ITV Bid Rejected by Peppa Pig-Owner Entertainment One

August 10 2016 - 6:10AM

Dow Jones News

LONDON—Canadian film and television producer and distributor

Entertainment One Ltd., the owner of children's cartoon series

Peppa Pig, Wednesday said it rejected a $1.3 billion offer from

U.K. broadcaster ITV PLC.

The company said it received an offer of 236 pence a share,

which would value it at around £ 1 billion ($1.3 billion), but

"rejected it on the basis that it fundamentally undervalues the

company and its prospects." It later clarified that the offer was

from ITV. The U.K. company—Britain's largest terrestrial

broadcaster by sales—wasn't immediately available for comment.

Shares in Entertainment One, which is listed in London, were up

5.6% on Wednesday morning, valuing it at £ 983.3 million. ITV

shares ticked up less than 1%.

A deal between the companies would have helped ITV diversify its

business away from advertising revenue amid concerns of a slowdown

in the U.K. as media operators are forced to cut spending to offset

the economic fallout of the Brexit vote.

Although ITV indicated last month that it hadn't suffered a

drop-off in advertising following the Brexit vote, it still aims to

cut costs by £ 25 million across its operations, including possible

job losses, in 2017, with ITV Chief Executive Adam Crozier citing

"wider economic uncertainty."

ITV generated net advertising revenue of £ 838 million for the

first six months of the year, flat compared with the year-earlier

period as advertisers—around February, when the U.K. vote date was

announced—started to pull back from business amid concerns over a

slowdown in consumer spending. ITV's overall net profit fell to £

243 million from £ 257 million.

Still, ITV's production arm showed strong growth, as

year-over-year revenue increased 31%. That gain highlights the

broadcaster's interest in Entertainment One as part of its stated

goal of building a "global production business of scale."

In recent years, ITV has gone on a run of snapping up production

companies across the world, including in the U.S., to boost its

expanding production arm ITV Studios—its stellar-performing

business that is driving the company's top line.

It is also eager to gain an edge in the U.K.'s competitive

broadcasting market, which has been shaken up in recent years by

telecommunications firms like BT Group PLC entering pay-television,

as well as over-the-top streaming platforms like Netflix Inc.

By acquiring Entertainment One, ITV would have gained access to

an owner and distributor of 40,000 television and film titles,

including Grey's Anatomy, through its stake in Mark Gordon Co., and

the film release this year of "The BFG" in partnership with Amblin

Partners. Entertainment One's content library also includes 4,500

hours of television programming and 45,000 music tracks, according

to the company's website.

Analysts at Liberum said Entertainment One's rejection of the

offer isn't surprising given that its largest shareholder, the

Canada Pension Plan Investment Board, bought most of its 19.7%

stake at 269 pence a share. But ITV may balk at making an offer in

excess of 300 pence a share as such a move could hinder its ability

to pay a special dividend, they added.

Rory Gallivan and Simon Zekaria contributed to this article.

Write to Ben Dummett at ben.dummett@wsj.com and Jacquie McNish

at Jacquie.McNish@wsj.com

(END) Dow Jones Newswires

August 10, 2016 05:55 ET (09:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

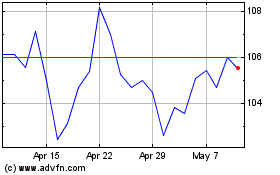

Bt (LSE:BT.A)

Historical Stock Chart

From Mar 2024 to Apr 2024

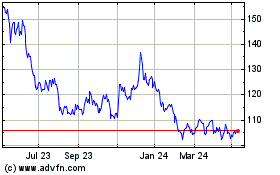

Bt (LSE:BT.A)

Historical Stock Chart

From Apr 2023 to Apr 2024