TIDMIMM

RNS Number : 8856R

Immupharma PLC

27 September 2017

FOR IMMEDIATE RELEASE 27 SEPTEMBER 2017

ImmuPharma PLC

("ImmuPharma" or the "Company")

INTERIM RESULTS ANNOUNCEMENT

for the six months ended 30 June 2017

ImmuPharma PLC (LSE:IMM), ("ImmuPharma" or the "Company"), the

specialist drug discovery and development company, is pleased to

announce its interim results for the six months ended 30 June 2017

(the "Period").

Key Highlights

-- Lupuzor(TM) : is the Company's lead program for the potential

breakthrough compound for Lupus a potential life threatening

auto-immune disease

-- Total 11 sites active in US with 70 patients

-- Five European countries with 81 Lupus patients taking part in

the trial: Czech Republic, France, Germany, Hungary and Poland

-- One Mauritius site with 49 Lupus patients included in

trial

-- Most recent update on progress of Lupuzor(TM) trial announced on 21 September 2017

-- Top line results on track to report in Q1 2018

-- As announced on 26 September 2017, first steps initiated for

Lupuzor's(TM) regulatory submissions

-- GBP4.1 million fundraising (before expenses) successfully completed in March 2017

-- Northland Capital Partners appointed as sole broker and NOMAD

-- Stable financial performance over the Period, in line with market expectations

o Net assets of GBP6.4 million (31 December 2016: GBP5.5

million)

o Loss for the Period of GBP3.0 million (H1 2016:

GBP3.7million)

-- Research and Development expenses of GBP2.3 million (H1 2016:

GBP2.5 million)

o Basic and diluted loss per share of 2.34p (H1 2016: 3.35p)

-- New employee share option plan implemented in March 2017 to

continue to attract and retain key individuals

-- 'Investor' Event on 30 June 2017

o ImmuPharma successfully hosted a technology symposium on

Friday 30 June following the Company's AGM. The event attended by

institutional and private investors included presentations from key

management on the three core technology platforms. The video of the

presentation can be seen on

http://www.immupharma.co.uk/media/events

-- New ImmuPharma website launched: www.immupharma.co.uk

Commenting on the Interims and outlook Tim McCarthy, Chairman,

said:

"Ensuring that our pivotal Phase III Lupuzor(TM) trial

progresses on track remains a key focus for ImmuPharma.

"We recently announced that all patients in the study have now

passed the six months stage, with over 26% of patients having now

completed the full 12 months. With a continued robust safety

record, we are looking forward with confidence and planning for a

successful outcome of the study with all patients completing the

treatment protocol in the coming months and to reporting top-line

results in Q1 2018.

"Having successfully completed a GBP4.1 million fundraising

(before expenses) in March, the Board would like to thank its

shareholders for their continued support, as well as its staff,

corporate and scientific advisors and the CNRS for their ongoing

collaboration."

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014. ("MAR")

For further information please contact:

+ 44 (0) 20 7152

ImmuPharma plc 4080

Tim McCarthy, Chairman

Dimitri Dimitriou, Chief Executive

Officer

Dr Robert Zimmer, President

and CSO

Tracy Weimar, Vice President,

Operations and Finance

Lisa Baderoon, Head of Investor

Relations + 44 (0) 7721 413496

Northland Capital Partners

Limited, Joint Broker +44 (0) 20 3861 6625

Patrick Claridge, David Hignell,

Jamie Spotswood Corporate Finance

Rob Rees, Corporate Broking

ImmuPharma plc

Chairman's Statement

INTERIM HIGHLIGHTS

The first half of 2017 saw the continued progression of our lead

program Lupuzor(TM) , for the treatment of Lupus, through

significant milestones in its pivotal Phase III trial. The most

recent update to the trial as announced on 21 September 2017

confirmed that as at 15 September 2017:

-- all patients in the study have passed the 6 months stage, and

-- 52 patients (26%) have completed the full 12 months of the study

Importantly there continues to be a robust safety record which

remains consistent with Lupuzor(TM)'s product profile as shown in

its previous Phase IIb study.

As announced on 26 September 2017, with the trial progressing on

track, ImmuPharma is planning ahead in anticipation of the trial's

successful outcome. In consultation with our regulatory advisors,

we are now progressing the completion of the regulatory dossiers in

preparation for submission to the Food and Drug Administration

(FDA) and the European Medicines Agency (EMA). This includes the

finalisation of the Drug Master File (DMF) and in particular the

manufacture of commercial batches of the Lupuzor(TM) drug. These

will be manufactured according to described procedures in the DMF,

to be ready for inclusion in the Company's regulatory submissions.

ImmuPharma expects to have the first set of batches ready by the

end of Q1 2018 in line with Lupuzor's(TM) Phase III top line

results being announced.

We were also pleased to have successfully completed an

oversubscribed GBP4.1 million fundraising (before expenses) in

March 2017. The funds raised strengthened the Company's Statement

of Financial Position and have also supported further investment in

ImmuPharma's earlier stage portfolio, in particular its P140

peptide platform.

Lupuzor(TM) Phase III Trial - Progress through H1 2017

Lupuzor(TM) received approval from the US Food and Drug

Administration (FDA) to start Phase III with a Special Protocol

Assessment (SPA) and Fast Track designation, perceived as the 'Gold

Standard' from the FDA. Under the SPA, the necessary number of

patients for the Phase III programme is much lower than other Lupus

development candidates in previous clinical trials and underpins

the significant efficacy and safety profile shown by Lupuzor(TM) in

its clinical development program to date. Importantly, this means

that the total cost and time to completion of Phase III is

significantly reduced.

The Phase III trial is a double-blind, randomised,

placebo-controlled trial. The study involves patients being dosed

for one year, receiving 0.2mg once every month subcutaneously.

Significant progress was made toward completion of the trial. 293

patients were screened illustrating the demand from physicians for

a new, safe and effective treatment for Lupus. Of these, the

required 200 patients have been successfully recruited and

randomised (dosed). Patients are participating in the trial in 7

countries across 28 sites.

In the United States the trial has been approved by a major

Central Institutional Review Board (IRB) which is allowing several

sites to participate through a single IRB. In Europe, the study is

approved through the centralised Voluntary Harmonisation Procedure

(VHP). Through the EU VHP the study is taking place in Germany,

France, Czech Republic, Hungary and Poland.

ImmuPharma was also requested to open a new site in Mauritius.

CAP Research, a major clinical research organisation in Mauritius,

is leading the trial and 49 patients have been recruited.

Mauritius, with a population of around 1.2 million, has a high

proportion, approximately 300 of Lupus patients currently

diagnosed. Top line data is expected during Q1 2018. Progress of

the trial can be seen at: www.clinicaltrials.gov (search term

'Lupuzor').

Lupus - Opportunity

There are an estimated five million people globally suffering

from Lupus, with approximately 1.5 million patients in the US,

Europe and Japan (Source: Lupus Foundation of America). Current

'standard of care' treatments, including steroids and

immunosuppressants, can potentially have either serious side

effects for patients or limited effectiveness, with over 60% of

patients not adequately treated. GSK's Benlysta is the first Lupus

drug approved in many years and paves the path to market for

Lupuzor(TM). Based on conservative estimates, and taking into

account that Benlysta is priced currently at approximately

US$30,000 per patient per year, Lupuzor(TM) would be entering a

market with the potential for multi-billion dollar sales.

Lupuzor(TM) has the potential to be a novel specific first-line

drug therapy for the treatment of Lupus by specifically modulating

the immune system and halting disease progression in a substantial

proportion of patients. Lupuzor(TM) has a unique mechanism of

action that modulates the activity of CD4 T-cells which are

involved in the cell-mediated immune response which leads to the

Lupus disease. Lupuzor(TM), taken over the long term, as indicated

in earlier stage clinical trials, has the potential to prevent the

progression of Lupus rather than just treating its symptoms, with

the rest of the immune system retaining the ability to work

normally.

There will be a number of routes to market for Lupuzor(TM) which

could include: a global licensing deal; ImmuPharma partnering with

regional distributors, or an outright sale of Lupuzor(TM) or the

Company. The prime objective of any strategy would be to maximise

shareholder return.

Pipeline Overview

Lupuzor(TM) - Forigerimod / P140 Auto-Immune Platform

Lupuzor(TM), is also known by its chemical name 'Forigerimod' or

P140.

ImmuPharma, in conjunction with the CNRS, is working hard on

expanding the P140 auto immune pipeline, which is supported by

Lupuzor(TM) 's strong efficacy and safety profile and by its

mechanism of action.

An important patent has been granted in key countries (USA, EU,

China, India and Japan) covering Lupuzor(TM) up to 2032 and its use

in the treatment of a majority of autoimmune diseases such as

Sjogrens, rheumatoid arthritis, Crohn's and CIDP.

Additionally, a new patent has been filed (co-owned with CNRS)

to cover non-autoimmune indications. Further preclinical work

continues at the CNRS with the objective of further indications

moving into the clinic in due course.

Nucant Platform

Our Cancer Nucant program, IPP-204106, is focused on combination

therapy approaches and ImmuPharma is reviewing a number of options

to further progress this program. In 2016, a grant was awarded by

the EU to different EU partners (EUR7 million total with EUR430k

awarded to ImmuPharma) to develop the Nucants in combination with

cytotoxic drugs linked to a solid support. The concept has been

validated in pre-clinical studies. As indicated in many high-level

scientific journals (Cancer Research), Nucants can be used to

selectively target cancer cells and deliver on target highly

cytotoxic drugs. Further, it has been proven that Nucants are

drastically enhancing the effects of cytotoxic drugs at the tumour

level (factor 3) allowing thereby improved efficacy and/or

reduction of side effects for the same efficacy. The product,

subject to funding, is ready for Phase II development.

The Group has also been awarded grants to investigate its use in

age-related macular degeneration, diabetic retinopathy and other

ophthalmological indications. The preliminary results are very

encouraging and the product could be ready for clinical assessment

provided sufficient funding is secured.

Peptide Platform

ImmuPharma's subsidiary 'Ureka' has initiated the development of

a novel and innovative peptide technology platform through the

Company's collaboration with CNRS, thereby gaining access to

pioneering research centred on novel peptide drugs at the

University of Bordeaux and the Institut Européen de Chimie et

Biologie (IECB). Jointly, ImmuPharma and CNRS have filed a new

co-owned patent controlling this breakthrough peptide technology.

The first therapeutic area being targeted is diabetes with

glucagon-like peptide -1 agonists, a class of drugs for the

treatment of diabetes, as well as initiating the development of

novel peptides as glucagon antagonists - one of the novel

approaches to treat Type I and Type II diabetes. A consequence of

this approach is the development of long acting peptides to treat

NASH (Non-Alcoholic Steato-Hepatitis), one of the most important

challenges for public health in the future. ImmuPharma has received

non-refundable grants of approximately EUR600,000 to develop this

technology with application to peptides used to treat diabetes as

well as to peptides which allow the control of protein/protein

interactions (cancer, targeting P53 interactions).

Investor Symposium on 30 June 2017

ImmuPharma held a technology symposium in London on 30 June 2017

following the Company's AGM. Over forty investors attended the

event which included both institutions and private investors. The

key objective of the event was to give further insight into

ImmuPharma's three core technology platforms:

-- Lupuzor(TM) / P140 : Auto Immune Diseases

-- Nucants : Oncology / Opthamology

-- Peptides : Metabolic Disorders

Vadim Alexandre, Healthcare Analyst at Northland Capital

Partners also provided his view on the investment case for

ImmuPharma centred on Lupuzor(TM), an overview of the Auto-Immune

sector and competitive landscape.

The video of the presentation can be seen on

http://www.immupharma.co.uk/media/events.

Financial Review

ImmuPharma's cash balance at 30 June 2017 was GBP3.13 million

(GBP1.88 million at 31 December 2016, GBP0.66 million at 30 June

2016). Further to the Lanstead sharing agreement entered into in

February 2016, the Company also has GBP0.94 million as a derivative

financial asset (GBP1.55 million at 31 December 2016, GBP3.14

million at 30 June 2016). The sharing agreement with Lanstead

includes the provision for 18 monthly tranches of proceeds from the

derivative financial asset depending on the share price performance

versus an agreed benchmark price. At 30 June 2017, there were 3

monthly tranches outstanding, therefore the sharing agreement will

shortly be coming to an end. The Company also has an asset in

respect of a prepayment of GBP0.80 million of advanced fees to

Simbec-Orion at 30 June 2017 (GBP1.24 million at 31 December 2016,

GBP1.75 million at 30 June 2016). Basic and diluted loss per share

were 2.34p and 2.34p respectively (30 June 2016: 3.35p and 3.35p).

In line with the Company's current policy, no interim dividend is

proposed.

Operating loss for the Period was GBP3.2 million (GBP3.2 million

for the six months ended 30 June 2016). Research and development

expenditure in the Period was GBP2.3 million (GBP2.5 million for

the six months ended 30 June 2016) reflecting primarily the

significantly increased expenditure related to the Lupuzor(TM)

Phase III clinical trial. Administrative expenses were GBP0.93

million during the Period (GBP0.73 million for the six months ended

30 June 2016).

Given the stage of ImmuPharma's development, the fact that

losses have continued to be made is to be expected since there is

minimal revenue and business activity is concerned with significant

investment in the form of clinical trial expenditure in addition to

maintaining the infrastructure of the Group.

Current Activities and Outlook

The Board are excited by ImmuPharma's medium and long term

potential. We are focused on the late stage clinical development of

Lupuzor(TM) through its pivotal Phase III trial and are looking

forward with confidence to announcing top-line data by the end of

the first quarter of 2018. We will also continue to communicate on

a regular basis with shareholders as this trial progresses.

ImmuPharma will also continue to look at ways to create further

value in its assets as it progresses its other earlier stage

pipeline candidates whilst exploring other opportunities around

Lupuzor's(TM) mechanism of action and its applicability to other

autoimmune conditions.

The Board would like to thank its shareholders, both

longstanding and those who participated in the more recent

fundraisings, for their support as well as its staff, corporate and

scientific advisers including Simbec-Orion and the CNRS for their

continued collaboration.

Tim McCarthy

Chairman

ImmuPharma plc

CONSOLIDATED INCOME STATEMENT

FOR THE PERIODED 30 JUNE 2017

Note Unaudited Audited Unaudited

6 months Year 6 months

ended ended ended

30 June 31 December 30 June

2017 2016 2016

GBP GBP GBP

Continuing operations

Revenue 1 86,504 164,784 2,924

Research and development

expenses (2,345,815) (5,267,087) (2,508,578)

Administrative expenses (927,640) (1,486,858) (733,893)

Operating loss (3,186,951) (6,589,161) (3,239,547)

Finance costs (375) (23,085) (501,671)

Finance income 153,915 297,809 362

Loss before taxation (3,033,411) (6,314,437) (3,740,856)

Tax (485) 990,421 (362)

Loss for the period (3,033,896) (5,324,016) (3,741,218)

Attributable to:

Equity holders of

the parent company (3,033,896) (5,324,016) (3,741,218)

Loss per ordinary

share

Basic 2 (2.34)p (4.54)p (3.35)p

Diluted 2 (2.34)p (4.54)p (3.35)p

ImmuPharma plc

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 30 JUNE 2017

Unaudited Audited Unaudited

6 months Year 6 months

ended ended ended

30 June 31 December 30 June

2017 2016 2016

GBP GBP GBP

Loss for the financial

period (3,033,896) (5,324,016) (3,741,218)

Other comprehensive

income

Items that may be reclassified

subsequently to profit

or loss:

Exchange differences

on translation of foreign

operations (56,133) 317,177 224,692

Total items that may

be reclassified subsequently

to profit or loss (56,133) 317,177 224,692

Other comprehensive

loss for the period (56,133) 317,177 224,692

Total comprehensive

loss for the period (3,090,029) (5,006,839) (3,516,526)

ImmuPharma plc

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2017

Note Unaudited Audited Unaudited

30 June 31 December 30 June

2017 2016 2016

GBP GBP GBP

Non-current assets

Intangible assets 497,585 511,088 522,668

Property, plant and

equipment 192,573 231,901 269,435

Derivative financial

asset 4 - - 587,054

Total non-current

assets 690,158 742,989 1,379,157

Current assets

Trade and other receivables 2,439,143 2,535,265 2,724,631

Derivative financial

asset 4 943,861 1,554,866 2,556,565

Cash and cash equivalents 3,131,595 1,876,718 661,009

Total current assets 6,514,599 5,966,849 5,942,205

Current liabilities

Financial liabilities

- borrowings 119,430 143,109 134,435

Trade and other payables 473,867 786,191 767,163

Provisions 33,162 15,050 -

Total current liabilities 626,459 944,350 901,598

Net current assets 5,888,140 5,022,499 5,040,607

Non-current liabilities

Financial liabilities

- borrowings 170,232 219,445 263,664

Net assets 6,408,066 5,546,043 6,156,100

EQUITY

Ordinary shares 13,252,298 12,463,836 12,178,122

Share premium 18,728,519 15,678,054 15,148,894

Merger reserve 106,148 106,148 106,148

Other reserves (3,316,753) (3,373,745) (3,531,612)

Retained earnings (22,362,146) (19,328,250) (17,745,452)

Total equity 6,408,066 5,546,043 6,156,100

ImmuPharma plc

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 30 JUNE 2017

Other Other Other

Merger reserves - reserves reserves Retained

reserve Acquisition - - Earnings

reserve Translation Equity

Reserve shares

Share Share to be Total

capital premium issued equity

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January

2016 8,862,246 10,490,920 106,148 (3,541,203) (1,926,850) 1,703,380 (14,004,234) 1,690,407

Loss for the

financial

period - - - - - - (3,741,218) (3,741,218)

Exchange

differences

on

translation

of foreign

operations - - - - 224,692 - - 224,692

New issue of

equity

capital 3,315,876 5,305,401 - - - - - 8,621,277

Cost of new

issue

of equity

capital - (647,427) - - - - - (647,427)

Share based

payments - - - - - 8,369 - 8,369

------------ ------------ ---------- ------------- --------------------- ----------- -------------- -------------

At 30 June

2016 12,178,122 15,148,894 106,148 (3,541,203) (1,702,158) 1,711,749 (17,745,452) 6,156,100

============ ============ ========== ============= ===================== =========== ============== =============

At 1 January

2016 8,862,246 10,490,920 106,148 (3,541,203) (1,926,850) 1,703,380 (14,004,234) 1,690,407

Loss for the

financial

year - - - - - - (5,324,016) (5,324,016)

Exchange

differences

on

translation

of foreign

operations - - - - 317,177 - - 317,177

New issue of

equity

capital 3,601,590 5,798,410 - - - - - 9,400,000

Cost of new

issue

of equity

capital - (611,276) - - - - - (611,276)

Share based

payment - - - - - 73,751 - 73,751

------------ ------------ ---------- ------------- --------------------- ----------- -------------- -------------

At 31

December

2016 & 1

January

2017 12,463,836 15,678,054 106,148 (3,541,203) (1,609,673) 1,777,131 (19,328,250) 5,546,043

Loss for the

financial

period - - - - - - (3,033,896) (3,033,896)

Exchange

differences

on

translation

of foreign

operations - - - - (56,133) - - (56,133)

New issue of

equity

capital 788,462 3,311,542 - - - - - 4,100,004

Cost of new

issue

of equity

capital - (261,077) - - - - - (261,077)

Share based

payment - - - - - 113,125 - 113,125

At 30 June

2017 13,252,298 18,728,519 106,148 (3,541,203) (1,665,806) 1,890,256 (22,362,146) 6,408,066

============ ============ ========== ============= ===================== =========== ============== =============

Attributable

to:-

Equity

holders

of the

parent

company 13,252,298 18,728,519 106,148 (3,541,203) (1,665,806) 1,890,256 (22,362,146) 6,408,066

============ ============ ========== ============= ===================== =========== ============== =============

ImmuPharma plc

CONSOLIDATED STATEMENT OF CASHFLOWS

FOR THE PERIODED 30 JUNE 2017

Note Unaudited Audited Unaudited

6 months Year 6 months

ended ended

30 June ended 30 June

2017

31 December 2016

2016 (Restated)

GBP GBP GBP

Cash flows from

operating activities

Cash used in operations 3 (3,200,329) (7,191,318) (4,484,973)

Tax 6,680 707,135 5,944

Interest paid (375) (1,917) (496)

Net cash used in

operating activities (3,194,024) (6,486,100) (4,479,525)

Investing activities

Purchase of property,

plant and equipment (1,595) (4,731) (3,404)

Interest received 170 1,722 362

Net cash used in

investing activities (1,425) (3,009) (3,042)

Financing activities

(Decrease) in bank

overdraft (138) (1,091) (1,199)

Loan repayments (80,447) (143,482) (93,579)

Gross proceeds from

issue of new share

capital 4,100,004 9,400,000 8,621,277

Settlements from sharing

agreement 4 682,360 2,690,451 309,650

Share capital issue

costs (261,077) (611,276) (647,427)

Funds deferred per

sharing agreement 4 - (3,949,230) (3,949,230)

Net cash generated

from /(used in) financing

activities 4,440,702 7,385,372 4,239,492

Net increase/(decrease)

in cash and cash equivalents 1,245,253 896,263 (243,075)

Cash and cash equivalents

at start of period 1,876,718 833,388 833,388

Effects of exchange

rates on cash and

cash equivalents 9,624 (147,067) 70,696

Cash and cash equivalents

at end of period 3,131,595 1,876,718 661,009

ImmuPharma plc

NOTES TO THE CONSOLIDATED INTERIM ACCOUNTS FOR THE PERIOD ENDED

30 JUNE 2017

1 ACCOUNTING POLICIES

Basis of preparation

The interim financial information in this report has been

prepared using accounting policies consistent with IFRS as adopted

by the European Union. IFRS is subject to amendment and

interpretation by the International Accounting Standards Board

(IASB) and the IFRS Interpretations Committee and there is an

ongoing process of review and endorsement by the European

Commission. The financial information has been prepared on the

basis of IFRS to be adopted by the European Union and applicable as

at 31 December 2017. The Group has chosen not to adopt IAS 34

"Interim Financial Statements" in preparing the interim financial

information.

The accounting policies applied are consistent with those that

were applied to the financial statements for the year ending 31

December 2016.

Non-Statutory accounts

The financial information set out in this interim report does

not constitute the Group's statutory accounts, within the meaning

of Section 434 of the Companies Act 2006. The statutory accounts

for the year ended 31 December 2016 have been filed with Registrar

of Companies. The auditors reported on those accounts; their report

was unqualified, did not contain a statement under either Section

498 (2) or Section 498 (3) of the Companies Act 2006 and did not

include references to any matters to which the auditor drew

attention by way of emphasis. The financial information for the 6

months ended 30 June 2017 and 30 June 2016 is unaudited.

Copies of this statement will be available on the Company's

website - www.immupharma.com.

ImmuPharma plc

NOTES TO THE CONSOLIDATED INTERIM ACCOUNTS FOR THE PERIOD ENDED

30 JUNE 2017

(Continued)

2 LOSS PER SHARE

Unaudited Audited Unaudited

6 months Year 6 months

ended ended ended

30 June 31 December 30 June

2017 2016 2016

GBP GBP GBP

Loss

Loss for the purposes

of basic and diluted

loss per share being

net loss attributable

to equity shareholders (3,033,896) (5,324,016) (3,741,218)

Number of shares

Weighted average number

of ordinary shares for

the purposes of basic

loss per share 129,517,245 117,340,467 111,578,525

Basic loss per share (2.34)p (4.54)p (3.35)p

Diluted loss per share (2.34)p (4.54)p (3.35)p

There is no difference between basic loss per share and diluted

loss per share as the share options and warrants are

anti-dilutive.

The group has granted share options in respect of shares to be

issued.

ImmuPharma plc

NOTES TO THE CONSOLIDATED INTERIM ACCOUNTS FOR THE PERIOD ENDED

30 JUNE 2017

(Continued)

3 CASH USED IN OPERATIONS

Unaudited Audited Unaudited

6 months Year 6 months

ended ended ended

30 June 31 December 30 June

2017 2016 2016

GBP GBP GBP

Operating loss (3,186,951) (6,589,161) (3,239,547)

Depreciation & amortisation 61,954 121,337 59,058

Share based payments 113,125 73,751 8,369

(Increase)/decrease

in trade & other receivables 34,004 (387,713) (915,358)

(Decrease) in trade

& other payables (322,963) (403,414) (392,281)

Increase in provisions 18,112 15,050 -

Gain/(loss) on

foreign exchange 82,390 (21,168) (5,214)

Cash used in

operations (3,200,329) (7,191,318) (4,484,973)

4 DERIVATIVE FINANCIAL ASSET

In February 2016, as part of a placing that

raised, in aggregate, GBP8.4 million (before

expenses) from new and existing shareholders,

the Company issued 17,021,277 new ordinary

shares to Lanstead Capital LP at a price of

26p per share for GBP4.4 million. All of the

shares were allotted to Lanstead with full

voting rights at that date. The Company simultaneously

entered into a sharing agreement with Lanstead

with a reference price of 34.6667p per share.

The sharing agreement is for an 18 month period.

The actual consideration is variable depending

upon the Company's share price. The agreement

is treated as a derivative financial asset

and valued at fair value through the income

statement with reference to the Company's

share price.

Of the subscription proceeds of GBP4.4 million

received from Lanstead, GBP3.76 million (85%)

was invested by the Company in the sharing

agreement and will be received in monthly

instalments over the life of the agreement.

The remaining GBP663,820 (15%) was available

for immediate working capital purposes.

The Company also issued, in aggregate, a further

851,064 new ordinary shares to Lanstead as

a value payment in connection with the agreement.

At the end of the accounting period the amount

receivable is restated to fair value based

upon the share price of the Company at that

date. Any change in the fair value of the

derivative financial asset is reflected in

the income statement.

5 SUBSEQUENT EVENTS

There were no events subsequent to 30 June

2017.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EASNKADAXEFF

(END) Dow Jones Newswires

September 27, 2017 02:00 ET (06:00 GMT)

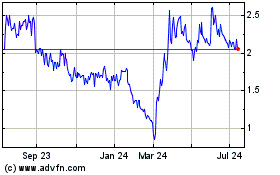

Immupharma (LSE:IMM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Immupharma (LSE:IMM)

Historical Stock Chart

From Apr 2023 to Apr 2024