Kennametal Beats Q3 Earnings Ests, Revs Lag - Analyst Blog

May 01 2014 - 1:51PM

Zacks

Kennametal Inc. (KMT) reported adjusted

earnings per share of 74 cents in third-quarter fiscal 2014 (ended

Mar 31, 2014). The bottom-line result was 2 cents above the Zacks

Consensus Estimate of 72 cents and increased 13.8% year over

year.

GAAP earnings per share in the quarter came in at 64 cents versus

67 cents earned in the year-ago quarter.

Revenue

Kennametal’s revenues in third-quarter fiscal 2014 were $755.2

million, up 15.2% year over year. The year-over-year increase can

be attributed to a 3% hike in organic revenues, 1% gain from more

working days in the quarter and a 12% contribution from the

acquisition of Tungsten Materials Business (TMB) from ATI in Nov

2013.

Excluding the $77.7 million contribution from the TMB acquisition,

adjusted revenues in the quarter were $677.6 million, lagging the

Zacks Consensus Estimate of $746.0 million

A brief discussion on the segments of Kennametal is given

below:

The Industrial segment’s revenues in the quarter increased 13.3%

year over year to $399.7 million. Organic growth of 5% was driven

by improvements in general engineering and transportation end

markets, offset by declines in aerospace and defense end

markets.

On a geographical basis, revenues increased 11% in Asia, 9% in

Europe and 1% in the Americas. Adjusted revenues, excluding the

$28.4 million gain from TMB acquisition, were $371.3 million.

The Infrastructure segment generated revenues of $355.6 million,

reflecting an increase of 17.5% year over year. Organic growth in

the quarter was flat year over year. Revenues in Europe grew 4% and

in North America increased by 3%, offset partially by 9% decline in

Asia. Adjusted revenues, excluding $49.3 million of gain from TMB

acquisition, were $306.3 million.

On a geographical basis, Kennametal’s revenues from North America

increased 21.4% year over year to $351.5 million; revenues from

Western Europe were $238.3 million, up 19.6% year over year while

revenues from Rest of the World was about $165.5 million, down 0.7%

year over year.

Margins

Cost of revenue in fiscal third-quarter increased 15.6% year over

year and represented 68.4% of total revenue; up from 68.2% in the

year-ago quarter. Operating expenses, as a percentage of total

revenue, stood at 20.2%, up 60 basis points year over year.

Adjusted operating margin in the quarter was 12.7%.

Balance Sheet

Exiting third-quarter fiscal 2014, Kennametal had cash and cash

equivalents of $161.8 million versus $163.3 million in the

preceding quarter. Long-term debt and capital leases decreased

sequentially to $1,022.1 million from $1,035.6 million in the

previous quarter.

Cash Flow

In the 9 months ended Mar 31, 2014, Kennametal generated cash of

$153.2 million versus $150.4 million in the year-ago period.

Capital spent on purchases of property, plant and equipment was

$86.0 million, up from $53.8 million in the 9 months ended Mar 31,

2013.

Free cash flow was approximately $68.2 million compared with $98.3

million in the year-ago period.

In conjunction with the earnings release, Kennametal announced that

its board of directors has approved a quarterly cash dividend

payment of 18 cents per share on May 28 to shareholders of record

as of May 13, 2014.

Outlook

For fiscal 2014, Kennametal lowered its total sales growth guidance

to a range of 10−11% from the 12−13% range expected earlier. The

revised guidance includes a roughly 7−8% (versus 7−9% expected

earlier) contribution from the TMB acquisition.

Organic revenue growth is anticipated to be within the 2−3% range

versus 2−4% expected earlier.

Earnings per share guidance has been lowered to a range of

$2.60−$2.70 from $2.60-$2.75 expected earlier.

Kennametal anticipates cash flow from operating activities to range

within the $280−$310 million range. Capital expenditure is

predicted to be in the $130−$140 million range, while free cash

flow is likely to be within $150−$170 million.

Kennametal currently has a market capitalization of $3.7 billion

and carries a Zacks Rank #3 (Hold). Other stocks to watch out for

in the industry include NN Inc. (NNBR),

Stanley Black & Decker, Inc. (SWK) and

Timken Co. (TKR). While NN Inc. holds a Zacks Rank

#1 (Strong Buy), Stanley Black & Decker and Timken carry a

Zacks Rank #2 (Buy).

KENNAMETAL INC (KMT): Free Stock Analysis Report

NN INC (NNBR): Free Stock Analysis Report

STANLEY B&D INC (SWK): Free Stock Analysis Report

TIMKEN CO (TKR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

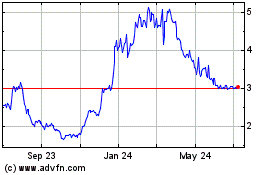

NN (NASDAQ:NNBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

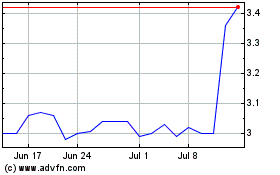

NN (NASDAQ:NNBR)

Historical Stock Chart

From Apr 2023 to Apr 2024