of

$2.3 million. Of the net unrealized loss for this quarter,

$2.1 million gain relates to foreign exchange contracts and

hedging operational costs in NOK.The mark-to-market net loss

related to interest rate swaps and foreign exchange contracts for

the three months ended June 30, 2015 includes unrealized gain

of $1.6 million and realized loss of $1.3 million. Of the

unrealized gain for this quarter, $0.4 million relates to foreign

exchange contracts hedging operational costs in NOK.

- On May 18, 2016 all subordinated units

converted into common units on a one-for-one basis.

UNAUDITED CONDENSED CONSOLIDATED BALANCE

SHEET

At June 30,2016 At December

31,2015 (USD in thousands)

ASSETS Current

assets: Cash and cash equivalents $ 25,667 $ 23,573 Amounts due

from related parties 25 58 Inventories 774 849 Derivative assets

232 — Other current assets (1) 1,705 1,800

Total current assets 28,403

26,280 Long-term assets: Vessels and

equipment: Vessels 1,351,838 1,351,219 Less accumulated

depreciation (183,598 ) (158,292 ) Net

property, plant, and equipment 1,168,240 1,192,927

Derivative assets — 695 Accrued income 706 —

Total assets $ 1,197,349 $

1,219,902 LIABILITIES AND PARTNERS’ EQUITY

Current liabilities: Trade accounts payable $ 1,949 $ 1,995

Accrued expenses 3,469 3,888 Current portion of long-term debt (1)

53,888 48,535 Derivative liabilities 3,747 5,138 Income taxes

payable 18 249 Contract liabilities 1,518 1,518 Prepaid charter and

deferred revenue 6,999 3,365 Amount due to related parties

492 848

Total current liabilities

72,080 65,536 Long-term

liabilities: Long-term debt (1) 594,621 619,187 Derivative

liabilities 6,028 1,232 Contract liabilities 8,998 9,757 Deferred

tax liabilities 919 877 Other long-term liabilities 1,799

2,543

Total liabilities 684,445

699,132 Equity: Partners’ equity:

Common unitholders 502,756 411,317 Subordinated unitholders —

99,158 General partner interest 10,148 10,295

Total partners’ equity 512,904

520,770 Total liabilities and equity $

1,197,605 $ 1,219,902

- Effective January 1, 2016, the

Partnership implemented ASU 2015-03, Interest – Imputation of

Interest (Subtopic 835-30), Simplifying the Presentation of Debt

Issuance Costs, which requires that debt issuance costs related to

a recognized debt liability be presented in the balance sheet as a

direct deduction from the carrying amount of that debt liability

rather than as an asset. The recognition and measurement guidance

for debt issuance costs is not affected. Therefore, these costs

will continue to be amortized as interest expense using the

effective interest method. The new guidance is applied

retrospectively for all periods presented. As of June 30, 2016 and

December 31, 2015 the carrying amount of the deferred debt issuance

cost was $3.5 million and $4.0 million, respectively.

UNAUDITED CONDENSED CONSOLIDATED STATEMENT

OF CASH FLOWS

Six months endedJune 30, (USD in thousands)

2016 2015 Cash flows provided by operating

activities: Net income $ 22,241 $ 14,073 Adjustments to reconcile

net income to cash provided by operating activities: Depreciation

27,805 22,960 Amortization of contract intangibles / liabilities

(759 ) (759 ) Amortization of deferred revenue (886) (957 )

Amortization of deferred debt issuance cost 573 570 Goodwill

impairment charge — 6,217 Drydocking expenditure (2,595) — Income

tax expense 6 6 Income taxes paid (241) (336 ) Unrealized (gain)

loss on derivative instruments 3,868 3,011 Unrealized (gain) loss

on foreign currency transactions 63 (46) Changes in operating

assets and liabilities Decrease (increase) in amounts due from

related parties 33 968 Decrease (increase) in inventories 75 124

Decrease (increase) in other current assets 94 (1,903 ) Increase

(decrease) in trade accounts payable (87) 825 Increase (decrease)

in accrued expenses (419) 567 Decrease (increase) in accrued

revenue (706) — Increase (decrease) prepaid revenue 3,776 432

Increase (decrease) in amounts due to related parties (356) (1,625

)

Net cash provided by operating activities

52,485 44,127 Cash flows from investing

activities: Disposals (additions) to vessel and equipment (521)

(770) Acquisition of Dan Sabia (net of cash acquired) — (36,843)

Net cash used in investing activities (521 )

(37,613) Cash flows from financing activities:

Proceeds from long-term debt 5,000 — Repayment of long-term debt

(24,642) (46,859 ) Repayment of long-term debt from related parties

— (12,000) Payment on debt issuance cost (144) (8) Cash

distribution (30,107) (23,514 ) Proceeds from public offering, net

of underwriters’ discount — 116,924 Offering cost — (321 )

Net cash provided by (used in) financing activities

(49,893) 34,222 Effect of exchange rate

changes on cash 23 (79 ) Net increase in cash and cash equivalents

2,094 40,657 Cash and cash equivalents at the beginning of the

period 23,573 30,746

Cash and cash equivalents at the end

of the period $ 25,667 $ 71,403

APPENDIX A—RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES

Distributable Cash Flow (“DCF”)

Distributable cash flow represents net income adjusted for

depreciation, unrealized gains and losses from derivatives,

unrealized foreign exchange gains and losses, goodwill impairment

charges, other non-cash items and estimated maintenance and

replacement capital expenditures. Estimated maintenance and

replacement capital expenditures, including estimated expenditures

for drydocking, represent capital expenditures required to maintain

over the long-term the operating capacity of, or the revenue

generated by, the Partnership’s capital assets. The Partnership

believes distributable cash flow is an important measure of

operating performance used by management and investors in

publicly-traded partnerships to compare cash generating performance

of the Partnership from period to period and to compare the cash

generating performance for specific periods to the cash

distributions (if any) that are expected to be paid to our

unitholders. Distributable cash flow is a non-GAAP financial

measure and should not be considered as an alternative to net

income or any other indicator of KNOT Offshore Partners’

performance calculated in accordance with GAAP. The table below

reconciles distributable cash flow to net income, the most directly

comparable GAAP measure.

(USD in thousands)

Three MonthsEnded June

30,2016(unaudited) Three MonthsEnded

March 31, 2016(unaudited) Net income $

11,578 $ 10,663 Add: Depreciation 13,913

13,892 Other non-cash items; deferred costs amortization debt 287

287 Unrealized losses from interest rate derivatives and foreign

exchange currency contracts 1,608 4,348 Less: Estimated maintenance

and replacement capital expenditures (including drydocking reserve)

(7,894 ) (7,894 ) Other non-cash items; deferred revenue and

accrued income (1,032 ) (1,319 ) Unrealized gains from interest

rate derivatives and foreign exchange currency contracts —

(2,089 )

Distributable cash flow $

18,460 $ 17,888 Distributions declared

$ 15,027 $ 15,095

Distribution coverage ratio(1) 1.23 1.19

(1) Distribution coverage ratio is equal to distributable

cash flow divided by distributions declared for the period

presented.

Adjusted EBITDA

Adjusted EBITDA refers to earnings before interest,

depreciation, taxes, goodwill impairment charges and other

financial items (including other finance expenses, realized and

unrealized gain (loss) on derivative instruments and net gain

(loss) on foreign currency transactions). Adjusted EBITDA is a

non-GAAP financial measure used by investors to measure the

Partnership’s performance.

Adjusted EBITDA is used as a supplemental financial measure by

management and external users of financial statements, such as

investors, to assess the Partnership’s financial and operating

performance. The Partnership believes that Adjusted EBITDA assists

its management and investors by increasing the comparability of its

performance from period to period and against the performance of

other companies in its industry that provide Adjusted EBITDA

information. This increased comparability is achieved by excluding

the potentially disparate effects between periods or companies of

interest, other financial items, taxes, goodwill impairment charges

and depreciation, which items are affected by various and possibly

changing financing methods, capital structure and historical cost

basis and which items may significantly affect net income between

periods. The Partnership believes that including Adjusted EBITDA as

a financial measure benefits investors in (a) selecting

between investing in the Partnership and other investment

alternatives and (b) monitoring the Partnership’s ongoing

financial and operational strength in assessing whether to continue

to hold common units. Adjusted EBITDA is a non-GAAP financial

measure and should not be considered as an alternative to net

income or any other indicator of Partnership performance calculated

in accordance with GAAP. The table below reconciles Adjusted EBITDA

to net income, the most directly comparable GAAP measure.

(USD in thousands)

Three Months Ended

June

30,2016(unaudited)

Three Months Ended

March

31,2016(unaudited)

Net income $ 11,578 $ 10,663

Interest income — (2) Interest expense 5,055 5,029 Depreciation

13,913 13,892 Income tax benefit 3 3 EBITDA 30,549 29,585 Other

financial items (a) 3,592 3,486

Adjusted

EBITDA $ 34,141 $ 33,071

(a) Other financial items consist of other finance expense,

realized and unrealized gain (loss) on derivative instruments and

net gain (loss) on foreign currency transactions

FORWARD-LOOKING STATEMENTS

This press release contains certain forward-looking statements

concerning future events and KNOT Offshore Partners’ operations,

performance and financial condition. Forward-looking statements

include, without limitation, any statement that may predict,

forecast, indicate or imply future results, performance or

achievements, and may contain the words “believe,” “anticipate,”

“expect,” “estimate,” “project,” “will be,” “will continue,” “will

likely result,” “plan,” “intend” or words or phrases of similar

meanings. These statements involve known and unknown risks and are

based upon a number of assumptions and estimates that are

inherently subject to significant uncertainties and contingencies,

many of which are beyond KNOT Offshore Partners’ control. Actual

results may differ materially from those expressed or implied by

such forward-looking statements. Forward-looking statements include

statements with respect to, among other things:

- market trends in the shuttle tanker or

general tanker industries, including hire rates, factors affecting

supply and demand, and opportunities for the profitable operations

of shuttle tankers;

- Knutsen NYK’s and KNOT Offshore

Partners’ ability to build shuttle tankers and the timing of the

delivery and acceptance of any such vessels by their respective

charterers;

- forecasts of KNOT Offshore Partners’

ability to make or increase distributions on its units and the

amount of any such distributions;

- KNOT Offshore Partners’ ability to

integrate and realize the expected benefits from acquisitions;

- KNOT Offshore Partners’ anticipated

growth strategies;

- the effects of a worldwide or regional

economic slowdown;

- turmoil in the global financial

markets;

- fluctuations in currencies and interest

rates;

- fluctuations in the price of oil;

- general market conditions, including

fluctuations in hire rates and vessel values;

- changes in KNOT Offshore Partners’

operating expenses, including drydocking and insurance costs and

bunker prices;

- KNOT Offshore Partners’ future

financial condition or results of operations and future revenues

and expenses;

- the repayment of debt and settling of

any interest rate swaps;

- KNOT Offshore Partners’ ability to make

additional borrowings and to access debt and equity markets;

- planned capital expenditures and

availability of capital resources to fund capital

expenditures;

- KNOT Offshore Partners’ ability to

maintain long-term relationships with major users of shuttle

tonnage;

- KNOT Offshore Partners’ ability to

leverage Knutsen NYK’s relationships and reputation in the shipping

industry;

- KNOT Offshore Partners’ ability to

purchase vessels from Knutsen NYK in the future;

- KNOT Offshore Partners’ continued

ability to enter into long-term charters, which KNOT Offshore

Partners defines as charters of five years or more;

- KNOT Offshore Partners’ ability to

maximize the use of its vessels, including the re-deployment or

disposition of vessels no longer under long-term charter;

- the financial condition of KNOT

Offshore Partners’ existing or future customers and their ability

to fulfil their charter obligations;

- timely purchases and deliveries of

newbuilds;

- future purchase prices of newbuilds and

secondhand vessels;

- any impairment of the value of KNOT

Offshore Partners’ vessels;

- KNOT Offshore Partners’ ability to

compete successfully for future chartering and newbuild

opportunities;

- acceptance of a vessel by its

charterer;

- termination dates and extensions of

charters;

- the expected cost of, and KNOT Offshore

Partners’ ability to, comply with governmental regulations,

maritime self-regulatory organization standards, as well as

standard regulations imposed by its charterers applicable to KNOT

Offshore Partners’ business;

- availability of skilled labor, vessel

crews and management;

- KNOT Offshore Partners’ general and

administrative expenses and its fees and expenses payable under the

technical management agreements, the management and administration

agreements and the administrative services agreement;

- the anticipated taxation of KNOT

Offshore Partners and distributions to KNOT Offshore Partners’

unitholders;

- estimated future maintenance and

replacement capital expenditures;

- KNOT Offshore Partners’ ability to

retain key employees;

- customers’ increasing emphasis on

environmental and safety concerns;

- potential liability from any pending or

future litigation;

- potential disruption of shipping routes

due to accidents, political events, piracy or acts by

terrorists;

- future sales of KNOT Offshore Partners’

securities in the public market;

- KNOT Offshore Partners’ business

strategy and other plans and objectives for future operations;

and

- other factors listed from time to time

in the reports and other documents that KNOT Offshore Partners

files with the U.S Securities and Exchange Commission, including

its Annual Report on Form 20-F for the year ended December 31,

2015.

All forward-looking statements included in this release are made

only as of the date of this release on. New factors emerge from

time to time, and it is not possible for KNOT Offshore Partners to

predict all of these factors. Further, KNOT Offshore Partners

cannot assess the impact of each such factor on its business or the

extent to which any factor, or combination of factors, may cause

actual results to be materially different from those contained in

any forward-looking statement. KNOT Offshore Partners does not

intend to release publicly any updates or revisions to any

forward-looking statements contained herein to reflect any change

in KNOT Offshore Partners’ expectations with respect thereto or any

change in events, conditions or circumstances on which any such

statement is based.

1 Adjusted EBITDA and distributable cash flow are non-GAAP

financial measures used by investors to measure the performance of

master limited partnerships. Please see Appendix A for definitions

of Adjusted EBITDA and distributable cash flow and a reconciliation

to net income, the most directly comparable GAAP financial

measure.

2 Distribution coverage ratio is equal to distributable cash

flow divided by distributions declared for the period

presented.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160810005966/en/

Knot Offshore Partners LPJohn CostainT: +44 7496

170 620

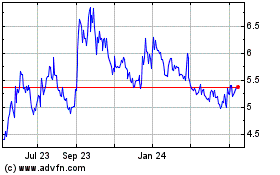

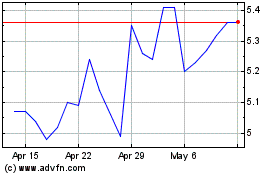

KNOT Offshore Partners (NYSE:KNOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

KNOT Offshore Partners (NYSE:KNOP)

Historical Stock Chart

From Apr 2023 to Apr 2024