Introducing Our SPY Line Chart Tool

December 08 2014 - 10:19AM

ETFDB

We recently rolled out a new feature on ETFdb that allows users

to get the best view of how the markets have behaved since the 2008

recession. The new tool, located here, displays a line chart

of the SPDR S&P 500 ETF (SPY)’s performance starting six months

before the market bottom. The tool allows users to compare SPY over

the years with a wide variety of other markets to see how

various economies and segments of the economy have progressed since

the financial crisis.

Users can compare SPY to commodities, bonds, major sectors, and

a multitude of countries from around the world. The chart makes it

easy to determine winners and losers for different stretches of

time and to see how the recovery has progressed across the

board.

Users can click on any of the buttons on the right-hand side of

the chart to compare SPY to a variety of ETFs representing all

corners of the market. The starting period is just before the crash

of Lehman and when the sell-off got particularly nasty – this

allows users to see both the dip and the recovery, rather than

starting at the bottom. At any point, users can hover-over the

chart for a more detailed look at the funds and their

performance:

This

tool can give users a powerful, comparative look at the market

over the last few years and the current bull run.

This

tool can give users a powerful, comparative look at the market

over the last few years and the current bull run.

Be sure to follow us on Twitter @ETFdb

Click here to read the original article on ETFdb.com.

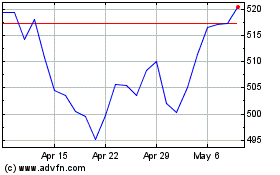

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

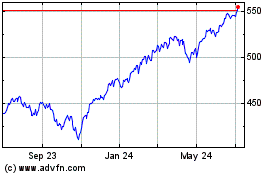

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Apr 2023 to Apr 2024