IEX Looks to Snatch NYSE, Nasdaq Listings With New Hire

November 14 2016 - 6:06PM

Dow Jones News

By Alexander Osipovich

IEX Group Inc., made famous by Michael Lewis's "Flash Boys," has

hired a Wall Street veteran to bolster its efforts to convince

companies to ditch the New York Stock Exchange and Nasdaq Inc. and

list on the upstart exchange.

Sara Furber, who was previously a managing director at Morgan

Stanley, has joined IEX as its head of listings, the exchange said

Monday. She reports to IEX chief executive Brad Katsuyama.

IEX aims to start listing companies in 2017. The exchange, which

designed its fee structure and technology to thwart aggressive

high-frequency trading strategies, is leveraging its image as an

investor-friendly marketplace to attract listings -- a lucrative

business for NYSE and Nasdaq.

At least 10 companies, including some members of the S&P

500, have expressed interest in switching to IEX since the new

exchange began soliciting listings earlier this year, according to

a person familiar with the situation.

One of those is Wynn Resorts Ltd., the Nevada-based hotel and

casino developer. Its billionaire chairman and chief executive

Steve Wynn is an investor in IEX and a vocal supporter of its

campaign against high-frequency traders.

"High-frequency traders taking advantage of real investors can't

be good for our company or any publicly traded company," Mr. Wynn

said in a statement emailed to The Wall Street Journal.

"I would consider listing our company with IEX as soon as they

are able to do so," added Mr. Wynn, whose company is currently

listed on Nasdaq.

Listings would provide a vital new stream of revenues for IEX,

which currently has under 2% of market share in U.S. stocks

trading. IEX has only been operating as a full-fledged stock

exchange since August, after winning approval from the Securities

and Exchange Commission in June.

NYSE and Nasdaq have traditionally been the go-to destination

for high-profile corporate listings. Firms that have initial public

offerings on NYSE often celebrate by ringing the opening bell on

the exchange's historic trading floor in lower Manhattan. Nasdaq,

meanwhile, developed a reputation as the favored exchange for

technology companies going public.

The parent company of NYSE, Intercontinental Exchange Inc.,

earned $405 million from its listings business last year, while

Nasdaq Inc.'s listings-related revenues were $264 million.

The other major operator of U.S. stock exchanges, Bats Global

Markets Inc., also runs a listings business but focuses on

exchange-traded funds rather than corporate issuers.

Ms. Furber was previously a member of Morgan Stanley's

management committee and responsible for digital innovation for the

wealth management group, according to the IEX press release. She

also served as the chief operating officer of both Morgan Stanley

Wealth Management and the firm's investment management's long-only

business.

Other Wall Street veterans are helping IEX attract issuers. In

addition to Ms. Furber, IEX has hired two former managing directors

of NYSE, Suzette Crivaro and John Longobardi, to develop its

listings business.

Listing on IEX is a way "for companies to demonstrate alignment

with their shareholders," Mr. Katsuyama said in the press

release.

Write to Alexander Osipovich at

alexander.osipovich@dowjones.com

(END) Dow Jones Newswires

November 14, 2016 17:51 ET (22:51 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

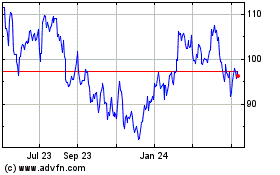

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Wynn Resorts (NASDAQ:WYNN)

Historical Stock Chart

From Apr 2023 to Apr 2024