Italy's main stock exchange is on the cusp of welcoming its

first new real-estate company in a decade.

Milan-based Coima Res plans to raise €215 million ($245.1

million) from U.S. and European investors in an initial public

offering this month. It would be the first property IPO on the FTSE

MIB since 2006, according to data-provider Dealogic.

Seeking to jump-start a stagnant sector for real-estate

investment trusts has been challenging, with investors fretting

about volatile markets and the general lack of transparency in

Italian property.

Coima reduced the target amount last week from €300 million in

part because of such concerns. It postponed the IPO in January

because of market volatility stemming from investors' worries about

slowing economic growth.

Compared with January, the "general environment in the market is

more volatile now, and more of a challenge," said Manfredi Catella,

chief executive at Coima. "We're fully aware we're opening the

market in Italy for the REIT industry."

Investor sentiment toward Italy has deteriorated significantly

from a positive start to the year. In March, Italian and Swiss

stocks were the least favored among European fund managers,

according to a Bank of America Merrill Lynch survey. The FTSE MIB

is down around 17% from the start of January in highly volatile

trading.

Adding to worries, last week Italy's government cut its already

cautious growth forecasts for 2016 and 2017 to 1.2% and 1.4%,

respectively, from 1.6% for both years.

Coima's fraught journey to the Milan bourse follows failures of

other Italian real-estate firms. Two Italian property groups

withdrew plans to go public last year—one of them twice, in July

and again in October, Dealogic data show. Other firms' plans for

IPOs never materialized.

Meanwhile, demand for Italian commercial real estate is booming

as international investors hunt for returns amid low interest

rates. Commercial property transaction volumes in Italy rose 66% in

2015 from 2014, according to Real Capital Analytics.

The $9.7 billion of deals last year was just 3.4% of the

European total, the data show. A lack of transparency and low deal

flow are limits to transactions, analysts said.

U.S. private-equity firms, such as Blackstone LLP, have been

very active in Italy. But longer-term investors, like pension funds

and sovereign-wealth funds, have largely struggled to find adequate

large-scale acquisitions of properties like office buildings or

shopping malls, Mr. Catella said.

Options are also slim for investors wanting to buy shares in

Italian property firms, with only two major REITs listed in Milan:

Beni Stabili SIIQ and Immobiliare Grande Distribuzione SIIQ.

A successful IPO from Coima is "potentially very positive for

the REIT sector" both in Italy and Europe, said Peter Papadakos,

managing director at real-estate firm Green Street Advisors.

"It could be taken as a sign that the market for IPOs is more

open than we thought," he said.

The listed real-estate sector in Europe is relatively small.

According to Green Street, the market capitalization of European

REITs is just 15.4% of the global total, compared with 48.4% in the

U.S. and 30.8% in the Asia-Pacific region.

But markets where REITs were almost nonexistent just a few years

ago—such as Germany, Spain and Ireland—have been growing. German

REITs made up more than 19% of the European listed property market

in March, compared with 3.7% at the start of 2010, Green Street

data show. REITs have also sprung up in Spain and Ireland after

governments eased regulations.

The Italian government softened its REIT regulation in late

2014. Analysts said Italy could be next to take off, although they

cautioned that major challenges still exist.

Coima Res is being launched by Coima, a property firm set up by

the Catella family in 1974. In 2007, Coima formed a business with

Texas-based property investor Hines to build the 28-building Porta

Nuova, one of the biggest redevelopment projects in Milan. Mr.

Catella bought the majority interest from Hines's Italian

fund-management business last September.

Porta Nuova was sold to sovereign-wealth fund the Qatar

Investment Authority in two deals in 2013 and 2015.

QIA is a key investor for Coima Res. It will contribute a €145

million portfolio of 96 Deutsche Bank branches to the new REIT.

Using cash raised and debt, Coima Res has already made an

agreement to acquire the Vodafone headquarters in Milan from a

wealthy Italian investor for €200 million. A pipeline of other

deals is expected to follow, Mr. Catella said.

"We're aware of the difficulties to be pioneers in this fragile

world," Mr. Catella said. "But at the end of the day, we're

confident in the fundamentals of the Italian real-estate

market."

Write to Art Patnaude at art.patnaude@wsj.com

(END) Dow Jones Newswires

April 12, 2016 06:05 ET (10:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

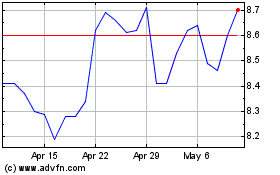

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Mar 2024 to Apr 2024

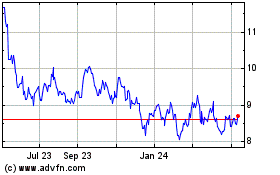

Vodafone (NASDAQ:VOD)

Historical Stock Chart

From Apr 2023 to Apr 2024