ICE to Supervise LBMA Silver Price Benchmark

July 14 2017 - 2:29PM

Dow Jones News

By Alexander Osipovich

Intercontinental Exchange Inc. will take over supervision of a

key measure of silver prices, adding a new prize to the family of

benchmarks run by the New York-based exchange operator.

ICE and the London Bullion Market Association said Friday that

ICE, beginning in the fall, would begin running the daily

electronic auctions that determine the LBMA Silver Price. CME Group

Inc. and Thomson Reuters Corp. have jointly run the benchmark since

2014.

Formerly known as the silver fix, the benchmark is used by

miners, precious metal refiners and commodity traders as a

reference price in physical supply contracts. It's similar to the

LBMA Gold Price, the former gold fix, which ICE has run since 2015.

The two measures also set the price of some derivatives contracts

and exchange-traded funds.

Until several years ago, both the gold and silver fixes were set

in daily conference calls held by a small number of bullion-trading

banks. But the decades-old process was dropped in favor of

electronic auctions after it came under regulatory scrutiny. The

Wall Street Journal reported in 2015 that U.S. officials were

investigating at least 10 major banks over the possible rigging of

precious metals markets.

Benchmarks set by groups of large banks came under scrutiny

after a scandal erupted five years ago over the London interbank

offered rate, or Libor, a reference rate that sets the price for

trillions of dollars of derivatives contracts and borrowings

world-wide.

Deutsche Bank AG, UBS Group AG and half a dozen other financial

institutions have collectively paid billions of dollars over

allegations that they manipulated Libor or related interest-rate

benchmarks. Deutsche Bank and UBS both entered guilty pleas over

their roles.

ICE, the owner of the New York Stock Exchange, has emerged as a

main beneficiary of the push to clean up critical benchmarks. In

2014, it replaced the British Bankers' Association as the

administrator of Libor, and it took over another troubled

interest-rate benchmark, ISDAfix, now called ICE Swap Rate.

The LBMA is an industry group that represents a variety of

bullion market players, including central banks and gold miners,

and which owns the intellectual property rights to the gold and

silver benchmarks. It had been looking for a new administrator for

its silver price since CME and Thomson Reuters said earlier this

year they would quit running it, citing new European regulations on

benchmark regulation to take effect in 2018.

ICE beat out the London Metal Exchange, owned by Hong Kong

Exchanges & Clearing Ltd., which had also been seeking to run

the LBMA's silver benchmark, a person familiar with the situation

said.

ICE Benchmark Administration, the unit that will handle the

silver price, makes money by collecting a slice of the licensing

fees paid by firms that use its gold and interest-rate benchmarks

for their own products and activities.

Write to Alexander Osipovich at

alexander.osipovich@dowjones.com

(END) Dow Jones Newswires

July 14, 2017 14:14 ET (18:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

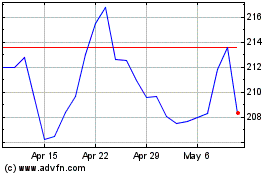

CME (NASDAQ:CME)

Historical Stock Chart

From Mar 2024 to Apr 2024

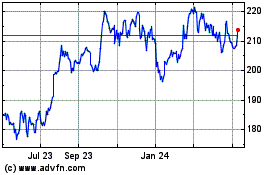

CME (NASDAQ:CME)

Historical Stock Chart

From Apr 2023 to Apr 2024