Italy's Eni Posts Loss on Weak Oil Price -- Update

July 29 2016 - 5:13AM

Dow Jones News

By Eric Sylvers

Eni SpA swung to a loss in the second quarter as the low price

of crude oil led to a steep drop in revenue, while the forced

shutdown of a domestic oil field in southern Italy resulted in a

drop in production.

Like BP PLC, Royal Dutch Shell and other rivals that have

reported weaker earnings in the second quarter, Eni continues to

search for ways to confront the drop in oil prices. In March the

Italian company promised EUR13 billion ($14.40 billion) in cost

cuts and assets sales by 2019. The cost cuts are mostly to come

from renegotiating supplier contracts, while the assets sales will

be of stakes in recently discovered oil and gas fields.

Friday, Eni confirmed its target to cut capital spending this

year by 20%.

Eni, which is 30%-owned by the government, is looking to sell

stakes in several large oil and gas projects, including one off the

coast of Mozambique. Eni expects to announce that sale, which could

net the company about EUR3 billion, before the end of the year.

Exxon Mobil Corp. is in advanced talks to buy a stake in the

Mozambique project, people familiar with the negotiations have

said.

Brent crude, the global benchmark, averaged $46 a barrel in the

second quarter. While that was about a third better than the first

quarter, it was still down sharply from the $62 barrel in last

year's second quarter. Friday Brent traded at about $43 a barrel

with many analysts expecting the price to remain under pressure in

coming months as concerns grow that there is an oversupply in part

due to a resurgence of U.S. shale oil.

Eni is ensnared in a legal dispute in the Italian region of

Basilicata where prosecutors forced the shutdown of the Val d'Agri

complex pending an investigation into illegal waste trafficking.

Eni isn't under investigation. The shutdown is costing Eni about

60,000 barrels of oil a day. Royal Dutch Shell also has a stake in

the oil field.

Hydrocarbon production fell 2.2% in the quarter to 1.73 million

barrels of oil equivalent a day though Eni confirmed guidance for

full-year production to be in line with 2015 as it ramps up new

projects. In the first half, production was up 0.5%.

The company repeated it can pay out its current yearly

dividend--80 euro cents a share--without resorting to debt or

unplanned asset sales if oil stays around $50 a barrel. Eni pays

out its dividend in two tranches and Friday, as expected, said it

would pay an interim dividend of 40 cents a share.

Eni surprised the market early last year by cutting its dividend

by almost a third and is still the only major oil company to do

so.

The net loss from continuing operations was EUR446 million in

the second quarter compared with a profit of EUR498 million in the

same period a year earlier. Revenue plunged by a third to EUR13.42

billion.

Eni shares were down 1.6% at EUR13.44 in early trading in Milan.

The shares are little changed this year and down by about 15% in

the past 12 months.

Write to Eric Sylvers at eric.sylvers@wsj.com

(END) Dow Jones Newswires

July 29, 2016 04:58 ET (08:58 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

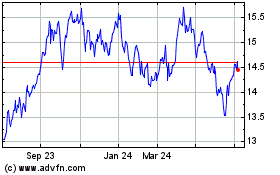

Eni (BIT:ENI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Eni (BIT:ENI)

Historical Stock Chart

From Apr 2023 to Apr 2024