Italian Confectioner in Sweet Deal With Nestlé -- WSJ

January 17 2018 - 3:02AM

Dow Jones News

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 17, 2018).

By Eric Sylvers, Saabira Chaudhuri and Annie Gasparro

How do you say "Butterfinger" in Italian? Americans may soon

find out.

Italian candy maker Ferrero International SA muscled further

into the North America market, agreeing to pay $2.8 billion in cash

to buy Nestlé SA's U.S. chocolate business that includes the

Butterfinger and Baby Ruth brands.

Ferrero beat out Hershey Co. as Nestlé, based in Switzerland,

carried out a monthslong sales process that also drew interest from

several private-equity firms.

Adding the Nestlé business, which had about $900 million in

sales in 2016, will make family-owned Ferrero the third-biggest

chocolate seller in the U.S. It is Ferrero's third sweets

acquisition in the country in less than a year, as the Italian

maker of Ferrero Rocher chocolates and Nutella spread bets billions

of dollars on an industry that many companies are turning away from

after a slowdown.

Candy is struggling to compete with healthier snacks such as

nuts and granola bars, losing shopper dollars and shelf space.

While Hershey bid against Ferrero for the Nestlé assets, the U.S.

company is also diversifying beyond sweets -- as is its biggest

domestic competitor, Mars Inc.

Last year, M&M's maker Mars, the world's largest pet-food

manufacturer, purchased a veterinary clinic and dog day-care

operator VCA Inc. for $7.7 billion. It also bought a minority stake

in KIND LLC, which makes fruit-and-nut bars. Hershey said last

month it would buy SkinnyPop popcorn owner Amplify Snack Brands

Inc. in its largest deal to date, valued at $1.6 billion.

But industry analysts say Americans' sweet tooth can still

generate growth for confectioneries that invest in innovation and

marketing. That is what Ferrero will be counting on. The company

has a strong record of innovating and recently released Tic Tac

gum, a twist on a mint that has been around for decades.

Ferrero, founded in the small northern Italian town of Alba, is

already the world's No. 4 confectionery by market share and had

about $12 billion in revenue in 2016.

The acquisition follows Ferrero's purchase last year of

Lemonheads maker Ferrara Candy Co. for about $1.3 billion, and the

much smaller Fannie May Confections for $115 million. Ferrero's new

strategy of pursuing acquisition-led growth, especially in the

U.S., has been led by Executive Chairman Giovanni Ferrero, the

founder's grandson who in 2011 took sole charge of the company.

In addition to the acquisitions, Mr. Ferrero has sought to

promote organic growth with new products, including the recently

introduced cookie version of its Kinder Surprise egg that is sold

in Europe but not in the U.S.

Vevey-based Nestlé, which has long tried to position itself as a

health-food company, has faced criticism from investors lately for

lack of focus, with a brand portfolio that includes products as

diverse as vitamins, bottled water, pizza and ice cream.

Nestlé, which gets only about 3% of its U.S. sales from sweets,

insists it is committed to confectionery outside the U.S., although

the business isn't among Chief Executive Mark Schneider's top

priorities. Globally, more than 80% of Nestlé's confectionery

business is made up of local brands, a model that differs from many

of Nestlé's other big businesses. Nestlé has been launching more

high-end chocolate, hoping to chase sales growth as overall

chocolate volumes decline. Performance so far has remained

sluggish.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com and

Annie Gasparro at annie.gasparro@wsj.com

(END) Dow Jones Newswires

January 17, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

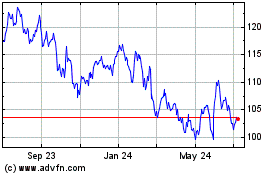

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nestle (PK) (USOTC:NSRGY)

Historical Stock Chart

From Apr 2023 to Apr 2024