Is Wisconsin Energy Poised to Beat Earnings Again? - Analyst Blog

April 28 2014 - 7:00PM

Zacks

We expect utility service provider Wisconsin Energy

Corp. (WEC) to beat expectations when it reports

first-quarter 2014 results on Apr 30, 2014.

Why a Likely Positive Surprise?

Our proven model shows that Wisconsin Energy is likely to beat

earnings because it has the right combination of two key

factors.

Positive Zacks ESP: The Earnings ESP (Expected

Surprise Prediction), which represents the difference between the

Most Accurate estimate and the Zacks Consensus Estimate, is +2.41%.

This is a meaningful and leading indicator of a likely positive

earnings surprise for this company.

Zacks #2 Rank (Buy): The stocks with Zacks Ranks

of #1, 2 and 3 have a significantly higher chance of beating

earnings. The Sell rated stocks (#4 and 5) should never be

considered going into an earnings announcement.

The combination of Wisconsin Energy’s Zacks Rank #2 (Buy) and

+2.41% ESP make us confident of a positive earnings beat on Apr

30.

What is Driving Better-than-Expected Earnings?

Wisconsin Energy could be up for another bottom-line outperformance

in first quarter 2014 following its positive earnings streak in the

last four quarters. A key factor that could act as a growth driver

includes the steady economic improvement in the state of

Wisconsin.

Continued customer additions signal better earnings prospects for

the company in the first quarter. Wisconsin Energy witnessed a 6.4%

and a more than 15% increase in electric service connections as

well as natural gas installations, respectively in 2013 from

2012.

In addition, Wisconsin Energy’s ambitious biomass-plant attained

full commercial operability in Nov 2013. This will allow the

company to meet rising industrial demand for electricity and in

turn will lend additional upside to its sales stream.

Moreover, Wisconsin Energy’s cost-abatement efforts via gradual

conversion of its coal-fired units to natural gas-fired plants will

help minimize operating costs. This could certainly enhance the

company’s profitability.

Other Stocks to Consider

Wisconsin Energy is not the only company looking up this earnings

season. We also see likely earnings beat coming from other utility

providers.

NRG Yield, Inc. (NYLD), Earnings ESP of +23.53%

and Zacks Rank #1 (Strong Buy).

Exelon Energy Corp. (EXC), Earnings ESP of +6.94%

and Zacks Rank #2 (Buy).

Ameren Corp. (AEE), Earnings ESP of +6.25% and

Zacks Rank #2 (Buy).

AMEREN CORP (AEE): Free Stock Analysis Report

EXELON CORP (EXC): Free Stock Analysis Report

NRG YIELD INC-A (NYLD): Free Stock Analysis Report

WISC ENERGY CP (WEC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

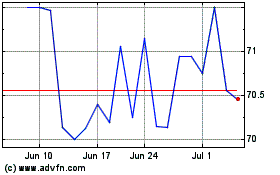

Ameren (NYSE:AEE)

Historical Stock Chart

From Mar 2024 to Apr 2024

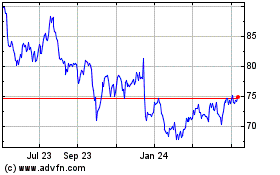

Ameren (NYSE:AEE)

Historical Stock Chart

From Apr 2023 to Apr 2024