Icahn May Seek Xerox Board Seats

November 23 2015 - 9:30PM

Dow Jones News

Xerox Corp. has struggled for years with shrinking sales of

printers and copiers. Now the 109-year-old company has a new

challenge: Activist investor Carl Icahn has taken a big stake and

is trying to shake things up.

Mr. Icahn disclosed Monday that he has accumulated a 7.1% stake

in Xerox, saying the company is undervalued and he may seek board

seats. Xerox shares, which had fallen 22% so far this year as of

Monday's close, rose 7.4% in after-hours trading to $11.69.

Mr. Icahn's disclosure comes a month after Xerox said it would

launch a review of its business. After posting its first quarterly

loss since 2010, the company's chief executive, Ursula Burns, said

on Oct. 26 that "undertaking a comprehensive review of structural

options for the company's portfolio is the right decision at this

time."

Xerox spokesman Sean Collins said Monday that the company

welcomed open and constructive dialogue with shareholders. "Our

board and management team are committed to improving performance

and creating value for shareholders and will continue to take the

actions to advance these objectives," he said.

Despite several initiatives aimed at moving beyond its

traditional office equipment roots, Xerox's revenue has been

shrinking for years. The company, which had nearly $20 billion in

revenue last year, ended Monday with a market value of about $10.6

billion.

Ms. Burns, a Xerox veteran who has run the company since 2009,

has tried to transition into a services-based business that handles

the back-office operations for companies and governments. Document

management, bill processing and other services made up 56% of the

company's top line during the nine months through Sept. 30.

Her boldest move was the $6.4 billion acquisition of Affiliated

Computer Services, which had a big business providing work for

state Medicare and Medicaid agencies. The deal added about 74,000

people to Xerox's then-workforce of about 54,000.

Mr. Icahn's stake would make the activist hedge-fund manager,

who has also agitated for shake-ups from Clorox Co. to eBay Inc.,

the second-biggest holder of Xerox shares behind institutional

holder Vanguard Group Inc., according to FactSet data.

Mr. Icahn said in a securities filing that he intends to hold

talks with Xerox's management and board concerning "improving

operational performance and pursuing strategic alternatives, as

well as the possibility of board representation."

Drew FitzGerald and David Benoit contributed to this

article.

Write to Josh Beckerman at josh.beckerman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 23, 2015 21:15 ET (02:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

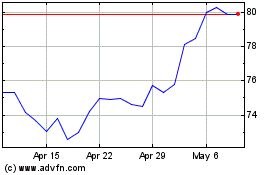

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

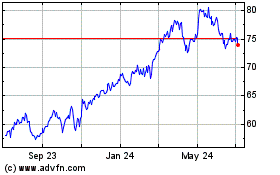

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024