Jim Breyer, IDG Raise $1 Billion China Fund

July 12 2016 - 11:40AM

Dow Jones News

Veteran Silicon Valley investor Jim Breyer and Chinese firm IDG

Capital Partners have raised one of the largest venture-capital

funds in China despite concerns that the market for later-stage

startups is overheated.

Mr. Breyer, best known for his early investment in Facebook

Inc., and IDG Capital, one of China's top investors, jointly

announced Tuesday they raised $1 billion to invest in growth-stage

companies both in China and those looking to enter the country. The

new fund will make investments in a wide range of industries

including technology, media, health care and energy.

The fund is the seventh and largest China investment fund that

IDG and Mr. Breyer have sponsored dating back to 2005, according to

Dow Jones LP Source. The first five were a collaboration between

IDG and Mr. Breyer's old U.S. firm, Accel Partners, and the last

two between IDG and Mr. Breyer's new firm, Breyer Capital.

At $1 billion under management, IDG Capital Fund III nearly

doubles the prior fund's $586 million. That fund, raised in 2014,

was smaller in part because it focused on early-stage startups

while the new one is targeting more mature companies. The last

growth fund, raised by IDG and Accel Partners, was $750 million in

2011.

One challenge, said Mr. Breyer in an interview, will be finding

investments in today's "frothy" market. "When late-stage company

valuations are as high as they are today in China and the U.S.,

prospective returns are much lower than they have been," he said.

"I try to remind myself and my Chinese partners: 'Do not pursue

high returns in a low-return environment.' "

Of the 10 largest global venture-capital funding rounds this

year, six of them involved Chinese companies, according to Dow

Jones VentureSource. They include a $4.5 billion investment in Didi

Chuxing Technology Co. that valued the ride-hailing company at $28

billion, and a $3.3 billion deal for Meituan-Dianping that gave the

e-commerce company a valuation over $18 billion.

Mr. Breyer said that considering the high valuations for private

companies, the firm will deploy its capital slowly over three to

four years for new investments. "One of the hardest parts of the

business to continuously try to master is to come to work and in

some cases not make new investments for a year," Mr. Breyer

said.

There are other challenges to investing in China. The country

restricts foreign investments in certain classes of companies that

hope to go public, including internet companies. That may have been

a bigger problem a year ago, when the Chinese stock market was

rising to new highs. At that point, even some companies trading

publicly in the U.S. went private so they could relist in

China.

But the Shanghai Composite Index crashed last summer. It is down

more than 40% from its 2015 high, reducing excitement locally for

highflying tech companies. The volatility was also blamed by many

venture capitalists for piercing the bubble that had started to

inflate valuations of late-stage U.S. private companies.

The decline in valuations has at least taken some air out of the

market, which could bolster future returns. And Mr. Breyer

nonetheless remains excited about Chinese investment opportunities.

"We believe there are some emerging opportunities around enterprise

in China and cloud computing that many global investors outside of

China [are] underestimating," he said.

The Breyer-Accel-IDG partnership over the years has resulted in

some big winners. One is Legendary Entertainment, which Accel,

Breyer Capital and IDG-Accel invested in six years ago and which

sold itself for $3.5 billion earlier this year to Chinese

conglomerate Dalian Wanda Group Co.

IDG Capital is also an investor in several companies valued at

$1 billion or more, including Chinese mobile-phone maker Xiaomi

Ltd., last valued at $46 billion, and Chinese e-commerce site Vancl

at $3 billion. Its big past bets include Baidu Inc., Tencent

Holdings Ltd., and Qihoo 360 Technology Co.

Write to Rolfe Winkler at rolfe.winkler@wsj.com

(END) Dow Jones Newswires

July 12, 2016 11:25 ET (15:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

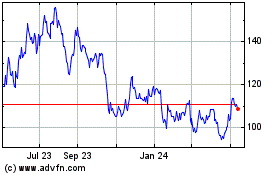

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Apr 2023 to Apr 2024