Japan Shares Fall as Investors Eye G-7 Meeting Outcome

May 23 2016 - 2:00AM

Dow Jones News

Shares in Japan fell Monday, as investors turned to meetings

between Group of Seven finance ministers and central bank chiefs,

while in China, shares rallied amid signs that regulators are eager

to limit new shares coming to the market.

The Nikkei Stock Average was down 1.1% as disagreement between

the U.S. and Japan bubbled over the weekend over whether the latter

should be allowed to intervene in the yen's recent rise.

Elsewhere, the Shanghai Composite Index was up 0.5%, the Hang

Seng Index was up 0.3% and Australia's S&P ASX 200 was flat.

South Korea's Kospi was up 0.3%.

The prospect of higher U.S. interest rates is at the top of

investors' list of concerns. Expectations that the Federal Reserve

could tighten as early as June had ticked up last week.

But investors in the region are also increasingly monitoring the

G-7 meetings this week in Japan. Officials there have yet to come

to an agreement on how to address slack in the global economy, for

example through coordinated fiscal and monetary policies.

"The market doesn't like an impasse," said Andrew Sullivan,

managing director at Haitong International in Hong Kong. "A lot of

people are sitting on the sidelines."

Japan shares were getting especially hurt after data from the

morning showed that Japanese exports declined 10% in April,

accelerating from a 6.8% drop the previous month. It was the

seventh-straight month of declines, reflecting the impact of

moderating global growth and a stronger yen. Economists surveyed by

The Wall Street Journal had expected a 9.1% decrease.

The Japanese yen was last up 0.2% against the U.S. dollar in

Asian trading hours.

The Shanghai Composite Index was up 0.5%, as investors monitored

regulators' latest stance on the market. China's stock regulator

rejected two small firms applying for initial public offerings last

Friday—Nanjing Petrochina Hengran Petro-Gas Co. and Jilin Kelong

Building Energy-Saving Technology Co.—suggesting that authorities

want to limit the supply of new shares that could pressure the

market.

Investors in China are also expecting regulators to toughen up

on trading suspensions. That has built up expectations for key

benchmark provider MSCI Inc. to add Chinese mainland stocks to its

widely-tracked indexes. The ability for Chinese firms to

self-impose trading suspensions has been a key sticking point for

investors opposed to the MSCI including so-called A shares in its

indexes.

Energy stocks in the region also fell as oil prices retreated on

Friday in New York and during the Asian trading day Monday.

Tokyo-listed Inpex Corp. was off 2.4%. Brent crude oil was last

down 0.3% at $48.58 a barrel.

In Hong Kong, the market was up as investors bought up defensive

names including utilities and telecom stocks. Shares of China

Mobile Ltd. were up 0.8% while Power Assets Holdings Ltd. rose

0.8%.

Takashi Nakamichi in Tokyo and Yifan Xie in Shanghai contributed

to this article.

Write to Chao Deng at Chao.Deng@wsj.com

(END) Dow Jones Newswires

May 23, 2016 01:45 ET (05:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

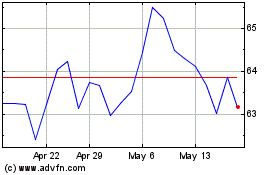

ASX (ASX:ASX)

Historical Stock Chart

From Mar 2024 to Apr 2024

ASX (ASX:ASX)

Historical Stock Chart

From Apr 2023 to Apr 2024