Inovio Pharmaceuticals, Inc. (NASDAQ:INO) today reported financial

results for the quarter ended June 30, 2017.

Total revenue was $20.4 million for the three

months ended June 30, 2017, compared to $6.2 million for the same

period in 2016. Total operating expenses were $30.0 million for the

current year quarter compared to $24.4 million for the prior year

quarter.

The net loss attributable to common stockholders

for the quarter ended June 30, 2017 was $9.5 million, or $0.13 per

share, compared to $18.7 million, or $0.26 per share, for the

quarter ended June 30, 2016. The decrease in net loss for the

quarter resulted primarily from higher revenue recognized related

to Inovio’s license and collaboration agreement with MedImmune

entered into in 2015.

Revenue

The increase in revenue was primarily due to $13.8

million in revenue recognized from MedImmune, as the previously

deferred revenue from the up-front payment received in September

2015 for MEDI0457 (INO-3112) was recognized during the three months

ended June 30, 2017. This revenue recognition occurred upon

MedImmune’s definitive selection of a new cancer product candidate

to be tested in clinical trials against an undisclosed cancer

target from our on-going research collaboration. The successful

advancement of this new product candidate by MedImmune could also

trigger future milestone payments and sales-based royalties payable

to Inovio.

Operating Expenses

Research and development expenses for the second

quarter of 2017 were $23.9 million compared to $19.6 million for

the second quarter of 2016. The increase in R&D expenses was

related to increased investment in all of Inovio’s product

development programs, including its recently commenced phase 3

trial for VGX-3100. General and administrative expenses were $6.2

million for the second quarter of 2017 versus $5.8 million for the

second quarter of 2016. The increase in G&A expenses

primarily related to an increase in non-cash stock based

compensation.

Capital Resources

As of June 30, 2017, cash and cash equivalents and

short-term investments were $92.0 million compared with $104.8

million as of December 31, 2016. At quarter end the

company had 77.6 million shares outstanding and 87.2 million shares

outstanding on a fully diluted basis. During the three months ended

June 30, 2017, Inovio sold 2,917,725 shares of common stock under

its ATM common stock sales agreement for net proceeds of $24.1

million, with an average sale price of $8.41 per share.

On July 25, 2017, the company closed an

underwritten public offering of 12,500,000 shares of common stock

at a public offering price of $6.00 per share, for gross proceeds

of $75.0 million. The net proceeds, after deducting the

underwriters’ discounts and commissions and other estimated

offering expenses payable by Inovio, were approximately $70.2

million. Inovio has granted the underwriters an option until

August 18, 2017 to purchase up to 1,875,000 additional shares of

its common stock on the same terms and conditions.

Inovio’s balance sheet and statement of operations

are provided below. The Form 10-Q providing the complete 2017

second quarter financial report can be found at:

http://ir.inovio.com/secfilings.

Corporate Update

Clinical Developments

VGX-3100: Cervical Pre-Cancer (Phase 3)

- In June, Inovio commenced its phase 3 clinical program to

evaluate the efficacy of Inovio’s DNA-based immunotherapy,

VGX-3100, to treat cervical dysplasia caused by human

papillomavirus (HPV). Initiating Inovio’s first phase 3 program

marks a significant milestone for the company, for the next

generation of DNA-based immunotherapies, and for women’s health. In

the phase 3 trial, Inovio will assess the efficacy of VGX-3100 in

regressing cervical HSIL (high-grade squamous intraepithelial

lesions; also called CIN2 or CIN3), a direct precursor to cervical

cancer, and in eliminating the HPV infection that causes these

lesions. The pivotal data from this program, if positive, could

support the licensure of VGX-3100 as the first immunotherapy for

this disease. HPV is the most common sexually transmitted

infection, with over 14 million new infections annually.

- Inovio satisfied the FDA’s request for information relating to

its CELLECTRA® 5PSP delivery device, resulting in the FDA removing

a previously imposed clinical hold on this program. During the hold

period, Inovio prepared investigational sites for the phase 3

study, resulting in the company opening 27 sites in just over the

first month since the hold was removed. Inovio is on track to

open at least 50 sites by the end of the year.

VGX-3100: Vulvar Pre-Cancer (Phase 2)

- In April, Inovio commenced a randomized, open-label phase 2

trial to evaluate the efficacy of VGX-3100 in 36 women with

high-grade HPV-related pre-cancerous lesions of the vulva, or

vulvar intraepithelial neoplasia, a disease with a high unmet

medical need. This is a new therapeutic indication for VGX-3100.

The primary endpoint of the study is histologic clearance of

high-grade lesions and virologic clearance of the HPV virus in

vulvar tissue samples. The study will also evaluate safety and

tolerability.

MEDI0457: HPV-Related Head & Neck Cancer (Phase

1/2)

- In May, Inovio announced that MedImmune, AstraZeneca’s global

biologics research and development arm, commenced a new clinical

trial investigating the combination of MEDI0457 (formerly INO-3112)

in-licensed from Inovio, an immunotherapy designed to generate

antigen-specific killer T cell responses targeting HPV-associated

tumors, and durvalumab, MedImmune’s PD-L1 checkpoint inhibitor. The

combination trial will enroll patients with metastatic

HPV-associated squamous cell carcinoma of the head & neck

(SCCHN) with persistent or recurrent disease after chemotherapy

treatment. This study marks a significant moment for Inovio as it

transitions into a late-stage biotechnology company. MedImmune is

investigating the possibility of elevating the response rate of

checkpoint inhibitors by using durvalumab in combination with a DNA

plasmid vaccine originally licensed from Inovio, which has shown

the ability to generate killer T cells.

- Combining the company’s first phase 3 program with the

previously announced phase 2 clinical trial of VGX-3100 for

treating HPV-related vulvar neoplasia, and the MEDI0457 checkpoint

inhibitor-based combination study with MedImmune/AstraZeneca

targeting HPV-associated, metastatic head and neck cancers, Inovio

is well positioned to comprehensively treat HPV-associated diseases

across the continuum of HPV infection through to cancer in both

women and men.

Infectious Disease Studies

- Inovio reported that its HIV vaccine, PENNVAX®-GP, produced

amongst the highest overall levels of immune response rates

(cellular and humoral) ever observed in a human study by an HIV

vaccine. The vaccine candidate, PENNVAX-GP, consists of a

combination of four HIV antigens designed to cover multiple global

HIV strains and generate both an antibody (humoral) immune response

as well as a T cell (cellular) immune response to both potentially

prevent and treat HIV. These significant results are consistent

with Inovio’s recent data reported from its Ebola, Zika and MERS

clinical trials in terms of achieving nearly 100% vaccine response

rates with favorable safety profiles. Furthermore, Inovio’s newer

and more tolerable intradermal vaccine delivery device showed that

Inovio can elicit very high immune responses at a much lower

dose.

- Inovio and its academic and industry collaborators received a

multi-year $6.95 million grant in March from the NIH’s National

Institute of Allergy and Infectious Diseases to develop a single or

combination therapy using Inovio’s PENNVAX-GP, with the goal of

attaining long-term HIV remission in the absence of antiviral

drugs. Development of Inovio’s PENNVAX-GP immunotherapy, which

widely targets multiple major clades of HIV — providing global

coverage — has been funded through a $25 million NIAID contract

awarded to Inovio and its collaborators. In addition, Inovio and

its collaborators were awarded a five-year $16 million Integrated

Preclinical/Clinical AIDS Vaccine Development (IPCAVD) grant in

2015 from NIAID. PENNVAX-GP is currently being studied in a phase 1

clinical trial (HVTN-098) to evaluate its safety and immunogenicity

in 94 healthy volunteers as a preventive vaccine (see above). The

newly funded study will assess the impact of this vaccine approach

in a therapeutic setting.

- In preliminary results from the expanded stage of Inovio’s

phase 1 clinical trial, EBOV-001, 95% (170 of 179) of evaluable

subjects generated an Ebola-specific antibody immune response, with

the mean antibody titer comparable or superior to those reported

from viral vector-based Ebola vaccines, along with a more safety

profile than those vaccines. This study was funded by a $45 million

contract from DARPA.

Corporate

Developments

- In May, Inovio and Regeneron entered into an immuno-oncology

clinical study agreement for glioblastoma (GBM) combination

therapy. The planned Phase 1b/2a clinical trial will combine

Regeneron’s PD-1 inhibitor REGN2810 and Inovio’s T cell activator

INO-5401 and immune activator INO-9012 for the potential treatment

of brain cancer. INO-5401 includes Inovio’s SynCon® antigens for

WT1, hTERT and PSMA and has the potential to be a powerful cancer

immunotherapy in combination with checkpoint inhibitors. The

National Cancer Institute previously highlighted WT1, hTERT and

PSMA among a list of attractive cancer antigens, designating them

as high priorities for cancer immunotherapy development, and

placing WT1 at the top of the antigen list. The hTERT antigen is

expressed in 85% of cancers; the WT1 and PSMA antigens are also

widely prevalent in many cancers. The open-label trial, which

is expected to begin later this year, is designed to evaluate the

safety and efficacy of the combination therapy in approximately 50

patients. GBM is the most aggressive form of brain cancer, and its

prognosis is extremely poor, despite a limited number of new

therapies approved over the last ten years. Under the terms

of the agreement, the trial will be solely conducted and funded by

Inovio, based upon a mutually agreed upon study design, and

Regeneron will supply REGN2810. Inovio and Regeneron will jointly

conduct immunological analyses in support of the study. Regeneron,

in collaboration with Sanofi, is developing REGN2810 both alone and

in combination with other therapies for the treatment of various

cancers.

- In June, Inovio entered into a collaboration agreement with

Genentech to commence a clinical trial to evaluate the combination

of Inovio’s T cell immunotherapy INO-5401 and Genentech’s PD-L1

checkpoint inhibitor atezolizumab in patients with advanced bladder

cancer. The phase 1b/2 immuno-oncology trial will evaluate

Genentech’s atezolizumab (TECENTRIQ®) in combination with Inovio’s

INO-5401, a T cell activating immunotherapy encoding multiple

antigens, and INO-9012, an immune activator encoding IL-12. The

planned clinical trial is anticipated to start later this year, and

is designed to evaluate the safety, immune response and clinical

efficacy of the combination therapy in approximately 80 patients

with advanced bladder cancer. Combining INO-5401/INO-9012 with

atezolizumab may provide a synergistic therapeutic effect as a

result of generating higher levels of activated T cells and

simultaneously inhibiting PD-L1.

- In July, Inovio completed an underwritten public offering of

common stock, raising net proceeds of $70.2 million after

underwriters’ discounts and commissions and estimated offering

expenses. Inovio expects that with the net proceeds of the

offering it will be able to advance its ongoing REVEAL 1 and 2

phase 3 trials and four phase 2 immuno-oncology trials and to fund

other pipeline advancements. The financing also added new

institutional investors to Inovio’s shareholder base.The recent

financing transaction will also support the following expected

near-term events:

- VGX-3100 phase 3 (cervical pre-cancer) trial – initiated

- MEDI0457 phase 1/2 combination (head & neck cancer) study –

initiated

- INO-5401 Glioblastoma multiforme (brain cancer) phase 1/2

combination study with Regeneron -- initiate 2H 2017

- INO-5401 Bladder cancer phase 1/2 combination study with

Genentech -- initiate 2H 2017

- INO-5150 Prostate cancer study (phase 1) report data – 3Q

2017

- INO-1800 Hepatitis B therapy study (phase 1) report data -- 4Q

2017

- INO-1400 (hTERT) report interim immune response and safety data

-- 4Q2017

- Vaccine clinical study publications (Zika, Ebola and MERS) – 4Q

2017As previously announced in February, Inovio entered into a

collaboration and license agreement with ApolloBio Corporation. If

the agreement receives the requisite approvals from ApolloBio’s

stock exchange, its board and its shareholders, the agreement will

become effective, at which time Inovio expects to receive up to $50

million in payments from Apollo -- $15 million in an upfront cash

payment for the license of VGX-3100 in greater China and up to $35

million in the form of an equity investment in Inovio’s common

stock.

Preclinical Developments

- Nature Communications published a paper

entitled “DNA Vaccination Protects Mice Against Zika Virus-Induced

Damage to the Testes,” reporting the results of a preclinical study

in which Inovio’s Zika vaccine prevented the persistence of virus

and damage in the male reproductive tract. This published data

suggests another avenue of potential protection against the Zika

virus. While detrimental effects on sperm and fertility have not

yet been reported in Zika-infected human males, persistence of Zika

in semen and sperm and sexual transmission by males has been

documented. This new preclinical data suggests that our Zika

vaccine may represent an opportunity to limit the potential for

sexual transmission of the virus. In addition to our ongoing

ZIKA-001 and 002 clinical studies, we are planning for a larger

phase 2 study in our efforts to bring our Zika vaccine to

patients.

- Npj Vaccines published a paper entitled “DNA

Inoculation of Synthetic Cross-Reactive Antibodies Protects Against

Lethal Influenza A and B Infections,” co-authored by Inovio

scientists and collaborators from the Wistar Institute and

MedImmune. The paper reported the results of a preclinical study in

which Inovio’s DNA-based monoclonal antibody product candidate for

the treatment of influenza produced broadly cross-reactive

antibodies that provided complete protection from a lethal

challenge with multiple viruses of both influenza A and B

types. Following previously reported similar data from

Inovio’s dMAb® candidates for HIV, dengue, and Chikungunya, this

study further validates the potential for Inovio’s dMAb technology

platform to be able to use encoded DNA plasmids for in vivo

production of monoclonal antibodies and to induce protective immune

responses. The goal for this platform is to rapidly generate

therapeutic monoclonal antibodies directly in the recipients. Such

benefits are complementary to Inovio’s antigen-generating platform

in terms of immune mechanism and short response times, and

advantages that overcome conventional monoclonal antibodies’ long

development lead times and complex manufacturing processes and

costs.

About Inovio Pharmaceuticals,

Inc.

Inovio is taking immunotherapy to the next level in

the fight against cancer and infectious diseases. We are the only

immunotherapy company that has reported generating T cells in vivo

in high quantity that are fully functional and whose killing

capacity correlates with relevant clinical outcomes with a

favorable safety profile. With an expanding portfolio of immune

therapies, the company is advancing a growing preclinical and

clinical stage product pipeline. Partners and collaborators include

MedImmune, Regeneron, Genentech, The Wistar Institute, University

of Pennsylvania, DARPA, GeneOne Life Science, Plumbline Life

Sciences, ApolloBio Corporation, Drexel University, NIH, HIV

Vaccines Trial Network, National Cancer Institute, U.S. Military

HIV Research Program, and Laval University. For more information,

visit www.inovio.com.

This press release contains certain forward-looking

statements relating to our business, including our plans to develop

electroporation-based drug and gene delivery technologies and DNA

vaccines, our expectations regarding our research and development

programs, including the planned initiation and conduct of clinical

trials and the availability and timing of data from those trials,

and the sufficiency of our capital resources. Actual events or

results may differ from the expectations set forth herein as a

result of a number of factors, including uncertainties inherent in

pre-clinical studies, clinical trials and product development

programs, the availability of funding to support continuing

research and studies in an effort to prove safety and efficacy of

electroporation technology as a delivery mechanism or develop

viable DNA vaccines, our ability to support our pipeline of SynCon®

active immunotherapy and vaccine products, the ability of our

collaborators to attain development and commercial milestones for

products we license and product sales that will enable us to

receive future payments and royalties, the adequacy of our capital

resources, the availability or potential availability of

alternative therapies or treatments for the conditions targeted by

the company or its collaborators, including alternatives that may

be more efficacious or cost effective than any therapy or treatment

that the company and its collaborators hope to develop, issues

involving product liability, issues involving patents and whether

they or licenses to them will provide the company with meaningful

protection from others using the covered technologies, whether such

proprietary rights are enforceable or defensible or infringe or

allegedly infringe on rights of others or can withstand claims of

invalidity and whether the company can finance or devote other

significant resources that may be necessary to prosecute, protect

or defend them, the level of corporate expenditures, assessments of

the company's technology by potential corporate or other partners

or collaborators, capital market conditions, the impact of

government healthcare proposals and other factors set forth in our

Annual Report on Form 10-K for the year ended December 31, 2016,

our Form 10-Q for the period ended June 30, 2017, and other

regulatory filings we make from time to time. There can be no

assurance that any product candidate in Inovio's pipeline will be

successfully developed, manufactured or commercialized, that final

results of clinical trials will be supportive of regulatory

approvals required to market licensed products, or that any of the

forward-looking information provided herein will be proven

accurate. Forward-looking statements speak only as of the date of

this release, and Inovio undertakes no obligation to update or

revise these statements, except as may be required by law.

| Inovio Pharmaceuticals, Inc. |

| CONSOLIDATED BALANCE SHEETS |

| |

| |

June 30, 2017 |

|

December 31, 2016 |

| |

(Unaudited) |

|

|

|

ASSETS |

|

|

|

| Current

assets: |

|

|

|

| Cash and cash

equivalents |

$ |

23,860,637 |

|

|

$ |

19,136,472 |

|

| Short-term

investments |

68,138,619 |

|

|

85,629,412 |

|

| Accounts

receivable |

7,522,548 |

|

|

15,821,511 |

|

| Accounts receivable

from affiliated entity |

1,189,300 |

|

|

748,355 |

|

| Prepaid expenses and

other current assets |

4,914,764 |

|

|

1,749,059 |

|

| Prepaid expenses and

other current assets from affiliated entity |

1,251,730 |

|

|

1,512,424 |

|

| Total current

assets |

106,877,598 |

|

|

124,597,233 |

|

| Fixed assets, net |

15,017,992 |

|

|

9,025,446 |

|

| Investment in

affiliated entity - GeneOne |

14,612,344 |

|

|

16,052,065 |

|

| Investment in

affiliated entity - PLS |

3,339,802 |

|

|

3,777,510 |

|

| Intangible assets,

net |

6,817,855 |

|

|

7,628,394 |

|

| Goodwill |

10,513,371 |

|

|

10,513,371 |

|

| Other assets |

1,674,251 |

|

|

2,113,147 |

|

| Total

assets |

$ |

158,853,213 |

|

|

$ |

173,707,166 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current

liabilities: |

|

|

|

| Accounts payable and

accrued expenses |

$ |

16,477,761 |

|

|

$ |

19,597,787 |

|

| Accounts payable and

accrued expenses due to affiliated entity |

847,421 |

|

|

1,072,579 |

|

| Accrued clinical trial

expenses |

7,188,751 |

|

|

6,368,389 |

|

| Common stock

warrants |

1,363,637 |

|

|

1,167,614 |

|

| Deferred revenue |

548,690 |

|

|

14,762,720 |

|

| Deferred revenue from

affiliated entity |

274,194 |

|

|

407,292 |

|

| Deferred rent |

681,544 |

|

|

446,646 |

|

| Total current

liabilities |

27,381,998 |

|

|

43,823,027 |

|

| Deferred revenue, net

of current portion |

205,938 |

|

|

317,808 |

|

| Deferred revenue from

affiliated entity, net of current portion |

— |

|

|

86,694 |

|

| Deferred rent, net of

current portion |

7,560,867 |

|

|

5,926,424 |

|

| Deferred tax

liabilities |

174,793 |

|

|

174,793 |

|

| Total

liabilities |

35,323,596 |

|

|

50,328,746 |

|

| Inovio

Pharmaceuticals, Inc. stockholders’ equity: |

|

|

|

| Preferred stock |

— |

|

|

— |

|

| Common stock |

77,634 |

|

|

74,062 |

|

| Additional paid-in

capital |

589,890,620 |

|

|

556,718,356 |

|

| Accumulated

deficit |

(467,715,568 |

) |

|

(434,838,235 |

) |

| Accumulated other

comprehensive income |

1,180,662 |

|

|

1,327,968 |

|

| Total Inovio

Pharmaceuticals, Inc. stockholders’ equity |

123,433,348 |

|

|

123,282,151 |

|

| Non-controlling

interest |

96,269 |

|

|

96,269 |

|

| Total stockholders’

equity |

123,529,617 |

|

|

123,378,420 |

|

| Total

liabilities and stockholders’ equity |

$ |

158,853,213 |

|

|

$ |

173,707,166 |

|

| Inovio Pharmaceuticals, Inc. |

| CONSOLIDATED STATEMENTS OF

OPERATIONS |

| (Unaudited) |

| |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2017 |

|

2016 |

|

2017 |

|

2016 |

|

Revenues: |

|

|

|

|

|

|

|

| Revenue under

collaborative research and development arrangements |

$ |

16,358,316 |

|

|

$ |

1,889,988 |

|

|

$ |

20,646,902 |

|

|

$ |

3,686,845 |

|

| Revenue under

collaborative research and development arrangements with affiliated

entity |

176,879 |

|

|

499,720 |

|

|

410,209 |

|

|

636,720 |

|

| Grants and

miscellaneous revenue |

2,797,647 |

|

|

3,814,083 |

|

|

8,037,880 |

|

|

9,990,381 |

|

| Grants and

miscellaneous revenue from affiliated entity |

1,079,282 |

|

|

— |

|

|

1,693,318 |

|

|

— |

|

| Total

revenues |

20,412,124 |

|

|

6,203,791 |

|

|

30,788,309 |

|

|

14,313,946 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

| Research and

development |

23,878,751 |

|

|

19,630,801 |

|

|

48,421,255 |

|

|

37,819,961 |

|

| General and

administrative |

6,169,106 |

|

|

5,799,530 |

|

|

13,936,695 |

|

|

11,171,143 |

|

| Gain on sale of

assets |

— |

|

|

(1,000,000 |

) |

|

— |

|

|

(1,000,000 |

) |

| Total operating

expenses |

30,047,857 |

|

|

24,430,331 |

|

|

62,357,950 |

|

|

47,991,104 |

|

| Loss from

operations |

(9,635,733 |

) |

|

(18,226,540 |

) |

|

(31,569,641 |

) |

|

(33,677,158 |

) |

| Other income

(expense): |

|

|

|

|

|

|

|

| Interest and other

income, net |

300,021 |

|

|

341,131 |

|

|

640,362 |

|

|

674,201 |

|

| Change in fair value of

common stock warrants, net |

(312,500 |

) |

|

(113,775 |

) |

|

(196,023 |

) |

|

(520,024 |

) |

| Gain (loss) on

investment in affiliated entity |

169,096 |

|

|

(705,527 |

) |

|

(1,439,721 |

) |

|

6,775,450 |

|

| Net loss

attributable to Inovio Pharmaceuticals, Inc. |

$ |

(9,479,116 |

) |

|

$ |

(18,704,711 |

) |

|

$ |

(32,565,023 |

) |

|

$ |

(26,747,531 |

) |

| Loss per common

share—basic and diluted: |

|

|

|

|

|

|

|

| Net loss per

share attributable to Inovio Pharmaceuticals, Inc.

stockholders |

$ |

(0.13 |

) |

|

$ |

(0.26 |

) |

|

$ |

(0.44 |

) |

|

$ |

(0.37 |

) |

| Weighted

average number of common shares outstanding—basic and

diluted |

75,409,702 |

|

|

72,957,159 |

|

|

74,783,791 |

|

|

72,591,986 |

|

CONTACTS:

Investors/Media: Jeff Richardson, Inovio Pharmaceuticals, 267-440-4211, jrichardson@inovio.com

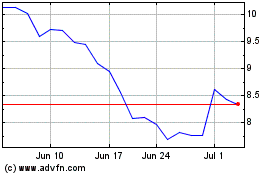

Inovio Pharmaceuticals (NASDAQ:INO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Inovio Pharmaceuticals (NASDAQ:INO)

Historical Stock Chart

From Apr 2023 to Apr 2024