Insperity Declares Special Dividend of $2 per Share

December 01 2014 - 8:30AM

Business Wire

Insperity, Inc. (NYSE:NSP), a leading provider of human

resources and business performance solutions for America’s best

businesses, today announced that its board of directors has

declared a special cash dividend of $2 per share. The dividend will

be paid on Dec. 26, 2014 to all stockholders of record as of Dec.

15, 2014.

“The authorization of this special dividend by our Board

reflects our continued commitment to building stockholder value

through the execution of our strategic plan and disciplined capital

allocation strategy,” said Paul J. Sarvadi, Insperity chairman and

chief executive officer. “With strong cash flows and a solid

balance sheet that included working capital of $119 million and no

debt at Sept. 30, 2014, we are pleased to return an additional $51

million to stockholders while continuing to invest in the business

and execute our long-term growth strategy.”

The special dividend is in addition to the regular quarterly

dividend of $0.19 per share previously announced on Nov. 14, 2014.

The board of directors has authorized six increases to the regular

dividend program since its beginning in 2005 at a quarterly rate of

$0.07 per share. The company previously paid a special dividend of

$1 per share in Dec. 2012.

“With this special dividend, Insperity will have returned a

total of $90 million to stockholders in 2014 in the form of

dividends and stock repurchases,” said Douglas S. Sharp, Insperity

senior vice-president of finance, chief financial officer and

treasurer. “Even with these substantial returns, our balance sheet

remains strong and we continue to have up to $100 million available

under our existing credit facility. Insperity has a consistent

track record of generating strong cash flows through our

operations, which we expect to continue in 2015 and beyond.”

In addition to its regular and special dividends, the company

has repurchased 1.9 million shares at a cost of $55 million since

2012, including 693,000 shares in the nine months ended Sept. 30,

2014. The company has conducted ongoing share repurchases in the

open market, and Insperity, Inc. periodically evaluates the size

and structure of its repurchases, as demonstrated by its offer to

repurchase shares through a $50 million modified “Dutch auction”

tender offer that it conducted in the fourth quarter of 2012.

Insperity, a trusted advisor to America’s best businesses for

more than 28 years, provides an array of human resources and

business solutions designed to help improve business performance.

Insperity® Business Performance Advisors offer the most

comprehensive suite of products and services available in the

marketplace. Insperity delivers administrative relief, better

benefits, reduced liabilities and a systematic way to improve

productivity through its premier Workforce Optimization® solution.

Additional company offerings include Human Capital Management,

Payroll Services, Time and Attendance, Performance Management,

Organizational Planning, Recruiting Services, Employment Screening,

Financial Services, Expense Management, Retirement Services and

Insurance Services. Insperity business performance solutions

support more than 100,000 businesses with over 2 million employees.

With 2013 revenues of $2.3 billion, Insperity operates in 57

offices throughout the United States. For more information,

visit http://www.insperity.com.

The statements contained herein that are not historical facts

are forward-looking statements within the meaning of the federal

securities laws (Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934). You can

identify such forward-looking statements by the words “expects,”

“intends,” “plans,” “projects,” “believes,” “estimates,” “likely,”

“possibly,” “probably,” “goal,” “opportunity,” “objective,”

“target,” “assume,” “outlook,” “guidance,” “predicts,” “appears,”

“indicator” and similar expressions. Forward-looking statements

involve a number of risks and uncertainties. In the normal course

of business, Insperity, Inc., in an effort to help keep our

stockholders and the public informed about our operations, may from

time to time issue such forward-looking statements, either orally

or in writing. Generally, these statements relate to future

dividends and stock repurchases, business plans or strategies,

projected or anticipated revenues, earnings, unit growth, profit

per worksite employee, pricing, operating expenses or other aspects

of operating results. We base the forward-looking statements on our

expectations, estimates and projections at the time such statements

are made. These statements are not guarantees of future performance

and involve risks and uncertainties that we cannot predict. In

addition, we have based many of these forward-looking statements on

assumptions about future events that may prove to be inaccurate.

Therefore, the actual results of the future events described in

such forward-looking statements could differ materially from those

stated in such forward-looking statements. Among the factors that

could cause actual results to differ materially are: (i) adverse

economic conditions; (ii) regulatory and tax developments and

possible adverse application of various federal, state and local

regulations; (iii) the ability to secure competitive replacement

contracts for health insurance and workers’ compensation contracts

at expiration of current contracts; (iv) increases in health

insurance costs and workers’ compensation rates and underlying

claims trends, health care reform, financial solvency of workers’

compensation carriers, other insurers or financial institutions,

state and federal unemployment tax rates, liabilities for employee

and client actions or payroll-related claims; (v) failure to manage

growth of our operations and the effectiveness of our sales and

marketing efforts; (vi) changes in the competitive environment in

the PEO industry, including the entrance of new competitors and our

ability to renew or replace client companies; (vii) our liability

for worksite employee payroll, payroll taxes and benefits costs;

(viii) our liability for disclosure of sensitive or private

information; (ix) our ability to integrate or realize expected

returns on our acquisitions; (x) failure of our information

technology systems; and (xi) an adverse final judgment or

settlement of claims against Insperity. These factors are discussed

in further detail in Insperity’s filings with the U.S. Securities

and Exchange Commission. Any of these factors, or a combination of

such factors, could materially affect the results of our operations

and whether forward-looking statements we make ultimately prove to

be accurate.

Except to the extent otherwise required by federal securities

law, we do not undertake any obligation to update our

forward-looking statements to reflect events or circumstances after

the date they are made or to reflect the occurrence of

unanticipated events.

Insperity, Inc.Investor Relations Contact:Douglas S.

Sharp, 281-348-3232Senior Vice President of Finance,Chief Financial

Officer and TreasurerorNews Media Contact:Jason Cutbirth,

281-312-3085Senior Vice President of

Marketingjason.cutbirth@insperity.com

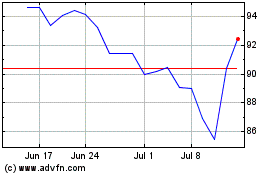

Insperity (NYSE:NSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

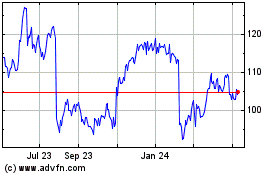

Insperity (NYSE:NSP)

Historical Stock Chart

From Apr 2023 to Apr 2024