TIDMKIBO

RNS Number : 8073K

Kibo Mining Plc

27 September 2016

Kibo Mining Plc

(Incorporated in Ireland)

(Registration Number: 451931)

(External registration number: 2011/007371/10)

Share code on the JSE Limited: KBO

Share code on the AIM: KIBO

ISIN: IE00B97C0C31

("Kibo" or "the Company")

Unaudited Interim results for the six months ended 30 June

2016

Dated 27 September 2016

Kibo Mining plc ("Kibo" or the "Company") (AIM: KIBO; AltX: KBO)

the mineral exploration and development company focused on coal,

gold, nickel, and uranium projects in Tanzania, is pleased to

announce its unaudited half year results for the period ended 30

June 2016.

Highlights from the Chairman, Christian Schaffalitzky's

statement:

-- Key feasibility studies on the Mbeya Coal to Power project

completed with strongly positive results;

-- Agreement reached with SEPCO III granting it sole bidder status

for the MCPP EPC contract for refund of 50% of development

costs incurred by the Company to date;

-- Agreement reached to convert Sanderson loan of GBP1.5m into

a 2.5% equity interest in the MCPP project company demonstrates

confidence in the project;

-- Recent appointments of reputable advisors and agreement with

GE International has given renewed momentum to MCPP as it

approaches financial close;

-- Plans well advanced to spin-out Imweru gold project into a

new AIM & JSE listed company, Katoro Gold Mining Limited,

raise funds and commence mine development.

Chairman's Statement

Dear Shareholder,

I am pleased to present our accounts for the six-month period

ending 30 June 2016 and report on significant progress on our Mbeya

Coal to Power ("MCPP") and Imweru gold projects. I outline a

summary of the principal operational and corporate developments

during the period below.

Operations - MCPP

The Company's primary focus was on advancing the various

component feasibility studies and stakeholder negotiations required

to finalise the Integrated Bankable Feasibility Study ("IBFS") for

our flag ship Mbeya Coal to Power Project ("MCPP"). We made

excellent progress on all fronts resulting in the completion of a

number of key technical studies and progress with associated

activities as follows:

-- Detailed engagement with TANESCO and the Government of Tanzania

on terms for the negotiation of a Power Purchase Agreement;

-- Consolidation of the MCPP Coal licence block by the acquisition

of 3 new licence areas;

-- Completion of a Mineral Resource re-statement on the Mbeya coal

deposit which showed an 10.42% increase in the total resource over

the previous estimate.;

-- Completion of the Definitive Power Feasibility Study and the Definitive

Mining Feasibility Study;

-- Appointment of consultants to complete Environmental and Social

Impact Assessment ("ESIA") and completion of Phase 1 of the ESIA

(scoping study) which also included implementation of a water availability

study; and

-- Initiation of EPC bid process for the construction of the project.

I am delighted with the strongly positive results from the key

studies finalised during the period which have continued to de-risk

the MCPP by demonstrating improved financial, technical and

operational metrics and so enhancing its prospects for a successful

financial close and commencement of project construction.

I note that momentum on the MCPP has continued to gather pace

during the third quarter 2016 with a highlight being the new

agreement we recently signed with international China based EPC

contractor, SEPCO III. This agreement grants SEPCO III the right to

be the sole EPC bidder for the construction of the MCPP power plant

in exchange for it refunding 50% of the development costs incurred

by Kibo to date on the project. We have already received the first

tranche of US$1.8 million of the development costs from SEPCO III.

The awarding of the EPC contract to SEPCO III will be contingent on

it meeting the strict bid proposal specification laid down by Kibo

and its power plant consultants Tractabel Engineering Ltd and

agreement being reached with Kibo on the balance of the development

costs to be refunded. The agreement with SEPCO III was achieved as

a result the outstanding results received from the power and mining

feasibility studies completed during the first half of 2016. The

agreement is an acknowledgement of the advanced development stage

achieved with the MCPP and the recognized quality of the project.

Consequently, the tender process for awarding the EPC contract to

construct the power plant is now warranted and has begun.

I also note the recent appointment of UK law firm Norton Rose

Fulbright as legal advisors on the MCPP, the Memo of Understanding

signed with US industrial conglomerate GE International for the

provision of technical services and assistance with bringing the

project to financial close and the appointment of Absa bank as

financial advisors. These appointments further reflect the

increased momentum we now have behind this much needed energy

project in southern Tanzania.

Operations - Imweru

Apart from reaching the major developmental milestones on the

MCPP discussed above, we also initiated a major initiative on our

Imweru gold project during the first half of 2016 in order to

release value for shareholders in this exciting gold project. We

are well advanced in our plans to spin-out this project into a new

AIM and JSE listed company, to be called Katoro Gold Mining Limited

("Katoro") and raise sufficient finance to develop a gold mine with

an initial production target of 50,000 oz. gold per annum within 12

to 18 months. While initially we had reached heads of agreement,

with Australian private company, Lake Victoria Gold, to include its

adjacent Imwelo project in Katoro, subsequent issues that came to

light during our due diligence review on Imwelo has meant that we

will not now proceed with amalgamating the two projects. Instead we

will replace Imwelo with our Lubando gold project areas ("Geita

East") which together with Imweru will be the initial projects in

Katoro.

Imweru and Lubando together have a combined gold resource of

approximately 700,000 oz. at 1-2 g/t. We plan to commence mine

development at Imweru where there is an existing JORC-compliant

Mineral Resource of 14.9 Mt @ 1.1 g/t (550,000 oz. Au) and for

which we have already commenced a Mining Feasibility Study. The

first part of this study, a Preliminary Economic Assessment, was

completed during 2015 and established the potential of Imweru to

warrant a mine development with a mine life of 7-10 years and the

potential to expand the resource and extend the mine life by

another 6 years. Lubando, located 70km east of Imweru, has a

NI43-101 compliant Mineral Resource of 2,593,710 tonnes at 2g/t

(168,300 oz. Au) and together with adjacent Geita East projects

properties at Busolwa and Pamba offer the opportunity for further

gold exploration and resource expansion that may lead to a mine

development being warranted in the longer term.

Operations - Other Projects

We have kept work to a minimum on our other projects at Haneti

(nickel-PGM), Morogoro (gold) and Pinewood (uranium) during 2016 to

date as we focus resources on our coal and gold development

projects. Haneti remains drill ready to test initial nickel-PGM

targets established from earlier exploration. We continue to engage

with Metal Tiger plc, our joint venture partners on the Morogoro

and Pinewood projects on the best way to extract value from these

projects and a number of initiatives are currently under

consideration.

Corporate

The increased funding requirement of the Company to maintain

momentum behind the MCPP during the period was satisfied with an

innovative loan arrangement with Sanderson Capital Partners. The

loan has proved to be a successful alternative to direct placings

in the market in minimising shareholder dilution and maintaining

shareholder value in the MCPP pending completion of the IBFS and

financial close. The loan of GBP 1.5 million, arranged in March

2106, was drawn down in five tranches of GBP 300,000 each over a

period of six months (March-August inclusive). A total of

15,060,418 Kibo shares were issued at prices of between 4p to 5.25p

in settlement of loan arrangement and drawdown fees over the loan

term. I am pleased to reflect on the re-negotiated terms for the

payback of the loan which we recently announced on the 1(st)

September and which converted the loan to a 2.5% equity interest in

the MCPP for a conversion fee of GBP150,000 in Kibo shares. These

attractive terms demonstrate confidence by Sanderson in the project

and also minimise dilution of your shareholding in Kibo.

In addition to the shares issued during the January - June

period pertaining to the Sanderson loan discussed above in the

amount of 12,902, 943 shares, a further 9,614,613 shares were

issued by the Company in settlement of an earlier Sanderson loan

and as payment for technical and corporate services to the Company.

The total number of shares thus issued during the first six months

of 2016 was thus 22,517, 556 shares at prices of between 3.7p and

5.25p.

The Company also received re-payment of GBP522,800 in January

2016 being the delayed receipt of the final proceeds from its

February 2015 placing with Hume Capital Securities plc (funds were

locked down following Hume going into administration in March

2016).

In conclusion, I would like to thank our board and management

for their on-going work under the direction of CEO Louis Coetzee

where we have again seen major critical milestones reached on the

MCPP since the start of the year.

_________________________________

Christian Schaffalitzky

Chairman

Unaudited Interim Results for the six months ended 30 June

2016

Unaudited condensed consolidated interim Statement of

Comprehensive Income

For the six months ended 30 June 2016

6 months to 6 months to 12 months to

30 June 30 June 31 December

2016 2015 2015

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Revenue 4,184 - 44,181

Administrative expenses

* (1,458,100) (851,620) (1,791,358)

Exploration Expenditure (866,967) (248,203) (1,454,216)

Reversal of Impairment - - 3,182,240

Bargain purchase on acquisition - 185,698 -

of subsidiary

Operating (loss)/ profit (2,320,883) (914,125) (19,153)

Investment and Other Income 480 234 196,315

------------ ------------ -------------

(Loss)/ Profit before tax (2,320,403) (913,891) 177,162

Tax - - -

------------ ------------ -------------

Loss for the period (2,320,403) (913,891) 177,162

Other comprehensive income:

Exchange differences on

translating of foreign operations,

net of taxes 46,378 69,704 16,366

Total comprehensive (loss)

/ profit for the period (2,274,025) (844,187) 193,528

------------ ------------ -------------

(Loss)/ Profit for the period

attributable to (2,320,403) (913,891) 177,162

------------ ------------ -------------

Owners of the parent (2,320,403) (913,891) 177,162

Non-controlling interest - - -

------------ ------------ -------------

Total comprehensive (loss)

income attributable to (2,274,025) (844,187) 193,528

------------ ------------ -------------

Owners of the parent (2,274,025) (844,187) 193,528

Non-controlling interest - - -

------------ ------------ -------------

Basic (loss)/ earnings per

share (0.007) (0.0029) 0.001

Diluted (loss)/ earnings

per share (0.007) (0.0029) 0.001

Headline loss per share (0.007) (0.0036) (0.010)

*Administrative expenditure for the interim period ended June

2016 includes GBP947,418 relating to financing activities specific

to the borrowings raised throughout the current period.

Unaudited condensed consolidated interim Statement of Financial

Position

As at 30 June 2016

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2016 2015 2015

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

Assets

Non-current assets

Property, plant and equipment 3,449 27,394 7,182

Intangible assets 17,596,105 14,413,865 17,596,105

Total non-current assets 17,599,554 14,441,259 17,603,287

------------- ------------- ---------------

Current assets

Trade and other receivables 56,718 844,143 550,692

Cash and cash equivalents 107,086 835,227 189,435

------------- ------------- ---------------

Total current assets 163,804 1,679,370 740,127

------------- ------------- ---------------

Total assets 17,763,358 16,120.629 18,343,414

------------- ------------- ---------------

Equity

Called up share capital 13,470,787 13,191,116 13,210,288

Share premium 26,495,318 25,791,441 25,782,519

Treasury shares (44,464) - (44,464)

Translation reserve (338,241) (331,281) (384,619)

Share based payment reserve 514,279 510,978 514,279

Retained deficit (23,861,789) (23,143,417) (21,541,386)

------------- ------------- ---------------

Total equity 16,235,890 16,018,837 17,536,617

------------- ------------- ---------------

Liabilities

Current liabilities

Trade and other payables 327,468 75,209 306,797

Current tax liability - 26,583 -

Borrowings 1,200,000 - 500,000

Total current liabilities 1,527,468 101,792 806,797

------------- ------------- ---------------

Total equity and liabilities 17,763,358 16,120,629 18,343,414

------------- ------------- ---------------

Unaudited Condensed Consolidated Statement of Changes in

Equity

Share Share Treasury Share based Foreign Total Retained Total

Capital Premium shares payment currency reserves deficit

reserve translation

reserve

GBP GBP GBP GBP GBP GBP GBP GBP

Balance at 30 June 2015

(unaudited) 13,191,116 25,791,441 - 510,978 (331,281) 179,697 (23,143,417) 16,018,837

Profit / (loss) for the

year 1,091,053 1,091,053

Other comprehensive income

(loss) - exchange

differences (53,338) (53,338) (53,338)

Share options and warrants

expired or cancelled

during the period (510,978) (510,978) 510,978

Share options issued during

the current period 514,279 514,279 514,279

Proceeds of share issue of

share capital (25,292) (8,922) (34,214)

Issue of treasury shares 44,464 -44,464

Balance at 31 December 2015

(audited) 13,210,288 25,782,519 (44,464) 514,279 (384,619) 129,660 (21,541,386) 17,536,617

Profit / (loss) for the

year - - - - - - (2,320,403) (2,320,403)

Other comprehensive income-

exchange differences on

translating of foreign

operations - - - 46,378 46,378 - 46,378

Share options issued during - - - - - - - -

the current period

Proceeds of share issue of

share capital 260,499 712,799 - - - - - 973,298

Balance as at 30 June 2016 13,470,787 26,495,318 (44,464) 514,279 (338,241) 176,038 (23,861,789) 16,235,890

(unaudited)

============================ =========== =========== ========= ============ ============ ========== ============= ============

Unaudited condensed consolidated interim statement of cash

flow

For the six months ended 30 June 2016

6 months 6 months 12 months

to to to

30 June 30 June 31 December

2016 2015 2015

(Unaudited) (Unaudited) (Audited)

GBP GBP GBP

(Loss) / Profit for the period

before taxation (2,320,403) (913,891) 177,162

Adjusted for:

Foreign exchange loss 46,378 69,704 16,366

Depreciation on property, plant

and equipment 3,683 699 21,685

Investment income (480) (234) (2,890)

Bargain purchase from business

combinations - (185,698) (193,425)

Loss on disposal of subsidiaries - - 5,762

Impairment of Goodwill recognised - - 20,057

Non-cash items - - 29,554

Movement on exploration activities - 248,203 -

Share based payments 973,348 - 596,287

Reversal of impairment - - (3,182,240)

Operating income before working

capital changes (1,297,474) (781,217) (2,541,236)

(Increase)/ Decrease in trade

and other receivables 493,974 (832,587) (539,135)

(Decrease)/ Increase in trade

and other payables 20,671 (138,314) 66,691

Cash flow from business combination - 161,367 -

Net cash outflows from operating

activities (782,829) (1,590,751) (3,013,680)

Cash flows from investing activities

Expenditure on exploration activities - (248,203) -

Net cash flow from acquisition

of subsidiaries - - 61,492

Net cash used in investing activities - (248,203) 61,492

Cash flows from financing activities

Proceeds from issue of share capital - 2,487,500 2,453,286

Proceeds from borrowings 700,000 - 500,000

Investment Income 480 234 2,890

------------ ------------ ------------

Net cash proceeds from financing

activities 700,480 2,487,734 2,955,176

Net increase in cash and cash

equivalents (82,349) 648,780 2,988

Cash and cash equivalents at beginning

of period 189,435 186,447 186,447

------------ ------------ ------------

Cash and cash equivalents at end

of period 107,086 835,227 189,435

------------ ------------ ------------

Notes to the unaudited condensed consolidated interim financial

statements

For the six months ended 30 June 2016

1. General information

Kibo Mining Plc ("the Company") is a public limited company

incorporated in Ireland. The condensed consolidated interim

financial statements consolidate those of the Company and its

subsidiaries (together referred to as the "Group"). The Company's

shares are listed on the AIM of the London Stock Exchange and the

Alternative Exchange of the JSE Limited (ALTX). The principal

activities of the Company and its subsidiaries are related to the

exploration for and development of coal and other minerals in

Tanzania.

2. Statement of Compliance and Basis of Preparation

The condensed consolidated financial statements are for the six

months ended 30 June 2016, and have been prepared using the same

accounting policies as those applied by the Group in its December

2015 consolidated annual financial statements, which are in

accordance with the framework concepts and the recognition and

measurement criteria of the International Financial Reporting

Standards (IFRS and IFRC interpretations) issued by the

International Accounting Standards Board ("IASB") as adopted for

use in the EU ("IFRS, including the SAICA financial reporting

guides as issued by the Accounting Practices Committee, IAS 34 -

Interim Financial Reporting, the Listings Requirements of the JSE

Limited, the AIM rules of the London Stock Exchange and the Irish

Companies Act 2015.

The condensed consolidated interim financial results are

prepared in accordance with the going concern principle under the

historical cost basis as modified by the fair value accounting of

certain assets and liabilities where required or permitted by IFRS

in the EU.

These condensed consolidated interim financial statements do not

include all the notes presented in a complete set of consolidated

annual financial statements.

The comparative amounts in the consolidated financial statements

include extracts from the Company's consolidated annual financial

statements for the period ended 31 December 2015.

These extracts do not constitute statutory accounts in

accordance with the Irish Companies Acts 2015. All monetary

information is presented in the presentation currency of the

Company being Pound Sterling.

3. Operating (loss)/ profit

Administrative expenditure for the interim period ended June

2016 includes GBP947,418 relating to financing activities specific

to the borrowings raised throughout the current period (2015

financial period GBP51,000).

4. Loss per share

Basic, dilutive and Headline loss per share

The basic and weighted average number of ordinary shares used in

the calculation of basic earnings per share is as follows:

6 months to 6 months 12 months

to to

30 June 30 June 31 December

2016 2015 2015

GBP GBP GBP

Loss for the year attributable

to equity holders of the parent (2,320,403) (913,891) 177,162

Weighted average number of

ordinary shares for the purposes

of basic and dilutive loss

per share 338,524,702 305,438,536 316,986,334

Basic loss per share (0.007) (0.0029) 0.001

Dilutive loss per share (0.007) (0.0029) 0.001

6 months 6 months 12 months

to to to

Reconciliation of Headline loss 30 June 30 June 31 December

per share

2016 2015 2015

GBP GBP GBP

Loss for the year attributable

to equity holders of the parent (2,320,403) (913,891) 177,162

Impairment of Goodwill - (185,698) 20,057

Loss on disposal of subsidiaries - - 5,762

Bargain purchase from acquisition

of subsidiaries - (193,425)

Reversal of Impairment of Intangible

Assets - - (3,182,240)

------------ ------------ ------------

Headline loss per share (2,320,403) (1,099,589) (3,172,684)

------------ ------------ ------------

Weighted average number of ordinary

shares for the purposes of headline

loss per share (revised) 338,524,702 305,438,536 316,986,334

Headline loss per share (0.007) (0.0036) (0.010)

Headline earnings per share (HEPS) is calculated using the

weighted average number of ordinary shares in issue during the

period and is based on the earnings attributable to ordinary

shareholders, after excluding those items as required by Circular

2/2015 issued by the South African Institute of Chartered

Accountants (SAICA).

5. Called up share capital and share premium

Authorised ordinary share capital of the company is

1,000,000,000 ordinary shares of EUR0.015 each and 3,000,000,000

deferred shares of EUR0.009 each.

Detail of issued capital is as follows:

Number of

Ordinary Nominal Share Treasury

shares Value Premium Shares

GBP GBP GBP

Balance at 31 December

2014 274,238,757 12,591,750 23,903,307 -

Shares issued in period

(net of expensed for

cash) 56,689,957 618,538 1,879,212 (44,464)

Balance at 31 December

2015 330,928,714 13,210,288 25,782,519 (44,464)

------------ ----------- ----------- ---------

Shares issued in period

(net of expensed for

cash) 22,517,556 260,499 712,799 -

------------ ----------- ----------- ---------

Balance at 30 June

2016 353,446,270 13,470,787 26,495,318 (44,464)

------------ ----------- ----------- ---------

6. Segment analysis

IFRS 8 requires an entity to report financial and descriptive

information about its reportable segments, which are operating

segments or aggregations of operating segments that meet specific

criteria. Operating segments are components of an entity about

which separate financial information is available that is evaluated

regularly by the chief operating decision maker. The Chief

Executive Officer is the Chief Operating decision maker of the

Group.

Management currently identifies two divisions as operating

segments - mining and corporate. These operating segments are

monitored and strategic decisions are made based upon them together

with other non-financial data collated from exploration activities.

Principal activities for these operating segments are as

follows:

30 June 2016 Mining and 30 June 2016

Exploration Corporate (GBP)

Group Group Group

Revenue 4,184 - 4,184

Administrative cost - (1,458,100) (1,458,100)

Exploration expenditure (866,967) - (866,967)

Investment and other income - 480 480

Profit/ (Loss) after tax (862,783) (1,457,620) (2,320,403)

------------- ------------ -------------

30 June 2015 Mining and 30 June 2015

Exploration Corporate (GBP)

Group Group Group

Revenue - - -

Administrative cost - (851,620) (851,620)

Exploration expenditure (248,203) - (248,203)

Investment and other income 234 185,698 185,932

Tax - - -

Profit/ (Loss) after tax (247,969) (665,922) (913,891)

------------- ---------- -------------

30 June 2016 30 June 2016

Mining Corporate (GBP)

Group Group Group

----------- ---------- -------------

Assets

Segment assets 17,751,867 11,491 17,763,358

Liabilities

Segment liabilities 198,790 1,328,678 1,527,468

Other Significant items

Depreciation 3,683 - 3,683

31 December 2015 31 December

Mining Corporate 2015 (GBP)

Group Group Group

----------- ---------- ------------

Assets

Segment assets 17,816,927 526,487 18,343,414

Liabilities

Segment liabilities 139,905 666,892 806,797

Other Significant items

Depreciation 21,685 - 21,685

7. Unaudited results

These condensed consolidated interim financial results have not

been audited or reviewed by the Group's auditors.

8. Dividends

No dividends were declared during the interim period.

9. Board of Directors

There were no changes to the board of directors during the

interim period, or any other committee's composition.

10. Subsequent events

No significant events have occurred in the period between the

reporting date and the date of this report.

27 September 2016

By order of the board:

Christian Schaffalitzky Chairman (Non-Executive)

Louis Coetzee Chief Executive Officer (Executive)

Noel O'Keeffe Technical Director (Executive)

Andreas Lianos Chief Financial Officer (Executive)

Lukas Maree Non-Executive Director

Wenzel Kerremans Non-Executive Director

Company Secretary: Noel O'Keeffe

Auditors: Saffery Champness

71 Queen Victoria Street

London EC4V 4BE

Broker: Beaufort Securities Limited

131 Finsbury Pavement

London EC2A 1NT

United Kingdom

UK Nominated Adviser: RFC Ambrian Limited

Level 28, QV1 Building

250 St Georges Terrace

Perth WA 6000

Corporate and Designated River Group

Adviser: 211 Kloof Street

Waterkloof

Pretoria, South Africa

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UNSKRNOAKURR

(END) Dow Jones Newswires

September 27, 2016 04:00 ET (08:00 GMT)

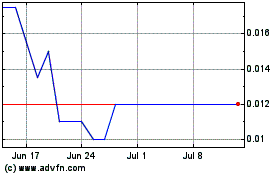

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kibo Energy (LSE:KIBO)

Historical Stock Chart

From Apr 2023 to Apr 2024