Consolidated sales reach all-time high for

second consecutive year

Kyocera Corporation (NYSE:KYO)(TOKYO:6971) today announced its

consolidated financial results for the fiscal year ended March 31,

2015, as summarized below. Complete details are available at:

http://global.kyocera.com/ir/financial/f_results.html

Consolidated Results:

Year-Over-Year

Unit: Millions (except percentages and

per-share amounts)

Years Ended March 31,

2014(FY14)in JPY

2015(FY15)in JPY

Increase(Decrease)

2015(FY15)in USD

2015(FY15)in EUR

Amountin JPY

% Net sales: 1,447,369 1,526,536 79,167 5.5 12,721 11,743

Profit from operations: 120,582 93,428 (27,154) (22.5) 779 719

Income before income taxes: 146,268 121,862 (24,406) (16.7) 1,016

937

Net income attributable toshareholders of

KyoceraCorporation:

88,756 115,875 27,119 30.6 966 891

Diluted earnings per shareattributable to

shareholders ofKyocera Corporation:

241.93 315.85 - - 2.63

2.43

Note: As a convenience to the reader, U.S. dollar (USD) and euro

(EUR) conversions are provided based on the rates of USD1 = JPY120

and EUR1 = JPY130, rounded to the nearest unit.

Consolidated Results Summary

With regard to the principal markets served by Kyocera

Corporation and its consolidated subsidiaries (the “Kyocera Group”

or “Kyocera”), the year ended March 31, 2015 (“the period”) brought

rising demand for smartphones, as well as increased sales of

automobiles especially in the United States and China. Japan’s

solar energy market slowed due to the end of subsidies for new

residential solar power systems and the suspension of utility-grid

access applications.

Kyocera recorded its highest annual consolidated revenue for the

second consecutive year, led by increased sales in its Components

Business, which mainly serves producers of automobiles,

smartphones, telecommunications infrastructure, and industrial

machinery. The company’s Equipment Business also recorded sales

growth, particularly outside of Japan, due to the launch of new

products and outreach to new customers. Profit increased in the

Fine Ceramic Parts Group, Semiconductor Parts Group, Electronic

Device Group and Information Equipment Group due to higher sales

and successful cost containment. Nonetheless, Kyocera’s

consolidated results in profit from operations and income before

income taxes decreased, due mainly to the recording of losses

related to asset impairments in the Applied Ceramic Products Group

and Telecommunications Equipment Group.

In summary, consolidated net sales increased 5.5% over the prior

period, to JPY1,526,536 (USD12,721) million; profit from operations

decreased 22.5%, to JPY93,428 (USD779) million; and income before

income taxes decreased 16.7%, to JPY121,862 (USD1,016) million. Net

income attributable to shareholders of Kyocera Corporation

increased 30.6%, to JPY115,875 (USD966) million, due primarily to

the revaluation of deferred tax assets and liabilities in line with

a revision of the Japanese tax system, resulting in an increase of

approximately JPY36,300 (USD303) million.

Consolidated Q4 Results,

Year-Over-Year

Unit: Millions (except percentages)

Three Months Ended March 31,

2014(FY14-Q4)in JPY

2015(FY15-Q4)in JPY

Increase(Decrease)

2015(FY15-Q4)in USD

2015(FY15-Q4)in EUR

Amountin JPY

% Net sales: 375,981 424,844 48,863 13.0 3,540 3,268 Profit

from operations: 30,886 3,206 (27,680) (89.6) 27 25 Income before

income taxes: 35,924 7,195 (28,729) (80.0) 60 55

Net income attributable toshareholders of

KyoceraCorporation:

19,392 41,904 22,512 116.1 349

322

Note: As a convenience to the reader, U.S. dollar (USD) and euro

(EUR) conversions are provided based on the rates of USD1 = JP120

and EUR1 = JPY130, rounded to the nearest unit.

Consolidated Forecast: Year Ending March 31, 2016

During the year ending March 31, 2016 (“Fiscal 2016”), the

Japanese economy is expected to head toward recovery as personal

consumption and private capital investment rebound. The European

economy is expected to continue expanding moderately, while the

U.S. economic forecast calls for steady growth.

With regard to Kyocera’s core markets, component demand is

expected to increase in the information and communications field,

based on continued growth in sales of smartphones and

infrastructure equipment such as telecommunications base stations.

In automotive markets, Kyocera forecasts higher demand for

electronic components and devices due to expanding automobile

production and the rising electronic content of in-vehicle safety

and emissions systems. In the environment and energy market, demand

for Home Energy Management Systems (HEMS) and power-storage units

is expected to grow despite an anticipated contraction in Japan’s

solar energy market.

Kyocera will strive to capitalize on expanding markets and

strengthen production capacity in both the Components Business and

Equipment Business with the aim of achieving record sales for the

third consecutive year. At the same time, efforts will be made to

boost profitability through comprehensive cost containment in order

to achieve full-year consolidated financial forecasts.

Consolidated Forecast: Year Ending

March 31, 2016

Unit: Yen in millions (except percentages, per-share amounts and

exchange rates)

Fiscal 2015Results

Fiscal 2016Forecast

Increase(Decrease)(%) to Fiscal2015

Results

Net sales: 1,526,536

1,600,000 4.8 Profit from operations:

93,428

160,000 71.3 Income before income taxes: 121,862

184,000 51.0

Net income attributable toshareholders of

Kyocera Corporation:

115,875

120,000 3.6

Diluted earnings per share attributableto

shareholders ofKyocera Corporation*:

315.85

327.10 - Average USD exchange rate: 110

115 -

Average EUR exchange rate: 139

125 -

* Forecast of “Diluted earnings per share attributable to

shareholders of Kyocera Corporation” is based on the diluted

average number of shares outstanding during the year ended March

31, 2015.

FORWARD-LOOKING STATEMENTS

Except for historical information contained herein, the matters

set forth in this press release are forward-looking statements that

involve risks and uncertainties including, but not limited to,

product demand, competition, regulatory approvals, the effect of

economic conditions and technological difficulties, and other risks

detailed in the Company’s filings with the U.S. Securities and

Exchange Commission.

About KYOCERA

Kyocera Corporation (NYSE:KYO)(TOKYO:6971)

(http://global.kyocera.com/), the parent and global headquarters of

the Kyocera Group, was founded in 1959 as a producer of fine

ceramics (also known as “advanced ceramics”). By combining these

engineered materials with metals and integrating them with other

technologies, Kyocera has become a leading supplier of electronic

components, printers, copiers, solar power generating systems,

mobile phones, semiconductor packages, cutting tools and industrial

ceramics. Kyocera appears on the latest listing of the “Top 100

Global Innovators” by Thomson Reuters, and is ranked #531 on Forbes

magazine’s current “Global 2000” listing of the world’s largest

publicly traded companies.

KYOCERA Corporation (Japan)Hina Morioka,

+81-(0)75-604-3416Corporate

Communicationswebmaster.pressgl@kyocera.jpFax:

+81-(0)75-604-3516

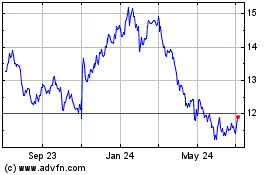

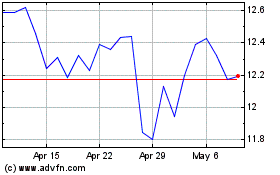

Kyocera (PK) (USOTC:KYOCY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kyocera (PK) (USOTC:KYOCY)

Historical Stock Chart

From Apr 2023 to Apr 2024