Judge Weighs Another Lawsuit Reprieve for Caesars

August 26 2016 - 1:50AM

Dow Jones News

CHICAGO—The federal judge weighing whether to grant Caesars

Entertainment Corp. another reprieve in an $11 billion legal battle

on Thursday raised the possibility that settlement talks might make

more progress if litigation involving bondholders is allowed to

proceed.

As lawyers wrapped up their arguments Thursday over a proposed

litigation shield for Caesars, Judge A. Benjamin Goldgar of the

U.S. Bankruptcy Court in Chicago asked if past settlement talks

were "more productive" when such a shield wasn't in place.

The judge then wondered whether the temporary litigation shield

he previously granted has had "exactly the opposite effect" by

discouraging settlement talks.

Caesars, which isn't in bankruptcy, faces lawsuits demanding

that it honor guarantees of more than $11 billion of its bankrupt

operating unit's bond debt. Caesars says the guarantees are no

longer valid.

Judge Goldgar, who is overseeing the operating unit's chapter 11

case, has previously enjoined, or halted, the litigation. That

shield will expire Monday, however, unless he renews the

injunction. If he doesn't, New York and Delaware courts could issue

speedy rulings on the disputed guarantees in a matter of weeks.

A ruling is expected Friday afternoon.

Lawyers for the bankrupt Caesars Entertainment Operating Co., or

CEOC, unit argue the success of its chapter 11 case, pending for

more than 19 months, is on the line. They say the injunction is

needed to protect an estimated $4 billion contribution by Caesars

to the restructuring, part of a broad settlement that aims to

resolve the bondholder litigation and other legal claims.

"Let us finish the job," CEOC lawyer David Zott said in court

Thursday.

"That's what you asked me for last time," Judge Goldgar

responded. "So the job wasn't finished? What's to make me think

that it will be if I grant you what you want this time?"

Mr. Zott, of Kirkland & Ellis, cited testimony from an

adviser to the bankrupt operating unit, who earlier this week said

a settlement is "close."

Bondholders, however, say protecting Caesars has so far

discouraged settlement talks and will continue to do so. They say

allowing their litigation to proceed will level the playing

field.

"There's nothing about another injunction that would be

equitable or fair," said Jones Day lawyer Jim Johnston, who

represents bondholder plaintiff Wilmington Savings Fund

Society.

CEOC sought chapter 11 protection in January 2015 with some $18

billion in debt, the product of a 2008 leveraged buyout by

private-equity firms Apollo Global Management and TPG, currently

Caesars' majority owners.

The major hurdle in CEOC's chapter 11 case has been securing

unanimous creditor support for a broad deal to settle legal claims

against Caesars and the private-equity firms.

A court-appointed investigator found that a series of

prebankruptcy transactions orchestrated by Caesars and its backers

moved valuable assets away from CEOC, hurting the now-bankrupt

company and its creditors.

Caesars and its backers staunchly defend the deals, which are

also the subject of the bondholder litigation, and dispute

liability.

Write to Jacqueline Palank at jacqueline.palank@wsj.com

(END) Dow Jones Newswires

August 26, 2016 01:35 ET (05:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

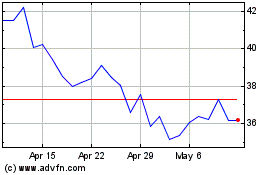

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Mar 2024 to Apr 2024

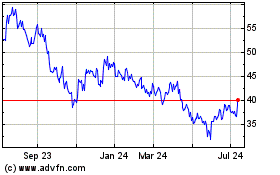

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Apr 2023 to Apr 2024