Indian Rupee Extends Decline To Near 6-week Low Versus U.S. Dollar

July 27 2015 - 7:35AM

RTTF2

The Indian rupee continued to be lower against the U.S. dollar

in evening deals on Monday, as mounting worries about China's

economy and apprehensions about whether market regulator SEBI will

review participatory notes norms dragged down regional stocks.

The benchmark index BSE Sensex fell 550.93 points or 1.96

percent to 27,561.38, marking its biggest single-day loss since

June 2. The broader Nifty index fell 160.55 points or 1.88 percent

to 8,361, its biggest single-day loss since June 11.

In an attempt to calm foreign investors, Finance Minister Arun

Jaitley said today that the government would not take any

"knee-jerk" reaction that will adversely impact India's investment

climate.

He said that the government will study the recommendations of

the Supreme Court-appointed SIT on black money before taking a

stand. "It is too early to say what view the government would take,

but it will certainly not take any such action in a knee-jerk

manner," he added. The report by the special investigations team

had suggested greater oversight of money laundering in stocks.

The rupee fell to 64.2055 a dollar, a level not seen since June

17. This is a 0.18 percent decrease from Friday's closing value of

64.0930. If the rupee continues fall, 65.5 is possibly seen as its

next downside target level.

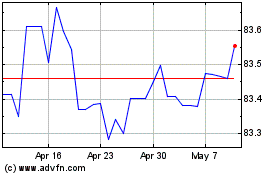

US Dollar vs INR (FX:USDINR)

Forex Chart

From Mar 2024 to Apr 2024

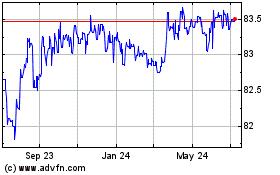

US Dollar vs INR (FX:USDINR)

Forex Chart

From Apr 2023 to Apr 2024