Imperial Oil Sees Output Gains from Oil-Sands

September 23 2015 - 6:50PM

Dow Jones News

The top executive at Exxon Mobil Corp.'s Canadian subsidiary on

Wednesday said new technology has the potential to more than double

production from a series of proposed oil-sands projects, a bullish

signal for Canada's high-cost heavy oil operations even as it faces

a slump in crude oil prices and falling investment.

Exxon subsidiary Imperial Oil Ltd. said pilot tests show a

nearly 30% increase in production using a modified version of its

steam-assisted gravity drainage, or SAGD, technology, which

recovers deposits of heavy oil embedded in sand with injections of

steam deep underground. The new techniques include adding a solvent

to improve the flow of oil to surface, known as SA-SAGD, and

generators that burn less natural gas to supply steam, Chief

Executive Rich Krü ger said.

Those innovations could boost output from each of at least seven

proposed oil-sands well projects to 55,000 to 75,000 barrels a day

in crude production, up from 30,000 to 40,000 barrels a day at

current-generation well sites, Mr. Krü ger said.

"This is bigger on a per phase basis than we've talked about in

the past," Mr. Krü ger told investors at a conference in Toronto,

adding he sees the initiative as "a very large, long-term growth

opportunity."

Aspen, the first of those planned projects, could start as soon

as 2020. But Mr. Krü ger said the company has yet to approve Aspen

as it evaluates the business case for it and the others, each of

which would cost about 2 billion Canadian dollars to develop.

The decision will come even as Imperial plans to cut its total

investment budget in half over the next five years to about C$2.5

billion annually after splurging on two major oil-sands projects

that recently began production. Those two operations—its Kearl

surface mine and Nabiye well site—will boost the company's output

by a combined 120,000 barrels of oil a day to a total of more than

400,000 barrels a day.

"We think we're commercially ready to go on SA-SAGD" technology,

Mr. Krü ger said, but he added the company is in no rush to make a

decision on whether to move ahead. Imperial is currently assessing

their cost, possible changes in Alberta's regulatory policies and

the outlook for oil prices, he said.

Most new oil-sands well plants require benchmark U.S. crude

prices above $67 a barrel to break even, which is well below

current levels of around $45 a barrel, according to RBC Dominion

Securities. Oil from Canada's oil sands is among the most expensive

forms of crude to produce because it is difficult to extract, lower

in quality than lighter grades and located in a remote area of

northern Alberta.

Write to Chester Dawson at chester.dawson@wsj.com

Access Investor Kit for "EXXON MOBIL CORP"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US30231G1022

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 23, 2015 18:35 ET (22:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

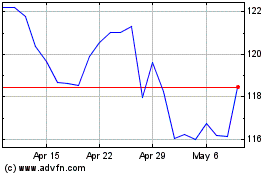

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

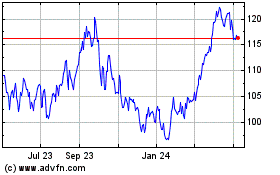

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024