TIDMKIBO

RNS Number : 8136U

Kibo Mining Plc

23 January 2017

Kibo Mining Plc (Incorporated in Ireland)

(Registration Number: 451931)

(External registration number: 2011/007371/10)

Share code on the JSE Limited: KBO

Share code on the AIM: KIBO

ISIN:IE00B97C0C31

("Kibo" or "the Company")

January 23, 2017

Kibo Announces Completion of Integrated Bankable Feasibility

Study

Kibo Mining plc ("Kibo" or the "Company") (AIM: KIBO; AltX:

KBO), the Tanzania focused mineral exploration and development

Company, is pleased to announce finalization of the Integrated

Bankable Feasibility Study ("IBFS") with the delivery of the

Integrated Financial Model for the Mbeya Coal to Power Project

("MCPP").

The IBFS comprises an integration of the Definitive Mining

Feasibility Study ("DMFS"), the Definitive Power Feasibility Study

("DPFS"), the Integrated Financial Model for the MCPP and all other

relevant technical studies on the MCPP done to date, inclusive of

the financial outcomes from the power EPC agreement.

The IBFS concluded that the MCPP is financially, technically and

operationally a very robust project.

Key highlights from the IBFS are set out below:

- Total capital requirement for the integrated project reduced

21.1 % from the original integrated prefeasibility study ("IPFS")

figure;

- Indicative MCPP total revenue over an assumed 25-year life of

project (Note: the final life of project will be fixed by the final

Power Purchase Agreement ("PPA")) of approximately US$7.5 to US$8.5

billion;

- Indicative post tax Equity IRR between 21% and 22%, an

increase of 11% on the indicative IPFS post-tax Equity IRR, based

on the following conservative debt assumptions:

(R) Debt tenor: 12 years;

(R) All in interest rate (post construction): 10%; and

(R) DSRA facility: 6 months

- Post tax Project IRR ranging between 14.7% and 16%;

- Indicative post-tax payback:

(R) Equity Payback period: 4 to 5 years

(R) Debt Payback Period: 11 to 12 years

- Sufficient additional coal resources available from the Mbeya

Coal Mine to expand the power station to more than double the

current design size and plant life. In this regard, the plant

design already makes provision for a future second stage expansion

to 600MW (i.e. a further 300MW of capacity with the potential for a

third stage expansion of a further 400MW in the long term).

- Technical and environmental risk assessment confirmed

construction-ready state of the project, with no 'red flags' on the

environmental side, bearing in mind the clean coal nature of the

plant design.

- The MCPP can be constructed and commissioned within the

previously projected schedule duration of 36 months.

The following comprise key highlights from the MCPP definitive

feasibility studies (as reported previously):

- Mining

(R) 122Mt Coal Resource of which 85.9% of stated resource

qualifies for inclusion in any future reserve statement. Of this,

39Mt is included in the Pit Design, and is sufficient to satisfy

the required indicative coal requirement of 39Mt for 30 years. The

Mbeya Coal product exceeds standard technical requirements of the

power plant.

(R) Application of the Mbeya Coal Ltd Special Mining License

submitted to the Ministry of Energy and Minerals is aimed at

securing 70Km(2) of Mining Area

(R) Financial Viability of the Mbeya Coal Resource

demonstrated

-- IRR of 69.2%

-- Payback period 2.4 years

-- Peak funding requirement of USD17 million

-- All-in cost margin of 39% - (all-in cost margins of above 25%

are considered healthy by Kibo)

-- Power Station coal requirements reduced by 23% from that

identified in MPFS bringing significant environmental and cost

benefits

(R) Modified Terrace Mining (free dig truck & shovel

overburden, continuous miner coal) confirmed as the most accurate

and cost effective for the coal mine, and key to optimized mining

and power financials

- Power (1)

(R) Required calorific value: 12.85 GJ/t.

(R) Net power generated: 1,840 GWh/a

(R) Coal Consumption: 1,497,432 tpa (As Fired)

(R) Limestone Consumption: 110,359 tpa

(R) Water Consumption: 4,273,207 lpa

(R) Solid Waste Incl Ash: 679,306 tpa

(1.) GWh/a: Gigawatt hours per annum; tpa: tons per annum; lpa:

liter per annum.

Notes to Readers.

Readers are referred to Kibo RNS dated 10 March 2015 as well as

related announcements on the DMFS and DPFS released to date and

also to related supporting data / information published on Kibo's

website www.kibomining.com

The Company remains restricted in its ability to release certain

detailed information relating to the IBFS due to the fact that the

Company is engaged in highly confidential discussions with various

parties, including regulatory authorities. The release of certain

detailed financial information could result in a breach of Kibo's

confidentiality obligations, and is commercially sensitive. This

could harm the Company's ability to successfully complete

negotiations.

The financial information provided in this announcement is a

limited extract from the MCPP IBFS that has been conducted to

determine the bankability of the MCPP. These figures however remain

subject to further evaluation and testing during PPA and funding /

investment negotiations which are currently underway. As a

consequence, there is likely to be further changes to the figures

as the various business streams progress and conclude.

Louis Coetzee, CEO of Kibo Mining, said: "We are extremely

pleased with the positive results from the IBFS. The IBFS comprises

the DMFS, DPFS and Integrated Financial Model, and as can be seen,

the results are materially different from those received

previously. The significant improvement in the various IRR figures

exceeds management expectations and will without doubt attract

favorable attention from potential investors.

The IBFS results shows the MCPP to be equally strong and robust

in respect of the fundamental requirements of all the various

stakeholder interests in the MCPP. This puts the Company in a

strong position in its ongoing discussions / negotiations with

regard to the final PPA as well as with potential funders /

investors in the MCPP.

With independent confirmation on the bankability of the MCPP,

the Company expects to see a significant increase in interest and

support from potential investors and other stakeholders in the

MCPP."

Contacts

Louis Coetzee +27 (0) 83 Kibo Mining Chief Executive

2606126 plc Officer

------------------- ---------------- -------------------- ---------------------

Andreas +27 (0) 83 River Group Corporate Adviser

Lianos 4408365 and

Designated Adviser

on JSE

------------------- ---------------- -------------------- ---------------------

Jon Belliss +44 (0) 207 Beaufort Securities Broker

382 8300 Limited

------------------- ---------------- -------------------- ---------------------

Oliver +61 8 9480 RFC Ambrian Nominated Adviser

Morse 2500 Limited on AIM

------------------- ---------------- -------------------- ---------------------

Liz Morley +44 (0) 203 Bell Pottinger Investor and

/ 772 2500 Media Relations

Anna Legge

------------------- ---------------- -------------------- ---------------------

Kibo Mining - Notes to editors

Kibo Mining is listed on the AIM market in London and the AltX

in Johannesburg. The Company is focused on exploration and

development of mineral projects in Tanzania, and controls one of

Tanzania's largest mineral right portfolios. Tanzania provides a

secure and stable operating environment for the mineral resource

industry and Kibo Mining therein.

Kibo Mining holds a thermal coal deposit at Mbeya, which has a

significant NI 43-101 compliant defined resource, and is developing

a 250-350 MW mouth-of-mine thermal power station, the Mbeya Coal to

Power Project ("MCPP"), previously called Rukwa Coal to Power

Project ("RCPP"), with an established management team that includes

ABSA / Barclays as Financial Advisor. Kibo is undertaking a Coal

Mining Definitive Feasibility Study and a Power Pre- Feasibility

Study for the Mbeya project with an integrated Bankable Feasibility

Study report for the MCPP to be released in the near term. On 25

August 2016, Kibo signed an Agreement with China based EPC

contractor SEPCO III granting it the right to become the sole

bidder for the EPC contract to build the power plant component of

the MCPP in exchange for SEPCO III refunding 50% of the development

costs incurred by Kibo to date on the project. Kibo has already

received the first tranche of this funding in the amount of US$1.8

million on the 5th September 2016

The Company also has extensive gold focused interests including

Lake Victoria Goldfields and Morogoro projects. At Lake Victoria,

the Company has 100% owned projects with a 550,000 oz. JORC

compliant gold Mineral Resource at the Imweru Project and a 168,000

oz. NI 43-101 compliant gold Mineral Resource at the Lubando

Project. The Company is currently undertaking a Definitive

Feasibility Study on its Imweru Project.

Kibo also holds the Haneti Project on which the latest technical

report confirms prospectivity for nickel, PGMs, gold and strategic

metals including lithium.

Kibo Mining further holds the Pinewood (coal & uranium)

project where the company has entered into a 50/50 Exploration

Joint Venture with Metal Tiger plc.

Finally, the Company also holds the Morogoro (gold) project

where the company has also entered into a 50/50 Exploration Joint

Venture with Metal Tiger plc.

The Company's projects are located in the established and gold

prolific Lake Victoria Goldfields, the emerging goldfields of

eastern Tanzania and the Mtwara Corridor in southern Tanzania where

the Government has prioritized infrastructural development

attracting significant recent investment in coal and uranium. The

Company has a positive working relationship with the Tanzanian

government at local, regional and national levels and works hard to

maintain positive relationships with all communities where company

interests are held. The Company recognizes the potential to enhance

the quality of life and opportunity for Tanzanian citizens through

careful development of its projects.

Updates on the Company's activities are regularly posted on its

website www.kibomining.com

Johannesburg

23 January 2017

Corporate and Designated Adviser

River Group

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCQXLBLDFFZBBQ

(END) Dow Jones Newswires

January 23, 2017 02:00 ET (07:00 GMT)

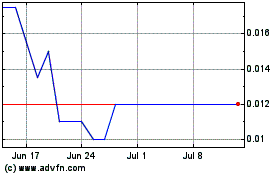

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Apr 2023 to Apr 2024