TIDMIMM

RNS Number : 2484L

Immupharma PLC

30 September 2016

FOR IMMEDIATE RELEASE 30 SEPTEMBER 2016

ImmuPharma PLC

("ImmuPharma" or the "Company")

INTERIM RESULTS ANNOUNCEMENT

for the six months ended 30 June 2016

ImmuPharma PLC (LSE:IMM), ("ImmuPharma" or the "Company"), the

specialist drug discovery and development company, is pleased to

announce its interim results for the six months ended 30 June 2016

(the "Period").

Key Highlights (including post Period review)

-- Lupuzor(TM) : is the Company's lead programme for the

potential breakthrough compound for Lupus a potential life

threatening auto-immune disease

o Pivotal Phase III trial is progressing on track with

development partner Simbec-Orion

-- Total 11 sites now active in US

-- Five European countries now recruiting Lupus patients in

Czech Republic, France, Germany, Hungary and Poland

-- Two final European countries, UK and Italy, to open within

the next few weeks

-- New Mauritius site opened and over 10 Lupus patients

pre-screened prior to dosing

-- Prof. Sylviane Muller, inventor of Lupuzor, held a number of

key symposiums hosted in London, 8-9 June 2016, where she presented

on the unique 'Mechanism of Action' of Lupuzor(TM), also known by

its chemical name 'Forigerimod' or 'P140'.

o Prof. Muller provided further evidence of the role the P140

molecule can take in the potential treatment of other autoimmune

diseases, including those which are Orphan indications

o A new patent has been filed outside of Lupus in conjunction

with the Centre National de la Recherché Scientifique ("CNRS"), its

collaboration partner

-- GBP8.4 million fundraising completed in February and March 2016

o The Company successfully raised GBP8.4 million (gross) to fund

the pivotal Phase III Lupuzor(TM) trial and to support the

Company's working capital requirements

o New and existing shareholders participated in the fundraising,

including all of the Directors, Simbec-Orion, Aviva, Alto Invest

and Lanstead Capital

o Advance assurance received from HMRC for VCT and EIS

qualifying status

-- Wider program developments

o A number of options are under review to further progress

ImmuPharma's Cancer Nucant program, IPP-204106 following a Phase

I/IIa dose-finding adaptive study which showed that the maximum

tolerated dose was 9 mg/kg, the primary objective of the study

o ImmuPharma and CNRS have filed a new co-owned patent

controlling the Company's peptide platform technology, with Type II

diabetes being the first therapeutic area to be targeted.

o An additional patent has been filed by ImmuPharma to protect

certain peptides (GLP1 analogues) demonstrating outstanding

properties in terms of duration of action.

-- Northland Capital Partners appointed as joint broker

-- Stable financial performance over the Period, in line with market expectations

o Net assets of GBP6.2 million (31 December 2015 GBP1.7

million).

o Loss for the period of GBP3.7m (H1 2015: GBP1.5m)

-- Research and Development expenses of GBP2.5 million (H1 2015:

GBP0.9 million)

o Basic and diluted loss per share of 3.35p (H1 2015: 1.74p)

Commenting on the Interims and outlook Tim McCarthy, Chairman,

said:

"Successfully raising GBP8.4 million and commencing our pivotal

Phase III Lupuzor(TM) trial are two significant milestones for

ImmuPharma over the first half of 2016.

"We are delighted by the continued progress of our Lupuzor(TM)

Phase III trial having recently announced that the US now has 11

sites active and five countries across Europe are currently

recruiting Lupus patients with two further countries including the

UK to open in the near future. The opening of a new additional site

in Mauritius clearly illustrates the positive profile Lupuzor(TM)

is gaining within key cross sections of Lupus patient groups and

within the specialist rheumatologist community.

"We remain confident of reaching our key milestone of recruiting

the full 200 patients in 2016 with top line results in 2017 and

look forward to providing further positive updates on this

Lupuzor(TM) Phase III study as it progresses throughout the end of

this year and 2017.

"The Board would like to thank its shareholders for their

support, as well as its staff, corporate and scientific advisors

and the CNRS for their continued collaboration."

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014. ("MAR")

For further information please contact:

+ 44 (0) 20 7152

ImmuPharma plc 4080

Tim McCarthy, Chairman

Dimitri Dimitriou, Chief

Executive Officer

Tracy Weimar, Vice President,

Operations and Finance

Lisa Baderoon, Head of Investor

Relations + 44 (0) 7721 413496

Panmure, Gordon & Co., NOMAD

& Broker +44 (0) 20 7886 2500

Freddy Crossley, Duncan Monteith,

Corporate Finance

Charles Leigh-Pemberton,

Corporate Broking

Northland Capital Partners

Limited, Joint Broker +44 (0) 20 3861 6625

Patrick Claridge, David Hignell,

Corporate Finance

Rob Rees, Corporate Broking

CHAIRMAN'S STATEMENT

The first half of 2016 was dedicated to the progress of our lead

programme, Lupuzor(TM) (a breakthrough treatment for the

auto-immune disease Lupus), as it commenced its pivotal Phase III

trial and the dosing of Lupus patients in the US and across Europe.

This was combined with the strengthening of our financial position

by completing a successful placing and subscription raising GBP8.4

million before expenses in February and March.

To focus initially on the fundraising it was a sign of

widespread support that as part of the completion of the GBP8.4

million funding round key participators included:

-- All of the Directors

-- Simbec-Orion, our development partner

-- Aviva, our longstanding major institutional investor

-- New institutions including Alto Invest, a specialist Healthcare fund, and Lanstead Capital

-- Longstanding private client shareholders

As part of the fundraising exercise, ImmuPharma also received

confirmation of advance assurance from HM Revenue and Customs that

it is a qualifying holding for the purposes of the Venture Capital

Trust rules and a qualifying company for the purposes of the

Enterprise Investment Scheme. These assurances were important for

attracting a significant proportion of new shareholders into the

recent fundraising.

Lupuzor(TM) Phase III Trial - Progress through H1 2016

As background to the study, we stated that recruitment would

occur in up to 45 investigator sites, 10 sites in United States and

35 in Europe, to ensure the screening of 270 potential patients, in

order to recruit the required 200 patients for the trial. The Phase

III trial is a double-blind, randomised, placebo-controlled trial.

The study will involve patients dosing for one year, receiving

0.2mg once every month subcutaneously.

Current Status

We can now confirm that we have 11 sites opened in the US. In

Europe we have sites open in five countries - France, Hungary,

Poland, Czech Republic and Germany. A further two countries, UK and

Italy, will open in the next few weeks. Further details on the

trial and updates on recruitment can be seen at:

www.ClinicalTrials.gov.

New Site in Mauritius: post review period

On 7 September we announced the opening of a new site in

Mauritius. This was a new country allocation due to the request

from the Mauritian Government based on the high incidence of Lupus

sufferers, approximately 3000, in this region. We have indicated

that around 30 Lupus patients will be included in the current

Lupuzor Phase III trial.

Lupuzor(TM) Symposium

In June, ImmuPharma organised a number of presentations attended

by investors, sell side analysts and media, hosted by Prof. Muller,

the inventor of Lupuzor(TM) in which she presented on the unique

'Mechanism of Action' of Lupuzor(TM), also known by its chemical

name 'Forigerimod' or 'P140' and provided further evidence of the

role the P140 molecule can take in the potential treatment of other

autoimmune diseases. A video of the presentation is available to

view on the Company's website on:

http://www.immupharma.org/events/2016.

There are an estimated five million people globally suffering

from Lupus, with approximately 1.5 million patients in the US,

Europe and Japan (Source: Lupus Foundation of America). Current

'standard of care' treatments, including steroids and

immunosuppressants, can potentially have either serious side

effects for patients or limited effectiveness, with over 60% of

patients not adequately treated. GSK's Benlysta is the first Lupus

drug approved in many years and paves the path to market for

Lupuzor(TM). Based on conservative estimates, and taking into

account that Benlysta is priced currently at approximately $35,000

per patient per year, Lupuzor(TM) would be entering a market with

the potential for multi-billion dollar sales.

Lupuzor(TM) has the potential to be a novel specific first-line

drug therapy for the treatment of Lupus by specifically modulating

the immune system and halting disease progression in a substantial

proportion of patients. Lupuzor(TM) has a unique mechanism of

action that modulates the activity of CD4 T-cells which are

involved in the cell-mediated immune response which leads to the

Lupus disease. Lupuzor(TM), taken over the long term, as indicated

in earlier stage clinical trials, has the potential to prevent the

progression of Lupus rather than just treating its symptoms, with

the rest of the immune system retaining the ability to work

normally.

There will be a number of routes to market for Lupuzor(TM) which

could be: a global licensing deal; ImmuPharma partnering with

regional distributors, or an outright sale of Lupuzor(TM) or the

Company. The prime objective of any strategy would be to maximise

shareholder return.

Pipeline Overview

Forigerimod / P140 Auto-Immune Platform

Lupuzor(TM), is also known by its chemical name 'Forigerimod' or

P140.

ImmuPharma, in conjunction with the CNRS, is working hard on

expanding the P140 auto immune pipeline, which is supported by

Lupuzor(TM) 's strong efficacy and safety profile and by its

mechanism of action.

A new patent has been filed (co-owned with CNRS) to cover other

autoimmune indications, outside of Lupus, some of which have the

potential for Orphan Drug designation. Further preclinical work

continues with the objective of further indications moving into the

clinic in due course.

Nucant Platform

The Company's Cancer Nucant program, IPP-204106, is focused on

combination therapy approaches. The Phase I/IIa dose-finding

adaptive study where the Nucant was associated with chondroitin

sulphate demonstrated that the maximum tolerated dose was 9 mg/kg,

which was the primary objective of the study. ImmuPharma is now

reviewing a number of options to further progress this program. A

grant was awarded by the EU to develop the Nucants in combination

with cytotoxic drugs linked to a solid support. The concept has

been validated in pre-clinical studies.

The Group has also been awarded grants to investigate its use in

age-related macular degeneration, diabetic retinopathy and other

ophthalmological indications.

Peptide Platform

ImmuPharma's subsidiary 'Ureka' has initiated the development of

a novel and innovative peptide technology platform through the

Company's collaboration with CNRS, thereby gaining access to

pioneering research centred on novel peptide drugs at the

University of Bordeaux and the Institut Européen de Chimie et

Biologie (IECB). Jointly, ImmuPharma and CNRS have filed a new

co-owned patent controlling this breakthrough peptide technology.

The first therapeutic area being targeted is diabetes with

glucagon-like peptide -1 agonists, a class of drugs for the

treatment of diabetes, as well as initiating the development of

novel peptides as glucagon antagonists - one of the novel

approaches to treat Type I and Type II diabetes. ImmuPharma has

received non-refundable grants of approximately EUR600,000 to

develop this technology with application to peptides used to treat

diabetes as well as to peptides which allow the control of

protein/protein interactions (cancer).

Financial Review

ImmuPharma's cash balance at 30 June 2016 was GBP0.66 million

(GBP0.83 million at 31 December 2015, GBP3.3 million at 30 June

2015). Further to the Lanstead sharing agreement entered into in

February, the Company also has GBP3.1 million as a derivative

financial asset. The sharing agreement with Lanstead includes the

provision for 18 monthly tranches of proceeds from the derivative

financial asset depending on the share price performance versus an

agreed benchmark price, with 15 tranches outstanding at the 30 June

2016. The Company also has an asset in respect of a prepayment of

GBP1.75 million of advanced fees to Simbec-Orion at 30 June 2016.

Basic and diluted loss per share were 3.35p and 3.35p respectively

(30 June 2015: 1.74p and 1.74p). In line with the Company's current

policy, no interim dividend is proposed.

Operating loss for the period was GBP3.2 million (GBP1.5 million

for the six months ended 30 June 2015). Research and development

expenditure in the period was GBP2.5 million (GBP0.87 million for

the six months ended 30 June 2015) reflecting primarily the

significantly increased expenditure related to the Lupuzor(TM)

Phase III clinical trial. Administrative expenses were GBP733,893

during the Period (GBP677,111 for the six months ended 30 June

2015). Consistent with the reclassification of expenses between

research and development and administration undertaken for the

accounts for the year ended 31 December 2015, the expenses for the

6 months ended 30 June 2015 have also been reclassified to aid

comparability.

Given the stage of ImmuPharma's development, the fact that

losses have continued to be made is to be expected since there is

minimal revenue and business activity is concerned with significant

investment in the form of clinical trial expenditure in addition to

maintaining the infrastructure of the Group.

Current Activities and Outlook

The Board continues to be excited by ImmuPharma's potential. We

are focused on the late stage clinical development of Lupuzor(TM)

through its pivotal Phase III trial through to its results, which

we are confident of announcing in respect of the top-line data by

the end of 2017, and to communicate on a regular basis with

shareholders as this trial progresses. We are now also beginning to

have dialogue with a number of Lupus patient groups, both in the UK

and the USA, and we will increase our efforts within this important

and powerful community throughout this year and beyond.

ImmuPharma will also progress its other earlier stage pipeline

candidates whilst exploring other opportunities around Lupuzor(TM)

's mechanism of action and its applicability to other autoimmune

conditions.

The Board would like to thank its shareholders, both

longstanding and those who participated in the recent fundraising,

for their support as well as its staff, corporate and scientific

advisers including Simbec-Orion and the CNRS for their continued

collaboration.

Tim McCarthy

Chairman

29 September 2016

Independent Review Report to ImmuPharma plc

Introduction

We have been engaged by ImmuPharma plc ("the Company") to review

the condensed set of consolidated financial statements in the

interim report for the six months ended 30 June 2016 which

comprises the Consolidated Income Statement, the Consolidated

Statement of Comprehensive Income, the Consolidated Statement of

Financial Position, the Consolidated Statement of Changes in

Equity, the Consolidated Statement of Cashflows, and the related

notes 1 to 5.

We have read the other information contained in the interim

report and considered whether it contains any apparent

misstatements or material inconsistencies with the financial

information in the condensed set of financial statements.

This report is made solely to the Company in accordance with the

terms of our engagement to assist the Company in meeting the

requirements of AIM Rule 18. Our review has been undertaken so that

we might state to the Company those matters we are required to

state to it in this report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the Company for our review work, for this

report or for the conclusions we have reached.

Directors' responsibilities

The interim report is the responsibility of, and has been

approved by, the directors. The directors are responsible for

preparing the interim report in accordance with AIM Rule 18.

As disclosed in note 1, the annual financial statements of the

Group are prepared in accordance with IFRS as adopted by the

European Union. It is the responsibility of the directors to ensure

that the condensed set of financial statements included in this

interim report have been prepared on a basis consistent with that

which will be adopted in the Group's annual financial

statements.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the interim report

based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK and

Ireland) and consequently does not enable us to obtain assurance

that we would become aware of all significant matters that might be

identified in an audit. Accordingly we do not express an audit

opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the interim report for the six months ended 30 June 2016 is not

prepared, in all material respects, in accordance with the

requirements of the AIM rules.

25 Moorgate

London

Nexia Smith & Williamson EC2R 6AY

Statutory Auditor

Chartered Accountants 29 September 2016

ImmuPharma plc

CONSOLIDATED INCOME STATEMENT

FOR THE PERIODED 30 JUNE 2016

Note Unaudited Audited Unaudited

6 months Year 6 months

ended ended ended

30 June 31 December 30 June

2016 2015 2015

GBP GBP GBP

Continuing operations

Revenue 2,924 76,407 13,559

Research and development

expenses (2,508,578) (2,993,717) (873,722)

Administrative expenses (733,893) (1,645,799) (677,111)

Operating loss (3,239,547) (4,563,109) (1,537,274)

Finance costs (501,671) (1,208) (7,172)

Finance income 362 15,843 3,179

Loss before taxation (3,740,856) (4,548,474) (1,541,267)

Tax (362) 650,977 -

Loss for the period (3,741,218) (3,897,497) (1,541,267)

Attributable to:

Equity holders of

the parent company (3,741,218) (3,897,497) (1,541,267)

Loss per ordinary

share

Basic 2 (3.35)p (4.40)p (1.74)p

Diluted 2 (3.35)p (4.40)p (1.74)p

ImmuPharma plc

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 30 JUNE 2016

Unaudited Audited Unaudited

6 months Year 6 months

ended ended ended

30 June 31 December 30 June

2016 2015 2015

GBP GBP GBP

Loss for the financial

period (3,741,218) (3,897,497) (1,541,267)

Other comprehensive

income

Items that may be reclassified

subsequently to profit

or loss:

Exchange differences

on translation of foreign

operations 224,692 (117,478) (180,262)

Total items that may

be reclassified subsequently

to profit or loss 224,692 (117,478) (180,262)

Other comprehensive

loss for the period 224,692 (117,478) (180,262)

Total comprehensive

loss for the period (3,516,526) (4,014,975) (1,721,529)

ImmuPharma plc

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2016

Note Unaudited Audited Unaudited

30 June 31 December 30 June

2016 2015 2015

GBP GBP GBP

Non-current assets

Intangible assets 522,668 522,462 530,354

Property, plant and

equipment 269,435 280,127 304,590

Derivative financial

asset 4 587,054 - -

Total non-current

assets 1,379,157 802,589 834,944

Current assets

Trade and other receivables 2,724,631 1,577,091 720,547

Derivative financial

asset 4 2,556,565 - -

Cash and cash equivalents 661,009 833,388 3,294,819

Total current assets 5,942,205 2,410,479 4,015,366

Current liabilities

Financial liabilities

- borrowings 134,435 163,070 295,634

Trade and other payables 767,163 1,078,640 243,464

Provisions - - 9,663

Total current liabilities 901,598 1,241,710 548,761

Net current assets 5,040,607 1,168,769 3,466,605

Non-current liabilities

Financial liabilities

- borrowings 263,664 280,951 317,696

Net assets 6,156,100 1,690,407 3,983,853

EQUITY

Ordinary shares 12,178,122 8,862,246 8,862,246

Share premium 15,148,894 10,490,920 10,490,920

Merger reserve 106,148 106,148 106,148

Other reserves (3,531,612) (3,764,673) (3,827,457)

Retained earnings (17,745,452) (14,004,234) (11,648,004)

Total equity 6,156,100 1,690,407 3,983,853

ImmuPharma plc

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 30 JUNE 2016

Other Other Other

Merger reserves - reserves reserves Retained

reserve Acquisition - - Earnings

reserve Translation Equity

Reserve shares

Share Share to be Total

capital premium issued equity

GBP GBP GBP GBP GBP GBP GBP GBP

At 1 January

2015 8,862,246 10,490,920 106,148 (3,541,203) (1,809,372) 1,703,380 (10,106,737) 5,705,382

Loss for the

financial

period - - - - - - (1,541,267) (1,541,267)

Exchange

differences

on

translation

of foreign

operations - - - - (180,262) - - (180,262)

At 30 June

2015 8,862,246 10,490,920 106,148 (3,541,203) (1,989,634) 1,703,380 (11,648,004) 3,983,853

At 1 January

2015 8,862,246 10,490,920 106,148 (3,541,203) (1,809,372) 1,703,380 (10,106,737) 5,705,382

Loss for the

financial

year - - - - - - (3,897,497) (3,897,497)

Exchange

differences

on

translation

of foreign

operations - - - - (117,478) - - (117,478)

At 31

December

2015 & 1

January

2016 8,862,246 10,490,920 106,148 (3,541,203) (1,926,850) 1,703,380 (14,004,234) 1,690,407

Loss for the

financial

period - - - - - - (3,741,218) (3,741,218)

Exchange

differences

on

translation

of foreign

operations - - - - 224,692 - - 224,692

New issue of

equity

capital 3,315,876 5,305,401 - - - - - 8,621,277

Costs of new

issue

of equity

capital - (647,427) - - - - - (647,427)

Share based

payments - - - - - 8,369 - 8,369

At 30 June

2016 12,178,122 15,148,894 106,148 (3,541,203) (1,702,158) 1,711,749 (17,745,452) 6,156,100

Attributable

to:-

Equity

holders

of the

parent

company 12,178,122 15,148,894 106,148 (3,541,203) (1,702,158) 1,711,749 (17,745,452) 6,156,100

ImmuPharma plc

CONSOLIDATED STATEMENT OF CASHFLOWS

FOR THE PERIOD ENDED 30 JUNE 2016

Note Unaudited Audited Unaudited

6 months Year 6 months

ended ended ended

30 June 31 December 30 June

2016 2015 2015

GBP GBP GBP

Cash flows from

operating activities

Cash used in operations 3 (4,484,973) (4,582,411) (2,329,728)

Tax 5,944 435,261 521,147

Interest paid (496) (1,208) (189)

Net cash used in

operating activities (4,479,525) (4,148,358) (1,808,770)

Investing activities

Purchase of property,

plant and equipment (3,404) (20,761) (12,838)

Interest received 362 11,541 3,179

Net cash used in

investing activities (3,042) (9,220) (9,659)

Financing activities

(Decrease)/increase

in bank overdraft (1,199) 879 (327)

Loan received - 22,130 21,180

Loan repayments (93,579) (333,135) (273,016)

Net proceeds from issue 4,024,620 -

of new equity capital -

Derivative repayments 309,650 -

received -

Net cash generated

from /(used in) financing

activities 4,239,492 (310,126) (252,163)

Net decrease in cash

and cash equivalents (243,075) (4,467,704) (2,070,592)

Cash and cash equivalents

at start of period 833,388 5,424,033 5,424,033

Effects of exchange

rates on cash and

cash equivalents 70,696 (122,941) (58,622)

Cash and cash equivalents

at end of period 661,009 833,388 3,294,819

ImmuPharma plc

NOTES TO THE INTERIM ACCOUNTS FOR THE PERIOD ENDED 30 JUNE

2016

1 ACCOUNTING POLICIES

Basis of preparation

The interim financial information in this report has been

prepared using accounting policies consistent with IFRS as adopted

by the European Union. IFRS is subject to amendment and

interpretation by the International Accounting Standards Board

(IASB) and the IFRS Interpretations Committee and there is an

ongoing process of review and endorsement by the European

Commission. The financial information has been prepared on the

basis of IFRS that the Directors expect to be adopted by the

European Union and applicable as at 31 December 2016. The Group has

chosen not to adopt IAS 34 "Interim Financial Statements" in

preparing the interim financial information.

The accounting policies applied are consistent with those that

were applied to the financial statements for the year ending 31

December 2015 with the addition of the following accounting policy

which has been adopted in respect of the derivative financial

asset:-

Valuation of Derivative Financial Asset

The Company has placed shares with Lanstead Capital LP and at

the same time entered into a sharing agreement. The amount

receivable each month, over an 18 month period will be dependent on

the Company's share price performance. At each period end the

amount receivable is restated to fair value. Any change in the fair

value of the derivative financial asset is reflected in the income

statement within finance costs.

Research and Development

Research and development expenses consist of costs directly

attributable to pharmaceutical research and development activities,

including administrative costs directly attributable to these

activities. During the year ended 31 December 2015, the Group

reviewed the classification of certain items of expenditure to

ensure that they had been classified in accordance with this

policy. The 6 months ended 30 June 2015 expenditure analysis has

been restated in order to present it on a consistent basis with

that applied in the year ended 31 December 2015.

Non-Statutory accounts

The financial information set out in this interim report does

not constitute the Group's statutory accounts. The statutory

accounts for the year ended 31 December 2015 have been delivered to

the Registrar of Companies. The auditors reported on those

accounts; their report was unqualified, did not contain a statement

under either Section 498 (2) or Section 498 (3) of the Companies

Act 2006 and did not include references to any matters to which the

auditor drew attention by way of emphasis. The financial

information for the 6 months ended 30 June 2016 and 30 June 2015 is

unaudited.

Copies of this statement will be available on the Company's

website - www.immupharma.com.

ImmuPharma plc

NOTES TO THE INTERIM ACCOUNTS FOR THE PERIOD ENDED 30 JUNE

2016

(continued)

2 LOSS PER SHARE

Unaudited Audited Unaudited

6 months Year 6 months

ended ended ended

30 June 31 December 30 June

2016 2015 2015

GBP GBP GBP

Loss

Loss for the purposes

of basic and diluted

loss per share being

net loss attributable

to equity shareholders (3,741,218) (3,897,497) (1,541,267)

Number of shares

Weighted average number

of ordinary shares for

the purposes of basic

loss per share 111,578,525 88,622,463 88,622,463

Basic loss per share (3.35)p (4.40)p (1.74)p

Diluted loss per share (3.35)p (4.40)p (1.74)p

There is no difference between basic loss per share and diluted

loss per share as the share options and warrants are

anti-dilutive.

ImmuPharma plc

NOTES TO THE INTERIM ACCOUNTS FOR THE PERIOD ENDED 30 JUNE

2016

(continued)

3 CASH USED IN OPERATIONS

Unaudited Audited Unaudited

6 months Year 6 months

ended ended ended

30 June 31 December 30 June

2016 2015 2015

GBP GBP GBP

Operating loss (3,239,547) (4,563,109) (1,537,274)

Depreciation & amortisation 59,058 121,748 62,521

Share based payments 8,369 - -

Increase in trade &

other receivables (915,358) (674,440) (484,482)

(Decrease)/increase

in trade & other payables (392,281) 552,556 (349,705)

Decrease in provisions - (23,468) (13,805)

(Gain)/loss on

foreign exchange (5,214) 4,302 (6,983)

Cash used in

operations (4,484,973) (4,582,411) (2,329,728)

4 DERIVATIVE FINANCIAL ASSET

In February 2016, as part of a placing that

raised, in aggregate, GBP8.4 million (before

expenses) from new and existing shareholders,

the Company issued 17,021,277 new ordinary

shares to Lanstead Capital LP at a price of

26p per share for GBP4.4 million. All of the

shares were allotted to Lanstead with full

voting rights at that date. The Company simultaneously

entered into a sharing agreement with Lanstead

with a reference price of 34.6667p per share.

The sharing agreement is for an 18 month period.

The actual consideration is variable depending

upon the Company's share price. The agreement

is treated as a derivative financial asset

and valued at fair value through the income

statement with reference to the Company's

share price.

Of the subscription proceeds of GBP4.4 million

received from Lanstead, GBP3.76 million (85%)

was invested by the Company in the sharing

agreement and will be received in monthly

instalments over the life of the agreement.

The remaining GBP663,820 (15%) was available

for immediate working capital purposes.

The Company also issued, in aggregate, a further

851,064 new ordinary shares to Lanstead as

a value payment in connection with the agreement.

At the end of the accounting period the amount

receivable is restated to fair value based

upon the share price of the Company at that

date. Any change in the fair value of the

derivative financial asset is reflected in

the income statement.

5 SUBSEQUENT EVENTS

There were no events subsequent to 30 June

2016.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLMATMBMTBLF

(END) Dow Jones Newswires

September 30, 2016 02:00 ET (06:00 GMT)

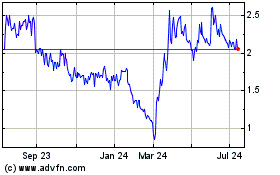

Immupharma (LSE:IMM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Immupharma (LSE:IMM)

Historical Stock Chart

From Apr 2023 to Apr 2024