TIDMJEL

RNS Number : 1195Y

Jersey Electricity PLC

13 May 2016

Jersey Electricity plc

Interim Management Report

for the six months ended 31 March 2016

The Board approved at a meeting on 12 May 2016 the Interim

Management Report for the six months ended 31 March 2016 and

declared an interim dividend of 5.50p compared to 5.25p for 2015.

The dividend will be paid on 30 June 2016 to those shareholders

registered in the records of the Company on 3 June 2016.

The Interim Management Report is attached and will be available

to the public on the Company's website

www.jec.co.uk/about-us/investor-relations/financial-figures-and-reports.

The Interim Management Report for 2016 has not been audited or

reviewed by our external auditors nor have the results for the

equivalent period in 2015. The results for the year ended 30

September 2015 have been extracted from the statutory accounts

which had an unqualified audit opinion.

M.P. Magee P.J. Routier

Finance Director Company Secretary

Direct telephone number : 01534 505201 Direct telephone number : 01534 505253

Email : mmagee@jec.co.uk Email : proutier@jec.co.uk

13 May 2016

The Powerhouse,

PO Box 45,

Queens Road,

St Helier,

Jersey JE4 8NY

Jersey Electricity plc

Unaudited Interim Management Report

for the six months to 31 March 2016

Financial Summary 6 months 6 months

2016 2015

--------------------------- --------- ---------

Electricity Sales in kWh

(000) 351,942 357,362

Revenue GBP57.0m GBP55.8m

Profit before tax GBP 7.9m GBP 8.0m

Profit in Energy business GBP 6.9m GBP 7.4m

Earnings per share 20.65p 20.75p

Final dividend paid per

ordinary share 7.60p 7.20p

Proposed interim dividend

per ordinary share 5.50p 5.25p

Net debt GBP21.1m GBP21.9m

Overall trading performance

Group revenue, at GBP57.0m, was 2% higher for the first half

year of 2016 than the same period in 2015 with this rise coming

from increased activity in the non-Energy business units. Profit

before tax was GBP7.9m being marginally behind the equivalent

period last year and remains at a level commensurate with a

sustainable rate of return typical for a regulated utility and at a

quantum needed to maintain our continued investment in

infrastructure. Cost of sales increased by GBP0.9m to GBP36.6m due

mainly to additional costs in the non-Energy business units

associated with the aforementioned rise in revenue. Operating

expenses at GBP11.9m were GBP0.4m above last year with an increase

in depreciation charges and pension costs being the primary

drivers. Earnings per share fell to 20.65p from 20.75p in 2015. Net

debt on the balance sheet at 31 March 2016 was GBP21.1m (2015:

GBP21.9m) but will rise in the second half driven by our continued

investment in infrastructure assets in our Energy business.

Energy Division

Unit sales of electricity fell by 1.5%, from 357m to 352m kWh,

compared with the same period in the prior year. Mild weather,

compared with long-term average temperatures, was experienced in

the first half of this financial year, resulting in a reduced use

of electricity primarily in the heating of residential properties.

Revenues in our Energy Division at GBP45.5m remained at the same

level as 2015 because although unit sales were lower the level of

activity in ad-hoc rechargeable work was much higher. Operating

profit in Energy at GBP6.9m was GBP0.5m lower than in the same

period last year with lower unit sales, higher depreciation,

increased maintenance and higher IAS19 pension costs being the

reasons. We imported 90% of our on-Island requirement from France

(2015: 94%) and generated 4% of our electricity in Jersey (2015:

2%). Additional training for power station staff was the main

reason for the higher level of generation/lower level of

importation between 2016 and the previous year. The remaining 6%

(2015: 4%) of our electricity came from the Energy from Waste

plant, owned by the States of Jersey.

Investment in infrastructure

Capital expenditure was GBP11.5m in the first 6 months of the

financial year. The main area of spend was for the N1 subsea cable

which is currently being manufactured in Italy and is expected to

be laid between Jersey and France later in 2016 and be commissioned

by early 2017. The previous EDF1 cable which it replaces was

successfully removed from the seabed during Spring 2016. N1 is a

joint project between Jersey Electricity and Guernsey Electricity

with a budgeted cost of around GBP40m and we are pleased with the

progress made to date in terms of both timing and cost. We are also

continuing with the preparation of the site for our new West of St

Helier Primary sub-station which has an estimated cost of GBP17m

and is planned to be commissioned in 2018.

Non-Energy performance

Year-on-year revenue in our retailing business, Powerhouse.je,

rose by 9% post the restructuring of this business unit in recent

years to GBP6.4m (2015: GBP5.9m) and encouragingly profitability

improved to GBP0.4m from GBP0.3m in what is a competitive

marketplace, both locally and off-island. Revenue rose by GBP0.1m

to GBP1.3m for our Property portfolio and profit rose to GBP0.9m

(2015: GBP0.8m) due to improved rental yield. JEBS, our contracting

and business services unit, saw a GBP0.5m increase in revenue to

GBP3.1m and moved from a breakeven position in 2015 to a profit of

GBP0.1m despite it being a challenge to recruit new skilled staff

in a tight local market. Our remaining business units were on

target and produced profits of GBP0.3m being at the same overall

level as in 2015.

Forward hedging of electricity and foreign exchange and customer

tariffs

Our goal, through use of our power purchase contract and

associated hedging policies, continues to be the delivery of

competitive and stable customer tariffs, along with secure

low-carbon electricity supplies whilst maintaining an appropriate,

fair return for our shareholders. Our electricity purchases are

materially hedged for the period 2016-19. As these are

contractually denominated in the Euro we enter into foreign

currency contracts to eliminate a large percentage of exposure to

aid tariff planning. We have seen significant volatility in foreign

exchange in the last six months against the Euro largely associated

with the impending UK vote as to whether to remain within the EU,

which is why we seek to largely eliminate exposure. This has

resulted in a fair value increase of GBP5.6m (net of tax) as shown

in the Condensed Consolidated Statement of Comprehensive Income,

and a resultant rise in our balance sheet net assets, whereas last

year we saw a movement in the opposite direction.

Debt and financing

The net debt figure, as expected, rose to GBP21.1m at 31 March

2016 compared to GBP17.5m at the last year end and we have

additional bank facilities in place to fund our continued forecast

investment spend. It is the aim of the Board that Jersey

Electricity continues to maintain a prudent level of debt in the

context of our overall balance sheet, which remains strong.

Dividend

Your Board proposes to pay an interim net dividend for 2016 of

5.50p (2015: 5.25p). We continue to aim to deliver sustained real

growth each year over the medium-term. The final dividend for 2015

of 7.60p, paid in late March in respect of the last financial year,

was an increase of 6% on the previous year.

Risk and outlook

The principal risks and uncertainties identified in our last

Annual Report have not materially altered in the interim period.

However as mentioned previously in the text above the potential

exit of the UK from the EU has created recent volatility in foreign

exchange markets. If the vote on 23 June results in a planned exit

it is likely that such volatility would continue and may influence

our longer-term tariff planning strategy (albeit we are largely

hedged in the short-term).

Your Board is satisfied that Jersey Electricity plc has

sufficient resources to continue in operation for the foreseeable

future, a period of not less than 12 months from the date of this

report. Accordingly, we continue to adopt the going concern basis

in preparing the condensed financial statements.

Responsibility statement

We confirm to the best of our knowledge:

(a) the condensed set of financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting';

(b) the Interim Directors Statement includes a fair review of

the information required by the Disclosure and Transparency Rule

DTR 4.2.7R (indication of important events during the first six

months and description of principal risks and uncertainties for the

remaining six months of the year); and

(c) the Interim Directors Statement includes a fair review of

the information required by the Disclosure and Transparency Rule

DTR 4.2.8R (disclosure of related party transactions and changes

therein); and

(d) this half yearly interim report contains certain

forward-looking statements with respect to the operations,

performance and financial condition of the Group. By their nature,

these statements involve uncertainty since future events and

circumstances can cause results and developments to differ

materially from those anticipated. The forward-looking statements

reflect knowledge and information available at the date of

preparation of this half yearly financial report and the Company

undertakes no obligation to update these forward-looking

statements. Nothing in this half yearly financial report should be

construed as a profit forecast.

C.J. AMBLER - Chief Executive M.P.MAGEE - Finance Director 13 May 2016

INVESTOR TIMETABLE FOR 2016

3 June Record date for interim ordinary dividend

30 June Interim ordinary dividend for year

ending 30 September 2016

1 July Payment date for preference share dividends

14 December Preliminary announcement of full year

results

Condensed Consolidated Income Statement (Unaudited)

Six months Six months Year ended

ended ended 30 September

31 March 31 March

2016 2015 2015

Note GBP000 GBP000 GBP000

Revenue 2 57,036 55,840 100,479

Cost of sales (36,610) (35,705) (64,604)

Gross profit 20,426 20,135 35,875

Revaluation of investment

properties - - (45)

Operating expenses (11,851) (11,408) (21,931)

----------- --------------- --------------

Group operating profit

before exceptional items 8,575 8,727 13,899

Exceptional items - RTE

outage compensation - - 479

- reversal of EDF1 related

provision - - 310

Group operating profit 2 8,575 8,727 14,688

Finance income 19 15 36

Finance expense (668) (786) (1,555)

Profit from operations

before taxation 7,926 7,956 13,169

Taxation 3 (1,573) (1,583) (2,397)

----------- --------------- --------------

Profit from operations

after taxation 6,353 6,373 10,772

Attributable to:

Owners of the Company 6,326 6,357 10,725

Non-controlling interests 27 16 47

----------- --------------- --------------

Profit for the period/year

attributable to the equity

holders of the parent

Company 6,353 6,373 10,772

----------- --------------- --------------

Earnings per share

- basic and diluted 20.65 20.75 35.00

Dividends per share

- paid 4 7.60 7.20 12.45

- proposed 4 5.50 5.25 7.60

Condensed Consolidated Statement of Comprehensive Income

(Unaudited)

Six months Six months Year ended

ended ended 30 September

31 March 31 March

2016 2015 2015

GBP000 GBP000 GBP000

Profit for the period/year 6,353 6,373 10,772

Items that will not be

reclassified subsequently

to

profit or loss:

Actuarial gain/(loss)

on defined benefit scheme 1,595 1,329 (5,706)

Income tax relating to

items not reclassified (319) (266) 1,141

1,276 1,063 (4,565)

Items that may be reclassified

subsequently to profit

or loss:

Fair value gain/(loss)

on cash flow hedges 6,979 (5,486) (874)

Income tax relating to

items that may be reclassified (1,396) 1,097 175

----------- ----------- --------------

5,583 (4,389) (699)

Total comprehensive income

for the period/year 13,212 3,047 5,508

Attributable to:

Owners of the Company 13,185 3,031 5,461

Non-controlling interests 27 16 47

----------- ----------- --------------

13,212 3,047 5,508

----------- ----------- --------------

Condensed Consolidated Statement of Changes in Equity

(Unaudited)

Share Revaluation ESOP Other Retained

capital reserve reserve reserves earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 October 2015 1,532 5,270 (97) (4,214) 145,223 147,714

Total recognised income

and expense for the period - - - - 6,326 6,326

Additional shares for

employee share scheme - - (114) - - (114)

Amortisation of employee

share scheme - - 20 - - 20

Unrealised gain on hedges

(net of tax) - - - 5,583 - 5,583

Actuarial gain on defined

benefit scheme (net of

tax) - - - - 1,276 1,276

Equity dividends paid - - - - (2,329) (2,329)

------- ----------- ------- -------- -------- -------

At 31 March 2016 1,532 5,270 (191) 1,369 150,496 158,476

------- ----------- ------- -------- -------- -------

At 1 October 2014 1,532 5,270 (36) (3,515) 142,878 146,129

Total recognised income

and expense for the period - - - - 6,357 6,357

Additional shares for

employee share scheme - - (93) - - (93)

Amortisation of employee

share scheme - - 26 - - 26

Unrealised loss on hedges

(net of tax) - - - (4,389) - (4,389)

Actuarial gain on defined

benefit scheme (net of

tax) - - - - 1,063 1,063

Equity dividends paid - - - - (2,206) (2,206)

------- ----------- ------- -------- -------- -------

At 31 March 2015 1,532 5,270 (103) (7,904) 148,092 146,887

------- ----------- ------- -------- -------- -------

At 1 October 2014 1,532 5,270 (36) (3,515) 142,878 146,129

Total recognised income

and expense for the period - - - - 10,725 10,725

Additional shares for

employee share scheme - - (112) - - (112)

Amortisation of employee

share scheme - - 51 - - 51

Unrealised loss on hedges

(net of tax) - - - (699) - (699)

Actuarial loss on defined

benefit scheme (net of

tax) - - - - (4,565) (4,565)

Equity dividends paid - - - - (3,815) (3,815)

------- ----------- ------- -------- -------- -------

At 30 September 2015 1,532 5,270 (97) (4,214) 145,223 147,714

------- ----------- ------- -------- -------- -------

Condensed Consolidated Balance Sheet (Unaudited)

Note As at As at As at 30

31 March 31 March September

2016 2015 2015

GBP000 GBP000 GBP000

Non-current assets

Intangible assets 198 80 227

Property, plant and

equipment 192,780 183,377 187,845

Investment property 20,460 20,505 20,460

Secured loan accounts 708 731 731

Other investments 5 5 5

Total non-current assets 214,151 204,698 209,268

---------- ---------- -----------

Current assets

Inventories 5,853 6,173 6,239

Trade and other receivables 19,038 19,350 14,777

Derivative financial

instruments 6 4,423 - 1,194

Cash and cash equivalents 8,905 8,106 12,503

Total current assets 38,219 33,629 34,713

Total assets 252,370 238,327 243,981

---------- ---------- -----------

Current liabilities

Trade and other payables 15,620 16,113 17,597

Derivative financial

instruments 6 2,564 9,733 6,314

Current tax payable 619 - 404

Total current liabilities 18,803 25,846 24,315

---------- ---------- -----------

Net current assets 19,416 7,783 10,398

---------- ---------- -----------

Non-current liabilities

Trade and other payables 20,930 19,540 18,884

Retirement benefit

deficit 5,696 193 7,291

Financial liabilities

- preference shares 235 235 235

Borrowings 30,000 30,000 30,000

Deferred tax liabilities 18,185 15,603 15,529

Total non-current liabilities 75,046 65,571 71,939

---------- ---------- -----------

Total liabilities 93,849 91,417 96,254

---------- ---------- -----------

Net assets 158,521 146,910 147,727

---------- ---------- -----------

Equity

Share capital 1,532 1,532 1,532

Revaluation reserve 5,270 5,270 5,270

ESOP reserve (191) (103) (97)

Other reserves 1,369 (7,904) (4,214)

Retained earnings 150,496 148,092 145,223

---------- ---------- -----------

Equity attributable

to owners of the Company 158,476 146,887 147,714

Non-controlling interests 45 23 13

---------- ---------- -----------

Total equity 158,521 146,910 147,727

---------- ---------- -----------

Condensed Consolidated Cash Flow Statement (Unaudited)

Six months Six months Year ended

ended ended 30 September

31 March 31 March

Note 2016 2015 2015

GBP000 GBP000 GBP000

Cash flows from operating activities

Operating profit before exceptional

items 8,575 8,727 13,899

Depreciation and amortisation

charges 4,957 4,865 9,926

Loss on revaluation of investment

property - - 45

Pension operating charge less

contributions paid 300 150 213

Loss on sale of fixed assets - 4 7

Operating cash flows before movements

in working capital 13,832 13,746 24,090

Decrease in inventories 386 1,160 1,095

(Increase)/decrease in trade

and other receivables (4,222) (3,328) 1,884

Increase/(decrease) in trade

and other payables 860 (1,016) (2,604)

Interest paid (654) (782) (1,548)

Preference dividends paid (4) (4) (9)

Cash amounts relating to exceptional

items - - 479

Net cash flows generated from

operating activities 10,198 9,776 23,387

--------------------------------------- ------- ----------- ----------- --------------

Cash flows from investing activities

Purchase of property, plant and

equipment (11,335) (9,160) (16,629)

Capitalised interest paid (117) - (4)

Purchase of intangible assets (6) (67) (207)

Net proceeds from disposal of

fixed assets - - 3

Net cash used in investing activities (11,458) (9,227) (16,837)

--------------------------------------- ------- ----------- ----------- --------------

Cash flows from financing activities

Equity dividends paid 4 (2,357) (2,234) (3,859)

Deposit interest received 19 15 36

Net cash used in financing activities (2,338) (2,219) (3,823)

--------------------------------------- ------- ----------- ----------- --------------

Net (decrease)/increase in cash

and cash equivalents (3,598) (1,670) 2,727

Cash and cash equivalents at

beginning of period/year 12,503 9,776 9,776

Net cash and cash equivalents

at end of period/year 8,905 8,106 12,503

Notes to the Condensed Interim Accounts (Unaudited)

1. Accounting policies

Basis of preparation

The interim financial statements for the six months ended 31

March 2016 have been prepared on the basis of the accounting

policies set out in the 30 September 2015 annual report and

accounts using accounting policies consistent with International

Financial Reporting Standards (IFRS) and in accordance with IAS 34

'Interim Financial Reporting'.

Jersey Electricity plc has considerable financial resources and,

as a consequence, the directors believe that it is well placed to

manage its business risks successfully. The directors have a

reasonable expectation that the Group has adequate resources to

continue in operational existence for the foreseeable future. Thus

they continue to adopt the going concern basis of accounting in

preparing the interim financial statements.

2. Revenue and profit

The contributions of the various activities to Group revenue and

profit are listed below:

Six months ended Six months ended Year ended

31 March 2016 31 March 2015 30 September

2015

External Internal Total External Internal Total External Internal Total

Revenue GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Energy 45,462 72 45,534 45,510 46 45,556 80,698 129 80,827

Building

Services 2,772 280 3,052 2,251 289 2,540 4,148 808 4,956

Retail 6,413 20 6,433 5,891 16 5,907 11,087 40 11,127

Property 1,046 299 1,345 962 299 1,261 2,084 599 2,683

Other 1,343 393 1,736 1,226 378 1,604 2,462 777 3,239

--------- --------- -------- --------- --------- -------- --------- --------- --------

57,036 1,064 58,100 55,840 1,028 56,868 100,479 2,353 102,832

Inter-segment

elimination (1,064) (1,028) (2,353)

-------- -------- --------

57,036 55,840 100,479

-------- -------- --------

Operating

profit

Energy 6,904 7,354 11,514

Building

Services 116 (4) (58)

Retail 411 286 334

Property 870 798 1,562

Other 274 293 592

-------- -------- --------

8,575 8,727 13,944

Revaluation

of investment

properties - - (45)

Exceptional

items :

RTE outage

compensation - - 479

Impact of

reversal

of EDF1

related

provision - - 310

Operating

profit 8,575 8,727 14,688

-------- -------- --------

Materially, all of the Group's operations are conducted within

the Channel Islands. All transfers between divisions are at an

arm's-length basis. The assets and liabilities of the Group are not

reported on as there has been no significant movement in the values

in the six months to 31 March 2016.

Notes to the Condensed Interim Accounts (Unaudited)

3. Taxation

Six months Year ended

ended 30 September

31 March

2016 2015 2015

GBP000 GBP000 GBP000

Current income tax 215 - 404

Deferred income tax 1,358 1,583 1,993

---------- ---------- --------------

Total income tax 1,573 1,583 2,397

========== ========== ==============

For the period ended 31 March 2016 and subsequent periods, the

Company is taxable at the rate applicable to utility companies of

20%.

4. Dividends

Six months Year

ended ended

31 March 30 September

2016 2015 2015

GBP000 GBP000 GBP000

Distributions to equity holders 2,329 2,206 3,815

======== ======== ==============

The distribution to equity holders in respect of the final

dividend for 2015 of GBP2,329,000 (7.60p net of tax per share) was

paid on 29 March 2016.

The Directors have declared an interim dividend of 5.50p per

share, net of tax (2015: 5.25p) for the six months ended 31 March

2016 to shareholders on the register at the close of business on 3

June 2016. This dividend was approved by the Board on 12 May 2016

and has not been included as a liability at 31 March 2016.

5. Pensions

In consultation with the independent actuaries to the scheme,

the valuation of the pension scheme assets and liabilities has been

updated to reflect current market discount rates, current market

values of investments and actual investment returns applicable

under IAS 19 'Employee Benefits', and consideration has also been

given as to whether there have been any other events that would

significantly affect the pension liabilities.

6. Financial instruments

The Group held the following derivative contracts, classified as

level 2 financial instruments at 31 March 2016.

Recurring fair value measurements: Six months Year

Ended

Ended 31 March

30 September

Foreign exchange currency hedges 2016 2015

GBP000 GBP000

Derivative assets 4,423 1,194

-------- ---------

Derivative liabilities (2,564) (6,314)

-------- ---------

Notes to the Condensed Interim Accounts (Unaudited)

All financial instruments for which fair value is recognised or

disclosed are categorised within the fair value hierarchy. This

hierarchy is based on the underlying assumptions used to determine

the fair value measurement as a whole and is categorised as

follows:

Level 1 financial instruments are those with values that are

immediately comparable to quoted (unadjusted) market prices in

active markets for identical assets or liabilities;

Level 2 financial instruments are those with values that are

determined using valuation techniques for which the basic

assumptions used to calculate fair value are directly or indirectly

observable (such as to readily available market prices);

Level 3 financial instruments are shown at values that are

determined by assumptions that are not based on observable market

data (unobservable inputs).

The derivative contracts for foreign currency shown above are

classified as level 2 financial instruments and are valued using a

discounted cash flow valuation technique. Future cash flows are

estimated based on forward exchange rates (from observable forward

exchange rates at the end of the reporting period) and contract

forward rates, discounted at a rate that reflects the credit risk

of various counterparties.

7. Related party transactions

The Company currently leases the La Collette Power Station site

from its largest shareholder, the States of Jersey, for a

peppercorn rent of GBP1,000 per annum. This lease was subject to a

rent review as at June 2006 and the Company is in dispute with its

landlord, the States of Jersey, concerning the outstanding rent

review. The information usually required by IAS 37 Provisions,

'Contingent liabilities and contingent assets', is not disclosed on

the grounds that it may prejudice the outcome of the dispute.

Value Value of Value of

of electricity goods & goods &

services other services services Amounts Amounts

supplied supplied purchased due to due by

by Jersey by Jersey by Jersey Jersey Jersey

Electricity Electricity Electricity Electricity Electricity

Six months ended 2016 2015 2016 2015 2016 2015 2016 2015 2016 2015

31 March

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

The States of

Jersey 3,761 3,867 725 590 1,102 561 732 661 1 128

JT Group Limited 980 980 268 173 19 66 157 118 3 -

Jersey Post

Int Limited 58 49 - - 17 16 7 7 - -

Jersey New

Waterworks

Ltd 409 417 74 47 64 55 63 63 7 -

The States of Jersey is the Group's majority and controlling

shareholder. Jersey New Waterworks is majority owned and controlled

by the States of Jersey. JT Group Limited and Jersey Post

International Limited are both wholly owned by the States of

Jersey. All transactions are undertaken at an arm's length

basis.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLFIEESIFLIR

(END) Dow Jones Newswires

May 13, 2016 02:00 ET (06:00 GMT)

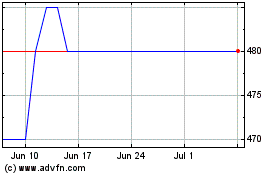

Jersey Electricity (LSE:JEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jersey Electricity (LSE:JEL)

Historical Stock Chart

From Apr 2023 to Apr 2024