ICBC Standard Bank Gets OK to Operate as U.S.-Registered Swap Dealer

May 27 2016 - 5:50PM

Dow Jones News

ICBC Standard Bank PLC has become the first Chinese bank to

operate as a U.S.-registered swap dealer, its latest international

expansion effort.

The bank said Friday that it had received approval from the

Commodity Futures Trading Commission to be a "provisionally

registered swap dealer," a role that would allow the bank to offer

over-the-counter derivatives to U.S. clients.

A swap dealer acts as a market maker in the swap market, often

by entering into swap agreements with counterparts. The market has

come under heightened scrutiny after the financial crisis.

ICBC Standard, which is 60% owned by the Industrial and

Commercial Bank of China Ltd., will be the latest to join the 106

financial institutions that were designated by the CFTC as swap

dealers as of May 10.

In a statement, Marc van der Spuy, chief executive of ICBC

Standard, said "this swap dealer designation is crucial" for its

growth in the U.S.

The bank was founded in February 2015 after ICBC, the world's

largest bank by assets, acquired a stake in Standard Bank's

London-based Global Markets business.

Earlier this month, ICBC Standard agreed to buy one of Europe's

largest vaults from Barclays PLC, in a move to push into the

business of precious-metal clearing and trading.

Write to Carolyn Cui at carolyn.cui@wsj.com

(END) Dow Jones Newswires

May 27, 2016 17:35 ET (21:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

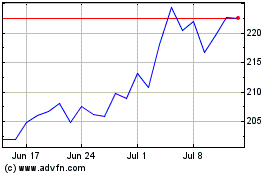

Barclays (LSE:BARC)

Historical Stock Chart

From Mar 2024 to Apr 2024

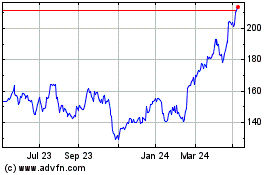

Barclays (LSE:BARC)

Historical Stock Chart

From Apr 2023 to Apr 2024