ING Profit Lifted as Bad Loans Fall --Update

November 04 2015 - 9:39AM

Dow Jones News

By Maarten van Tartwijk

AMSTERDAM--Dutch lender ING Groep NV on Wednesday posted a

bigger than-expected rise in third-quarter net profit, as its

retail bank benefited from a drop in loan-loss provisions in the

Netherlands.

ING, the Netherlands' largest bank by assets, said net profit

rose 15% to EUR1.06 billion ($1.49 billion) in the period.

Underlying pretax profit, which strips out divestments and other

special items, rose 1% to EUR1.5 billion. The results beat

analysts' expectations and ING shares traded 4% higher at EUR13.67

in Amsterdam in early afternoon trade.

The results came as many large European banks are rethinking

their business strategy in response to stricter regulation and

declining profits. For ING, the need for a sweeping overhaul

appears less acute after it completed a restructuring triggered by

its government bailout during the financial crisis of 2008.

Chief Executive Ralph Hamers said ING is now one of the better

performing banks in Europe, and noted that "some colleagues" have

yet to start restructuring. "We are delivering a return-on-equity

that other banks are only talking about," he said. In recent years,

ING has shed dozens of assets and thousands of jobs and

repositioned itself as a European consumer and business lender that

seeks to grow through expanding its digital offerings.

ING said its third-quarter results were boosted by an improved

performance of its retail bank. The division, which now forms the

core of the company, reported an underlying pretax profit of EUR1.1

billion, a 10% rise compared with last year, driven by a drop in

loan-loss provisions in the Netherlands. It helped to offset a

weaker performance of the commercial bank, which saw profit fall by

23% to EUR527 million.

Mr. Hamers said the Dutch economy is getting back in shape

following a lengthy crisis in 2012 and 2013. "The outlook is pretty

strong, with the housing market up and disposable incomes rising.

It looks like we've turned the corner," he said.

Mr. Hamers, however, warned that banks are increasingly being

squeezed by stiffer regulatory requirements put forward by various

international bodies such as the European Central Bank and the

Basel Committee of Banking Supervision. "All these initiatives have

the right intention, but there is absolutely no coordination. This

could have a detrimental effect on the economic recovery."

Regulatory expenses are increasingly weighing on the bank's cost

base. ING said the expenses will amount to EUR650 million in 2015,

up from EUR408 million in 2014 and EUR374 million in 2013.

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 04, 2015 09:24 ET (14:24 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

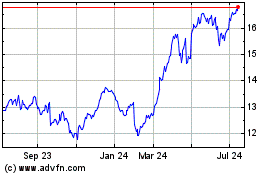

ING Groep NV (EU:INGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

ING Groep NV (EU:INGA)

Historical Stock Chart

From Apr 2023 to Apr 2024