IHeartMedia Wins Legal Fight With Lenders

May 24 2016 - 2:20PM

Dow Jones News

IHeartMedia Inc. secured a victory Tuesday against a group of

lenders that had tried to declare an event of default on billions

of dollars of the radio giant's debt.

A judge in the State District Court of Bexar County, Texas,

ruled a stock transfer made by the company, formerly known as Clear

Channel, last year was a permitted investment under the terms of

its loan agreements, the company said Tuesday

IHeartMedia had brought the Texas lawsuit in March, which put

the brakes on claims by a group of lenders, holding more than $3

billion in debt, that an equity transfer violated the terms of

their indentures and triggered a default.

With the court victory in hand, iHeart said it would continue

"to evaluate opportunities" to strengthen its balance sheet and

"looks forward to constructive discussions with our lenders" as we

continue to position iHeartMedia for long-term growth."

The group of lenders and bondholders that declared the event of

default—which includes a number of private-equity funds like

Benefit Street Partners LLC and Canyon Capital Advisors LLC as well

as investment firm giant Franklin Resources Inc.—didn't immediately

comment Tuesday.

Negotiations between the parties had been ongoing since December

when the lenders first wrote to iHeart about the transaction, but

broke down in March, resulting in the alleged events of default and

lawsuit.

At issue in the Texas litigation was whether the transfer of

shares that the lenders say are worth $1.241 billion is permitted

under the terms of the loan agreements.

The lenders argued in court documents that iHeart "gave away"

the shares, which were part of the package securing their debt,

when the company transferred them from its Clear Channel Outdoor

subsidiary to an unrestricted subsidiary called Broader Media LLC

and received nothing in return.

IHeart disputed that it violated the indenture. The company says

that the transfer of shares to Broader Media LLC was a permitted

investment that "fully complied with our financing agreement."

The ruling in Texas comes as iHeartMedia begins to grapple with

ways to address its massive debt load that totals $20.6 billion,

including $8.3 billion maturing in 2019. The debt load largely

stems from a 2006 leveraged buyout led by Bain Capital Partners LLC

and Thomas H. Lee Partners LP.

IHeartMedia, known as Clear Channel until 2014, owns more than

850 radio stations and billboards used for outdoor advertising.

Write to Stephanie Gleason at stephanie.gleason@wsj.com

(END) Dow Jones Newswires

May 24, 2016 14:05 ET (18:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

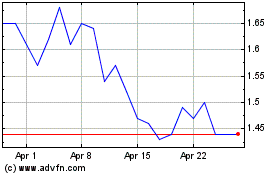

Clear Channel Outdoor (NYSE:CCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

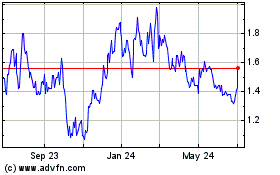

Clear Channel Outdoor (NYSE:CCO)

Historical Stock Chart

From Apr 2023 to Apr 2024