Inovio Announces Pricing of Public Offering of Common Stock

July 19 2017 - 10:10PM

Inovio Pharmaceuticals, Inc. (NASDAQ:INO) today announced the

pricing of an underwritten public offering of 12,500,000 shares of

its common stock, offered at a price to the public of $6.00 per

share. The gross proceeds to Inovio from the offering are

expected to be $75.0 million, before deducting the underwriting

discounts and commissions and offering expenses payable by

Inovio. All of the shares are being offered by Inovio.

The offering is expected to close on July 25, 2017, subject to

customary closing conditions. In addition, Inovio has granted

the underwriters a 30‑day option to purchase up to 1,875,000

additional shares of its common stock on the same terms and

conditions.

Inovio anticipates using the net proceeds from this

offering for general corporate purposes, including clinical trial

expenses, research and development expenses, general and

administrative expenses, manufacturing expenses and other business

development activities.

Citigroup, Piper Jaffray & Co. and RBC

Capital Markets are acting as joint book-running managers for the

offering. H.C. Wainwright & Co., Maxim Group LLC, Aegis

Capital Corp. and National Securities Corporation, are acting as

co-managers for the offering.

The shares of common stock described above are

being offered by Inovio pursuant to a shelf registration statement

filed by Inovio with the Securities and Exchange Commission

(SEC) that was declared effective on June 5, 2015. A final

prospectus supplement and accompanying prospectus relating to the

offering will be filed with the SEC and will be available on the

SEC’s website located at http://www.sec.gov. Copies of the

final prospectus supplement and the accompanying prospectus

relating to the offering, when available, may be obtained

from Citigroup Global Markets Inc., c/o Broadridge Financial

Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717, or by telephone at (800) 831-9146; or from Piper

Jaffray & Co., Attention: Prospectus Department, 800 Nicollet

Mall, J12S03, Minneapolis, MN 55402, or by telephone at (800)

747-3924, or by email at prospectus@pjc.com.

This press release shall not constitute an offer to

sell or the solicitation of an offer to buy these securities, nor

shall there be any sale of these securities in any state or other

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such state or other jurisdiction.

About Inovio Pharmaceuticals,

Inc.

Inovio is taking immunotherapy to the next level in

the fight against cancer and infectious diseases. We are the only

immunotherapy company that has reported generating T cells in vivo

in high quantity that are fully functional and whose killing

capacity correlates with relevant clinical outcomes with a

favorable safety profile. With an expanding portfolio of immune

therapies, the company is advancing a growing preclinical and

clinical stage product pipeline. Partners and collaborators include

MedImmune, Regeneron, Genentech, The Wistar Institute, University

of Pennsylvania, DARPA, GeneOne Life Science, Plumbline Life

Sciences, ApolloBio Corporation, Drexel University, NIH, HIV

Vaccines Trial Network, National Cancer Institute, U.S. Military

HIV Research Program and Laval University.

Forward-Looking Statements

This press release contains certain forward-looking

statements relating to Inovio’s business that involve a number of

risks and uncertainties, including statements about its

expectations with respect to the public offering. These

statements may be identified by introductory words such as “may,”

“expects,” “plan,” “believe,” “will,” “achieve,” “anticipate,”

“would,” “should,” “subject to” or words of similar meaning, or by

the fact that they do not relate strictly to historical or current

facts. For such statements, Inovio claims the protection of

the Private Securities Litigation Reform Act of 1995. Actual

events or results may differ from the expectations set forth herein

as a result of a number of factors, including, but limited to,

risks and uncertainties associated with market conditions and the

satisfaction of customary closing conditions related to the public

offering, and other factors discussed in the “Risk Factors” section

of Inovio’s Annual Report on Form 10-K for the year ended December

31, 2016, filed with the SEC on March 15, 2017, Inovio’s Form 10-Q

for the quarter ended March 31, 2017, filed with the SEC on May 10,

2017, and other filings that Inovio makes with the SEC from time to

time. There can be no assurance that any of the forward-looking

information provided herein will be proven accurate.

In addition, the forward-looking statements

included in this press release represent Inovio’s views as of the

date hereof. Inovio anticipates that subsequent events and

developments may cause its views to change. However, while Inovio

may elect to update these forward-looking statements at some point

in the future, the company specifically disclaims any obligation to

do so, except as may be required by law. These forward-looking

statements should not be relied upon as representing Inovio’s views

as of any date subsequent to the date of this release.

CONTACTS:

Investors & Media:

Jeffrey C. Richardson, Inovio Pharmaceuticals, 267-440-4211, jrichardson@inovio.com

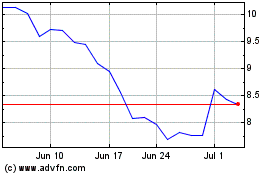

Inovio Pharmaceuticals (NASDAQ:INO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Inovio Pharmaceuticals (NASDAQ:INO)

Historical Stock Chart

From Apr 2023 to Apr 2024