IBM Sales Drop Amid Some Gains -- WSJ

July 19 2016 - 3:03AM

Dow Jones News

By Rachael King

International Business Machines Corp. sales continued to decline

in its most recent quarter, even as it made gains in strategic

areas, such as cloud computing and data analytics.

The Armonk, N.Y., company on Monday reported that its revenue

for the second quarter dropped 2.8% to $20.24 billion, as its

established businesses continue lose ground to cloud computing

services delivered over the internet. The company has posted

revenue declines for 17 straight quarters.

Nonetheless, revenue was better than analysts' expectation of

$20.03 billion, according to Thomson Reuters. The bottom line also

fell compared with one year earlier, but exceeded expectations. IBM

shares climbed 2.6% to $164 after hours.

The company reaffirmed its guidance of full-year earnings per

share of $13.50. Analysts had expressed concern that the forecast

might decline due to economic uncertainty surrounding the U.K.'s

decision in June to leave the European Union.

"Brexit didn't help, but from everything we've seen we haven't

changed our view," Martin Schroeter, IBM's chief financial officer,

said in an interview.

The computing giant said earnings fell to $2.5 billion, or $2.61

a share, from $3.45 billion, or $3.50 a share, one year

earlier.

In January, IBM had lowered guidance for the year and Mr.

Schroeter said earnings were in line with that projection. Still,

the most recent quarter marked the eighth quarter of lower core

earnings per share in the past 10 quarters, reflecting IBM's

struggle to build new businesses as older ones shrink. Before 2014,

the company hadn't posted a profit decline since 2003.

IBM said its revenue from cloud services grew 30% to $3.4

billion during the quarter. Those services include SoftLayer, which

sells access to computing capacity over the internet, and Bluemix,

which, among other capabilities, sells access to software over the

web. The cloud business during the quarter added new customers,

including Pratt & Whitney, Halliburton Co. and Kaiser

Permanente.

The company also is starting to see new revenue from the

billions of dollars it spent on acquisitions in the past year. IBM

closed acquisitions of 11 companies in areas such as data

analytics, cloud and security. Those deals include Truven Health

Analytics Inc., cloud-based video services firm Ustream Inc. and

Weather Co.

While the company has seen pockets of growth in what it calls

its "strategic imperatives -- cloud computing, artificial

intelligence, data analytics, mobile, social and security -- some

analysts said they won't be convinced of the company's successful

transition from waning older businesses until they see revenue

growth across the board.

"Despite the fact that revenues for these strategic imperatives

over the past four to five years have really been growing well, and

have been becoming a bigger part of the mix, the growth rate of the

company in terms of revenue has actually been flat to down," Toni

Sacconaghi, an analyst at Sanford C. Bernstein & Co. said in an

interview before Monday's earnings disclosure.

IBM's path to new businesses has been challenging. The laid off

tens of thousands of employees over the past year, even as it has

hired tens of thousands of new employees in these new businesses.

IBM says that its strategic imperative businesses grew by 12% to

$8.3 billion for the quarter. These businesses in the past year

logged revenue of $30.7 billion, making up 38% of the top line.

IBM shares have dropped by 17% since Chief Executive Virginia

Rometty took over in January 2012. The S&P 500 index rose 70%

during the same period.

Write to Rachael King at rachael.king@wsj.com

(END) Dow Jones Newswires

July 19, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

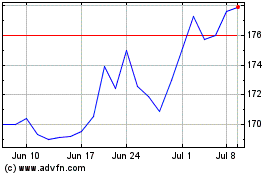

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

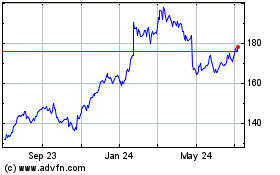

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024