Japan's Daicel Bets its Future on Takata's Air Bag Business

October 17 2016 - 7:40AM

Dow Jones News

TOKYO—Century-old chemicals maker Daicel Corp. has emerged as a

top contender in the bidding for air bag maker Takata Corp., people

familiar with the matter said, partly because Daicel sees its

growth threatened if someone else wins.

Daicel has teamed up with U.S. private-equity firm Bain Capital

to bid for Takata, which is seeking a lifeline after it recalled

tens of millions of air bags. The air bags can explode and spray

shrapnel in vehicle cabins, a problem linked to more than a dozen

deaths and more than 100 injuries globally.

A steering committee named by Takata is organizing an auction

for the company. The committee is weighing a U.S. bankruptcy filing

as one option for addressing recall costs and clearing a path for

outside investors, people familiar with the matter have said.

One message from the bidding process is that Takata's business

is attractive for a variety of industry players, assuming they can

be shielded from recall costs and other liabilities. That is

particularly the case for Daicel, which already supplies inflaters

for Takata air bags and fears losing out on the business if it

loses the auction, said two people with knowledge of the

situation.

The Bain-Daicel alliance is one of five bids that cleared the

first round. The steering committee has set a meeting in New York

Oct. 25-26 where the bidders will present their plans to car

makers, people familiar with the process said.

Auto makers are currently shouldering the costs for an onslaught

of recalls expected to total nearly 70 million air bags in the U.S.

alone.

One of those people said the Bain-Daicel offer was about $3.5

billion, exceeding other bids ranging from $1.2 billion to $2.3

billion. The exact terms of the bids couldn't be learned, and some

bidders might be willing to offer more depending on the deal's

structure. The committee aims to narrow down the list to two by

mid-November and select a finalist by December, this person

said.

For Daicel, a particular threat is Autoliv Inc. of Sweden, a

major air bag maker that has also submitted a bid for Takata.

People familiar with the bidding process said auto makers look

favorably on Autoliv's bid because of its experience as a major

auto-parts supplier, and auto makers think Autoliv could take over

Takata's business with less disruption than Daicel.

But the steering committee is leaning toward the Bain-Daicel

bid, not only because of its higher price tag but also because the

Bain-Daicel team is seen as more willing to keep Takata's business

intact, the person said. Also, the Bain-Daicel bid would be less

likely to raise antitrust concerns since Daicel doesn't currently

make air bags.

Takata's market capitalization has fallen below $300 million

from a peak of $2.7 billion hit months before U.S. federal

regulators warned in June 2014 that Takata-made air bags could

explode. Nonetheless, it has longstanding customers among major

auto makers and several business lines including seat belts and

child seats as well as air bags that make it attractive to

potential buyers.

Osaka-based Daicel historically made most of its money selling

chemicals like acetic acid, best known for its use in vinegar, and

products derived from wood pulp, such as cigarette filters.

Several of those business lines are in long-term decline. Global

demand for cigarettes is slackening and the chemicals business is

threatened by cheaper alternatives in China and India. The stronger

yen this year is eating into profits on sales in China, where

Daicel has a large cigarette filter business, and other

markets.

Daicel's three-year growth plan had called for it to bring in ¥

500 billion ($4.8 billion) in revenue in the year ending March

2017, but now it says it expects ¥ 444 billion for the year, a

slight decline from the previous year.

To return to growth, it is looking to its fast-growing business

manufacturing automotive components, including the explosive

compounds that go into air bags.

Daicel supplies air-bag inflaters to Takata and Toyoda Gosei

Co., a parts supplier for Toyota Motor Corp. Daicel says it is

churning out millions of air-bag modules for replacement products

owing to the Takata recalls. The company's sales of pyrotechnic

devices—a category that includes air bag inflaters—rose nearly 16%

in the July-September quarter compared with a year earlier.

Even before the recall, Daicel had hitched itself to Takata as a

way to bring its products to companies outside of Japan. That

partnership helped Daicel become a major player in the inflater

business. In 2012, Daicel bought Special Devices Inc., a U.S.-based

air bag component maker, for an undisclosed sum.

The other bidders for Takata are Flex-N-Gate Corp., Key Safety

Systems Inc. and U.S. private-equity fund KKR& Co., people

familiar with the matter have said.

Write to Atsuko Fukase at atsuko.fukase@wsj.com and Sean McLain

at sean.mclain@wsj.com

(END) Dow Jones Newswires

October 17, 2016 07:25 ET (11:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

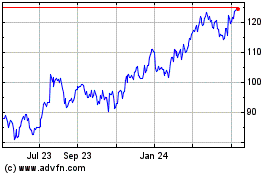

Autoliv (NYSE:ALV)

Historical Stock Chart

From Mar 2024 to Apr 2024

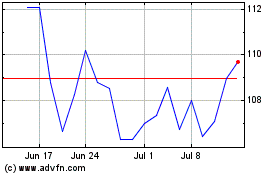

Autoliv (NYSE:ALV)

Historical Stock Chart

From Apr 2023 to Apr 2024