Intel Profit Rises, Helped by Lift in PC Sales -- 2nd Update

April 27 2017 - 7:22PM

Dow Jones News

By Ted Greenwald

Intel Corp.'s quarterly earnings soared 45%, as strong sales of

high-end processor chips outweighed high costs in what is normally

its most profitable business.

Revenue rose 8% to $14.8 billion in the first quarter. Intel

benefited especially from improvement in the personal-computer

business, with operating profit in the segment that sells PC chips

jumping 61% from a year earlier, as sales rose 5.7% to $7.98

billion.

Amid the overall strength, though, profit in the division that

sells chips for the servers used in data centers was hurt by an

earlier shift to a more advanced manufacturing process that can

improve chip performance but initially costs more. Intel said

operating profit in its data-center division narrowed by 16%, while

revenue rose 5.8% to $4.23 billion.

Shares fell nearly 4% in after-hours trading. Intel's share

price generally has lagged behind that of its semiconductor peers,

losing roughly 2% in the year to date.

Intel dominates its core markets of processor chips for PCs and

servers. But its overwhelming market share leaves limited room to

grow, and competition lately has emerged in both areas. A

revitalized Advanced Micro Devices Inc. is building momentum in the

PC market and has plans to sell server chips. Meanwhile, processors

from Nvidia Corp. have found a place in data centers, and chips

based on technology from ARM Holdings PLC are beginning to make

headway.

The PC market has been in a persistent decline, but PC shipments

in the first quarter were better than expected. Research by

International Data Corp. showed a marginal uptick in the first

quarter, year on year, compared with its forecast of a 1.8%

falloff.

Sales of server chips have been expected to compensate for any

PC shortfalls in 2017, driven by gargantuan internet operations

such as Alphabet Inc.'s Google Cloud Platform, Amazon.com Inc.'s

Amazon Web Services, and Microsoft Corp.'s Azure. The three

cloud-computing giants together spent $31.54 billion on data

centers in 2016, according to company filings -- up 22% from the

previous year.

Intel aims to spur growth by investing heavily in areas where it

has room to gain share. In March, it agreed to spend $15.3 billion

to buy Israeli car-camera pioneer Mobileye NV in a deal it expects

to close by the end of the year, and it has budgeted $12 billion in

annual capital expenditures, largely to build its memory business

and beef up its manufacturing facilities, it has said.

Opportunities in automotive, memory, mobile, and the addition of

computing and communications to a wide variety of items -- a trend

known as the Internet of Things -- will amount to a total market of

$220 billion by 2021, Intel has said.

Overall for the quarter, Intel reported net profit of 61 cents a

share. Adjusted earnings, excluding restructuring charges and

certain items arising from acquisitions and related taxes, were 66

cents a share. Analysts surveyed by Thomson Reuters expected

adjusted earnings of 65 cents per share on $14.81 billion in

revenue.

For 2017, Intel raised its adjusted profit projection by a

nickel to $2.85 a share, and said it expects $60 billion in

revenue. It had previously guided for the top line to remain flat

from 2016's $59.4 billion.

Write to Ted Greenwald at Ted.Greenwald@wsj.com

(END) Dow Jones Newswires

April 27, 2017 19:07 ET (23:07 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

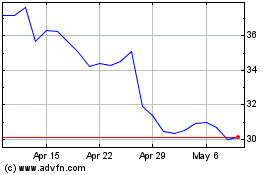

Intel (NASDAQ:INTC)

Historical Stock Chart

From Mar 2024 to Apr 2024

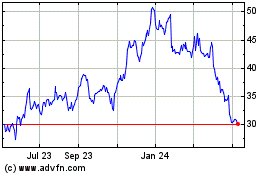

Intel (NASDAQ:INTC)

Historical Stock Chart

From Apr 2023 to Apr 2024