TIDMKIBO

RNS Number : 1662O

Kibo Mining Plc

26 May 2015

Kibo Mining Plc (Incorporated in Ireland)

(Registration Number: 451931)

(External registration number: 2011/007371/10)

Share code on the JSE Limited:KBO Share code on the AIM:

KIBO

ISIN:IE00B97C0C31

("Kibo" or "the Company")

26 May 2015

Rukwa Definitive Mining Feasibility Study: Update & Project

Name Change to Mbeya Coal to Power Project

Kibo Mining plc ("Kibo" or the "Company") (AIM: KIBO; AltX:

KBO), the Tanzania focussed mineral exploration and development

company is pleased to provide the market with a progress update for

the Rukwa Coal to Power Project, Phase 2, Stage 1, Definitive

Mining Feasibility Study ("DMFS"), and a formal renaming of the

project, to better reflect the regional scale and size of the

project.

Highlights

-- DMFS remains on schedule and well within budget;

-- Trade-off studies identify potential for significant

operating expenditure ("OPEX") reduction increasing project value

and profitability potential;

-- Blasting not required during the mining process with total

over burden and inter-burden minable through free-digging,

materially decreasing OPEX;

-- Surface Continuous Miner proves to be feasible mining method;

-- Rukwa Coal to Power Project ("RCPP") renamed to Mbeya Coal to

Power Project ("MCPP"), with immediate effect;

Louis Coetzee, CEO of Kibo Mining, commentedtoday: "We are

extremely pleased with the progress of the current phase of the

DMFS (Pre - Feasibility Phase). As the studies progress and the

commercial and statutory discussions reach increasing levels of

maturity, the Mbeya Coal to Power Project (Previously called the

Rukwa Coal to Power Project) continues to demonstrate robust and

improving project fundamentals.

Progress made to date continues to draw attention from third

parties, particularly those expressing an interest in investing

directly at project level. In this regard the company remains in

active discussions with various investors and now sees regular

additional enquiries from new supplementary third party investment

sources.

We are also very pleased with our new joint development partner

SEPCO III, with whom an effective and productive working

relationship has already been established in a very short space of

time."

DMFS - Summary of Latest Progress

The DMFS has now reached the mid- point and trade-off studies

indicate that all overburden material can be mined making use of

free-digging and trucking. This will significantly reduce the coal

mine OPEX. It will also bring about a significantly safer operating

environment since drilling and blasting will no longer be required,

eliminating the necessity for explosives on the mine site.

Even more exciting is the fact that the use of surface

continuous mining equipment, identified as a possible mining method

during the Concept Study, proved feasible at this stage. This will

allow precise accuracy in extraction of the various coal seams and,

more importantly, will eliminate the need for washing coal, making

it possible to deliver the raw mined product directly into the

power plant. Apart from the significant economic savings this will

bring about, all of the above will also make significant

contributions towards a much safer and environmentally friendly

mine operation.

Preliminary geotechnical evaluations also delivered positive

results and did not identify any areas of concern related to the

coal mine development or power plant construction. An extensive

geo-technical investigation, including a geo-technical drill

campaign at the RCPP site area amongst others, is scheduled to

commence within the next 10 - 18 days. Data and findings from the

geo-technical study will inform critical mine design criteria that

will be required for work planned during Stage 2 of the DMFS.

All other routine activities associated with the ongoing

feasibility work are taking place in parallel and remain on

schedule as planned. Some of these activities include the

establishment of a basic automated weather station as well as a

water testing hole. The latter will be drilled to support the

mining environmental assessment. Similarly, discussions and

interaction with the Tanzanian Government are ongoing as part of

the process to finalise the various critical agreements between the

MCPP and relevant government agencies.

The Company has also decided to officially change the name Rukwa

Coal to Power Project ("RCPP") to Mbeya Coal to Power Project

("MCPP"). The name change is aimed at avoiding further confusion of

the Company's coal to power project with similarly named projects,

owned by unrelated companies that have no relationship or

association to Kibo or any of the Company's projects in Tanzania.

The project is at the same time making major strides forward

towards plant construction and generation and in the process

unfolding the full extent of the MCPP's regional impact. The new

name will therefore also better reflect the regional impact and

presence of the project.

Contacts

+27 (0) 83 2606126 Kibo Mining Chief Executive Officer

Louis Coetzee plc

------------------ ------------------- -------------------- ------------------------

Andreas Lianos +27 (0) 83 4408365 River Group Corporate Adviser

and Designated Adviser

on JSE

------------------ ------------------- -------------------- ------------------------

Elliot Hance +44 (0) 207 382 Beaufort Securities Broker

8300 Limited

------------------ ------------------- -------------------- ------------------------

Oliver Morse +61 8 9480 2500 RFC Ambrian Nominated Adviser

Limited on AIM

------------------ ------------------- -------------------- ------------------------

Daniel Thöle +44 (0) 203 772 Bell Pottinger Investor and Media

Lucinda Alderson 2500 Relations

------------------ ------------------- -------------------- ------------------------

Kibo Mining - Notes to editors

Kibo Mining is listed on the AIM market in London and the AltX

in Johannesburg. The Company is focused on exploration and

development of mineral projects in Tanzania, and controls one of

Tanzania's largest mineral right portfolios. Tanzania provides a

secure and stable operating environment for the mineral resource

industry and Kibo Mining therein.

Kibo Mining holds a thermal coal deposit at Rukwa, which has a

significant JORC compliant defined resource (See Table 1 below),

and is developing a 250-350MW mouth-of-mine thermal power station

with an established management team that includes Standard Bank as

Financial Advisor. Kibo is undertaking a Coal Mining Definitive

Feasibility Study and a Power Pre-Feasibility Study for Rukwa with

an integrated Coal-Power interim study report to be released in the

near term. On 20(th) April 2015, Kibo signed a Joint Development

Agreement for the completion of the Definitive Feasibility Studies

and development of the RCPP with China based EPC contractor SEPCO

III.

The Company also has extensive gold focused interests including

Lake Victoria Goldfields and Morogoro projects. At Lake Victoria,

the Company has projects with a 550,000oz JORC compliant gold

Mineral Resource at Imweru Project (See Table 2 below) and a

168,000oz NI 43-101 compliant gold Mineral Resource at the Lubando

Project (See Table 3 below) in which the Company holds a 90%

attributable interest. The Company is currently undertaking a

Definitive Feasibility Study on its Imweru Project.

Kibo also holds the Haneti Project on which the latest technical

report confirms prospectivity for nickel, PGMs, gold and strategic

metals including lithium.

Kibo Mining further holds the Pinewood (coal & uranium)

project where the company has entered into a 50/50 Exploration

Joint Venture with Metal Tiger plc.

Finally the Company also holds the Morogoro (gold) project where

the company has also entered into a 50/50 Exploration Joint Venture

with Metal Tiger plc.

The Company's projects are located in the established and gold

prolific Lake Victoria Goldfields, the emerging goldfields of

eastern Tanzania and the Mtwara Corridor in southern Tanzania where

the Government has prioritised infrastructural development

attracting significant recent investment in coal and uranium. The

Company has a positive working relationship with the Tanzanian

government at local, regional and national levels and works hard to

maintain positive relationships with all communities where company

interests are held. The Company recognises the potential to enhance

the quality of life and opportunity for Tanzanian citizens through

careful development of its projects.

Updates on the Company's activities are regularly posted on its

website www.kibomining.com

Technical data

Rukwa Mineral Resource

Table 1 below presents a table showing the Mineral Resource

estimate for the Rukwa Coal Project. The table is taken from an NI

43 101-Compliant Report by GEMECS (Pty) Ltd dated April 2012.

Table 1

RUKWA COAL RESOURCE SUMMARY- GEMECS (Pty) Ltd

--------------------------------------------------------

SEAM NI 43-101 IN SITU

---------- ----------------- ---------- -------------

SEAM THICKNESS CLASS MILLION TONS

---------- ----------------- ---------- -------------

S4 1.14 Indicated 2.17

---------- ----------------- ---------- -------------

S3U 2.04 Indicated 6.92

---------- ----------------- ---------- -------------

S3L 2.3 Indicated 12.63

---------- ----------------- ---------- -------------

S2 3.45 Indicated 23.43

---------- ----------------- ---------- -------------

S1U 2.48 Indicated 7.34

---------- ----------------- ---------- -------------

S1L 2.92 Indicated 17.4

---------- ----------------- ---------- -------------

S0 1.08 Indicated 1.44

---------- ----------------- ---------- -------------

Total Indicated Resources 71.34

----------------------------- ---------- -------------

S4 1.31 Inferred 1.38

---------- ----------------- ---------- -------------

S3U 2.24 Inferred 2.94

---------- ----------------- ---------- -------------

S3L 2.27 Inferred 3.86

---------- ----------------- ---------- -------------

S2 3.42 Inferred 7.94

---------- ----------------- ---------- -------------

S1U 2.05 Inferred 6.5

---------- ----------------- ---------- -------------

S1L 3.15 Inferred 12.83

---------- ----------------- ---------- -------------

S0 1.06 Inferred 2.6

---------- ----------------- ---------- -------------

Total Inferred Resources 38.05

----------------------------- ---------- -------------

TOTAL RESOURCES *109.39

----------------------------- ---------- -------------

*Kibo holds 100% of the Rukwa Mineral Resource

Imweru Mineral Resource

Table 2 below presents a table showing the Mineral Resource

estimate for the Imweru Project at a base case economic cut-off

grade for the reporting of the resource of 0.4 g/t. The table is

taken from a JORC-Compliant Report by Tetra Tech EBA dated February

2014.

Table 2

Material Cut- Specific Metric Gold Contained

Area Type Classification off Gravity Tonnes Short Grade Gold Ounces

(g/t) (t) Tons (g/t) (troy)

========= ============= ================== ======== ============ ============ ============ ======== ===============

Laterite Indicated 0.40 2.50 131,000 144,000 1.785 8,000

============= ============================ ======== ============ ============ ============ ======== ===============

Saprolite Indicated 0.40 2.50 706,000 778,000 1.387 32,000

============= ============================ ======== ============ ============ ============ ======== ===============

Bedrock Indicated 0.40 2.89 1,895,000 2,089,000 1.043 64,000

============= ============================ ======== ============ ============ ============ ======== ===============

Central Total Indicated 0.40 2.77 2,732,000 3,012,000 1.168 103,000

========= ============= ================== ======== ============ ============ ============ ======== ===============

Laterite Inferred 0.40 2.50 685,000 755,000 1.317 29,000

============= ============================ ======== ============ ============ ============ ======== ===============

Saprolite Inferred 0.40 2.50 1,047,000 1,154,000 1.040 35,000

============= ============================ ======== ============ ============ ============ ======== ===============

Bedrock Inferred 0.40 2.89 7,838,000 8,640,000 1.029 259,000

============= ============================ ======== ============ ============ ============ ======== ===============

Central Total Inferred 0.40 2.82 9,569,000 10,548,000 1.051 323,000

========= ============= ================== ======== ============ ============ ============ ======== ===============

East Total Inferred 0.40 2.70 2,653,000 2,925,000 1.449 124,000

========= ============= ================== ======== ============ ============ ============ ======== ===============

Indicated 0.4 2.77 2,732,000 3,012,000 1.168 103,000

========================================== ======== ============ ============ ============ ======== ===============

Inferred 0.4 2.79 12,222,000 13,473,000 1.137 447,000

========================================== ======== ============ ============ ============ ======== ===============

Imweru Property Combined

Total (inf+ind) 0.4 2.79 14,954,000 16,485,000 1.143 550,000

======================== ================== ======== ============ ============ ============ ======== ===============

*Kibo holds 90% of the Imweru Mineral Resource

* Total estimates are rounded, based on composites capped at 26

g/t gold at Imweru Centraland 25 g/t at Imweru East, the cut-off

grade isbased on a gold price of US$1,200 and a 90% metallurgical

recovery is assumed in calculation of cut-offgrade. A base case of

0.40 g/t has been selected.

** Classification of MineralResources incorporates the terms and

definitions from the Australian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves (JORC Code) published

bythe Joint Ore Reserve Committee (JORC)

Lubando Mineral Resource

Table 3 below presents a table showing the Mineral Resource

estimate for the Lubando Project at a base case economic cut-off

grade for the reporting of the resource of 0.5 g/t Au. The table is

taken from an NI 43 101-Compliant Report by EBA Engineering

Consultants Limited (now part Tetra Tech EBA) dated August

2009.

TABLE3: LUBANDO MINERALRESOURCE SUMMARY - BASECASE*

-------------------------------------------------------------------------------------------------------

East Zone East Zone

Category West Zone South East Zone North Total

Mid

--------------------------- -------------- ------------- ------------- ------------- -------------

Measured Resource

--------------------------- -------------- ------------- ------------- ------------- -------------

Measured Resource(t) 107,900 4,880 16,900 54,440 184,150

--------------------------- -------------- ------------- ------------- ------------- -------------

Grade(g/t) 1.69 2.52 1.72 2.48 1.95

--------------------------- -------------- ------------- ------------- ------------- -------------

Total Gold(oz) 5,900 400 950 4,340 11,500

--------------------------- -------------- ------------- ------------- ------------- -------------

Indicated Resource

--------------------------- -------------- ------------- ------------- ------------- -------------

Indicated Resource(t) 280,710 18,330 61,000 149,350 509,420

--------------------------- -------------- ------------- ------------- ------------- -------------

Grade(g/t) 1.61 2.23 1.89 2.73 1.99

--------------------------- -------------- ------------- ------------- ------------- -------------

Total Gold(oz) 14,500 1,300 3,700 13,120 32,600

--------------------------- -------------- ------------- ------------- ------------- -------------

Inferred Resource

--------------------------- -------------- ------------- ------------- ------------- -------------

Total Resource(t) 1,090,000 65,470 209,340 535,330 1,900,140

--------------------------- -------------- ------------- ------------- ------------- -------------

Grade(g/t) 1.27 1.56 3.34 3.13 2.03

--------------------------- -------------- ------------- ------------- ------------- -------------

Total Gold(oz) 44,550 3,300 22,500 53,900 124,200

--------------------------- -------------- ------------- ------------- ------------- -------------

*Kibo holds 90% of the Lubando Mineral Resource

* Numbers are rounded. Composites capped at 10.85g/t gold.

Cut-off grade of 0.5 g/t gold based on a gold price of US$850/oz

and assumed 100% metallurgical recovery.CIM definitions were

followed for Mineral Resources.

Pursuant to the terms of an inherited agreement with Barrick

East Africa Exploration LTD (BEAL), Kibo currently has an effective

90% interest in the Imweru and Lubando Project (and thus a 90%

attributable interest in the Imweru and Lubando Mineral Resources

shown in Table 2 and 3 above), with Barrick having a 10% carried

interest up to a decision to mine at which point they have to

contribute or be diluted to a 2% net smelter royalty. BEAL also has

a first right of refusal pursuant to which they can buy the 90%

interest in the project at an agreed market related value after

completion of a Bankable Feasibility Study. Kibo remains the

operator of the project.

Review by Qualified Persons

The information in this announcement that relates to the Rukwa

Coal Mineral Resource is taken from a report titled "Independent

Technical Report for the Rukwa Coal Project, Mbeya Region, United

Republic of Tanzania" dated 19(th) April 2012 by CD van Niekerk

Director and Principal Geologist with the firm GEMECS (Pty) Ltd. Mr

van Niekerk is a Professional Natural Scientist with the South

African Council for Natural Scientific Professions (SACNASP),

Registration No. 400066/98 and a Fellow Member of the Geological

Society of South Africa. He has relevant experience and technical

qualifications to be a "Qualified Person" for reporting coal

resources to the NI 43-101 Standard

Information in this announcement that relates to the Imweru

Mineral Resource is taken from the report titled "Resource Update

for the Imweru Property Geita Region Northern, Tanzania, JORC

Competent Persons Report" dated February 17(th) 2014 (the

"Report"). The Report states a JORC-compliant Mineral Resource

estimate and was prepared for Kibo Mining plc by James Barr P.Geo.

and Darryn Hitchcock P.Geo. Senior Geologist and Geologist

respectively with TetraTech EBA Ltd. Both Mr. Barr and Mr.

Hitchcock are registered as Certified Professional Geologists with

Association of Professional Engineers and Geoscientists of British

Columbia a recognised professional organisation. Mr Barr as

principal author responsible for the Report has experience in the

evaluation and reporting of Archaean Gold projects and is a

"Qualified Person" for reporting gold resources to the JORC

Standard. He consents to the inclusion in this document of the

matters based on his information in the form and context in which

they appears.

The information in this announcement that relates to the Lubando

Mineral Resources is taken from a report titled "Technical Report

on the Lubando property, Mwanza, Tanzania" dated 31(st) August

2009" (the "Report") The Report is NI 43-101 compliant and was

prepared for Great Basin Gold Rusaf Gold Limited by Nathan Eric

Fier C.P.G., P.Eng. Market Director for EBA Engineering Consultants

Ltd and a Senior Mining Consultant. Mr. Fieris registered as a

Certified Professional Geologist with the American Institute of

Professional Geologists, Registration No 10062, and a professional

Engineer in British Columbia, Canada Registration No. 135165. He

has extensive experience in the evaluation and reporting of

Archaean Gold projects.

The Company's Exploration Director, Noel O'Keeffe has reviewed

the resource reports and the references to them in this

announcement.

Johannesburg

26 May 2015

Corporate and Designated Adviser

River Group

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCSEUESIFISEII

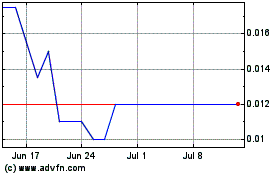

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Apr 2023 to Apr 2024