Japanese Stocks Take Another Hit on Yen Gains

September 14 2016 - 11:00PM

Dow Jones News

Asian stocks were largely treading water Thursday, as investors

stayed focused on key monetary policy meetings next week, but a

firmer yen pressured Japanese stocks.

The Nikkei Stock Average slid 1% in morning trade, with its

week-to-date losses extending to 3.1%. The S&P/ASX 200 edged

0.1% lower and Hang Seng futures slipped 0.1%. Elsewhere, South

Korea, China and Taiwan were closed for a public holiday.

"There's a holding pattern in the market today," said Chris

Weston, a market analyst at IG Market Ltd. "We're just really

trying to take our cues from what happens in the States at the

moment."

The U.S. Federal Reserve will kick off its two-day meeting on

Tuesday, during which central bankers will vote on whether to raise

interest rates. Higher rates would typically result in money

flowing out of emerging markets.

The yen appreciated 0.33% against the dollar, on bets the Fed is

less likely to lift interest rates in coming months. Japanese

automakers took a hit as their exports grew more expensive, with

Mitsubishi Motors Corp. last down 3.2%, Honda Motor Co. Ltd.

sliding 2.7% and Nissan Motor Co. Ltd. off 2.6%.

Nevertheless, the dollar-yen currency pair is expected to remain

directionless, with many investors sitting on the sidelines ahead

of monetary-policy meetings in the U.S. and Japan next week, said

Osao Iizuka, head of FX trading at Sumitomo Mitsui Trust Bank.

Going forward, investors will be keeping a close eye on U.S.

retail sales for August later Thursday, which could also affect the

Fed's willingness to move rates.

Hiroyuki Kachi contributed to this article.

Write to Ese Erheriene at ese.erheriene@wsj.com

(END) Dow Jones Newswires

September 14, 2016 22:45 ET (02:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

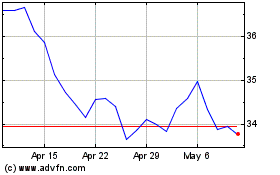

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

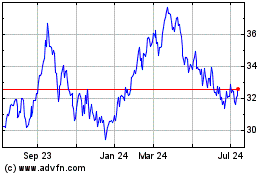

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Apr 2023 to Apr 2024