Introducing the Seven-Blade Razor. (No, Seriously.)

October 07 2015 - 6:31PM

Dow Jones News

By Paul Ziobro

Not even the satirists at the Onion predicted the razor's latest

iteration: seven blades.

The U.S. arm of the Korean razor maker Dorco Co. is launching

the Pace 7, which packs seven blades into the head of its razor

cartridge. The new model tops Dorco's own six-bladed razor and has

two more blades than the dominant U.S. brands, Procter & Gamble

Co.'s Gillette and Edgewell Personal Care Co.'s Schick.

The race to cram more blades onto a quarter-inch of real estate

has been a punch line of comedy writers. In 2004, the satirical

newspaper The Onion ran a fake op-ed purportedly from Gillette's

then-chief executive, Jim Kilts, boasting plans to top a rival's

four-blade razor by going with five. Two years later, Gillette came

out with the five-bladed Fusion, now the top-selling razor in the

U.S. by market share.

The joke underscores a real challenge for the U.S. shaving

industry, which racks up nearly $3 billion of annual sales of

everything from creams and aftershave to razors and blades.

Consumers no longer equate more blades with a better shave,

especially when each addition comes with a higher price tag.

Ken Hill, chief executive of Dorco USA and a former Schick

executive, acknowledges that there is skepticism to overcome. "Our

R&D group really believes that the seven blade is a much better

shave than the six blade, " Mr. Hill said.

Gillette and Schick have turned to other features in the face of

blade fatigue. Gillette introduced a new razor, the ProGlide

FlexBall, in 2014 that swivels side-to-side with the aim of

maintaining better contact with the face to cut scruff shorter.

Schick, meanwhile, has been promoting its Hydro 5 that moisturizes

skin during shaving with a "gel reservoir."

P&G has hinted a significant upgrade to its blade cartridges

starting next year, but hasn't disclosed details. In the past,

company executive haven't ruled out adding more blades.

P&G spokesman Kurt Iverson said that customers care about

things other than the number of blades, like the angle of the

blades and coating that helps the blade cut better and last

longer.

Gillette's upcoming razor comes as the U.S. shaving industry is

mired in a slump. Data tracker Euromonitor International estimates

that sales of razors and blades will fall 2% to $2.31 billion this

year, in part due to greater acceptance of stubble in the

workplace.

There is also a major shift in shopping habits too, as more

consumers buy their blades online from new players like Dollar

Shave Club, which sends blades to subscribers every month or so.

Gillette has responded by launching it own online club and touting

that its blades can last for a month before needing to be

replaced.

Dorco started in the U.S. in 2012 and is a very small player.

Its direct-to-consumer business has about $15 million a year in

annual sales in the U.S., though sales of its private-label razors

to the likes of Dollar Shave Club and Dollar General Corp. is

larger.

The company will sell the Pace 7 on its U.S. website, as well as

on Amazon. It plans to price the seven-blade model at 25% below the

top razors from Gillette and Schick that have two fewer blades.

Mr. Hill, who fondly remembers the Onion's spoof, says seven

blades might be the max. "At least for a couple of years," he

said.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 07, 2015 18:16 ET (22:16 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

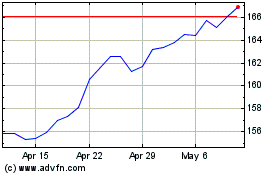

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

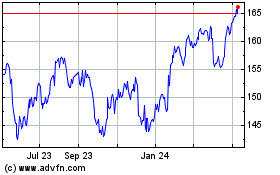

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024