Kiwi Slides On Finance Minister English Comments

May 01 2015 - 1:39AM

RTTF2

The New Zealand dollar weakened against the other major

currencies in the Asian session on Friday, following hawkish

comments from the nation's Finance Minister Bill English, who said

New Zealand would have wider budget deficit this year than

previously estimated.

In a pre-budget speech to the Wellington Employers' Chamber of

Commerce, English said the 2014/15 budget would show how very low

inflation would eat into the tax take.

"The Treasury now expects nominal GDP (Gross Domestic Product)

over the next four years through to 2019 to be around 1.5 percent

lower than forecast in Budget 2014 - mainly because of lower

inflation".

"That is about $15 billion less and, to put that in context,

that is more than half of the impact of the global financial

crisis, so these conditions are presenting some real challenges for

the Government's books," he said.

"But at the same time very low inflation and lower commodity

prices mean growth in the nominal economy - which is the dollar

value of what we produce each year - is more muted than expected,"

Bill said.

In other economic news, data from China's National Bureau of

Statistics showed that the manufacturing sector in China continued

to barely expand in April, with a manufacturing PMI score of 50.1.

That beat expectations for 50.0, and was unchanged from the March

reading. It also remained just above the line of 50 that separates

expansion from contraction.

The bureau also said its non-manufacturing PMI came in at 53.4 -

down from 53.7 but still well into expansion territory.

Meanwhile, the Asian stocks were trading lower, following the

weak lead overnight from Wall Street. Investors are also trading

cautiously as they digested a raft of economic data from Japan and

China. Also, many of the markets in Asia are closed on Friday for

the Labor Day holiday. The New Zealand benchmark NZSE 50 index was

falling 20.73 points or 0.3 percent to 5,770.

Thursday, the NZ dollar fell against its major rivals, after the

Reserve Bank of New Zealand's Monetary Policy Board decided to hold

its Official Cash Rate steady at 3.50 percent, in line with

economists expectation.

The NZ dollar fell 1.96 percent against the euro, 0.83 percent

against the U.S. dollar, 0.53 percent against the yen and 2.40

percent against the Australian dollar on Thursday.

In the Asian trading today, the NZ dollar fell to nearly a

2-month low of 1.4786 against the euro and a 1-week low of 0.7568,

from yesterday's closing values of 1.4727 and 0.7613, respectively.

If the kiwi extends its downtrend, it is likely to find resistance

around 1.51 against the euro and 0.73 against the greenback.

Against the Australian dollar, the kiwi dropped to 1.0409 from

yesterday's closing quote of 1.0372. The kiwi may test support near

the 1.05 region.

The kiwi edged down to 90.66 against the yen, from yesterday's

closing value of 90.87. On the downside, 88.70 is seen as the next

support level for the kiwi.

Data from Markit Economics showed that the manufacturing sector

in Japan slipped into contraction for the first time in nine

months, with a revised manufacturing PMI reading of 49.9. That's up

from last month's preliminary April reading of 47.7, although it's

down from 50.3 in March.

Looking ahead, U.K. mortgage approvals for March and Markit's

U.K. manufacturing PMI for April are due to be released in the

European session.

In the New York session, Canada and U.S. manufacturing PMI for

April, U.S. construction spending data for March and U.S.

Reuters/University of Michigan's final consumer sentiment index for

April are due. At 8:30 am ET, U.S. Federal Reserve Bank of

Cleveland President Loretta Mester will deliver a speech on "Issues

in Consumer Credit" before the Conference on Regulating Consumer

Credit in Philadelphia.

Subsequently, San Francisco Fed President John Williams is

expected to speak on "Monetary Policy in Financial Markets: Is

there a New Paradigm?" before the Chapman University Conference in

Orange, United States at 3:45 pm ET.

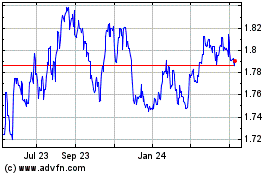

Euro vs NZD (FX:EURNZD)

Forex Chart

From Mar 2024 to Apr 2024

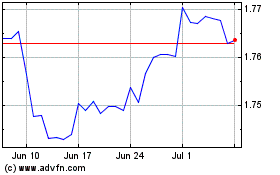

Euro vs NZD (FX:EURNZD)

Forex Chart

From Apr 2023 to Apr 2024