IBM Revenue Declines Again -- WSJ

January 20 2017 - 3:03AM

Dow Jones News

By Ted Greenwald

International Business Machines Corp. recorded its 19th

consecutive quarter of declining revenue, as it continued to try to

offset declines in older businesses with sales in newer ones that

are growing rapidly.

Fourth-quarter revenue at the Armonk, N.Y., computing giant slid

1% from the year-earlier period to $21.8 billion. Net profit edged

up nearly 1% to $4.5 billion, though that still left profit 11%

lower for the full year, at $11.9 billion.

Chief Financial Officer Martin Schroeter emphasized that annual

revenue in IBM's newer, faster-growing businesses rose 14% and now

makes up 41% of total sales -- ahead of the company's earlier

forecast that nascent businesses would contribute 40% by 2018.

"We feel pretty good about how we're entering 2017 stronger than

we entered 2016," he said in an interview.

Like other older companies that sell information technology to

corporate buyers, IBM is struggling to cope with the move to cloud

computing. That trend shifts customer spending from vendors who

equip private corporate facilities to those who offer subscriptions

to services delivered through the internet, such as Amazon.com

Inc.'s Amazon Web Services for computing power and Salesforce.com

Inc. for business apps.

Big Blue's chief executive, Ginni Rometty, has responded by

jettisoning low-growth, low-margin businesses and revamping its

remaining core assets to emphasize ones that she calls strategic

imperatives. Foremost among these are IBM's own cloud-computing

operations and Watson, its artificial-intelligence platform.

The transition has yet to rekindle growth for the company

overall, however. IBM's full-year revenue has declined for five

years, its pretax income has fallen for four, and its non-adjusted

earnings per share has slid for three.

IBM has said its strategic-imperative businesses have been

growing at double-digit percentages, while older, slower businesses

have been declining annually by percentages in the low teens,

according to analysts.

Investors recently have shown optimism that IBM's transition is

on track. The share price suffered in the years between 2013 and

2016, but during the past year rebounded more than 20%. Its share

price rose to 11.8 times expected earnings per share from 9.1

during the period, exceeding that of Hewlett Packard Enterprise Co.

and approaching that of Oracle Corp., two other big, mature IT

companies.

IBM "took their medicine upfront by divesting of the right

things and investing in the right things," said Patrick Moorhead,

an analyst with Moor Insights & Strategy.

Still, IBM shares slid about 2% in after-hours trading on

Thursday following the earnings release, after ending roughly flat

in 4 p.m. trading on the New York Stock Exchange. That occurred

even though IBM's adjusted quarterly earnings of $5.01 per share

exceeded its own and analysts' forecasts.

Some analysts expect the contribution of strategic initiatives

to total revenue to reach 50% in the second half of this year,

which would mark a milestone in the turnaround Ms. Rometty has

sought since taking her post in late 2012.

IBM has been working feverishly to build these new businesses,

especially Watson, which offers of commands and functions that

software developers can use to stitch artificial intelligence into

their programs.

Watson, led the way to the current era of

artificial-intelligence in which it is a focus of many big tech

companies. IBM has built out its platform to include AI as a

service, tools for build-it-yourself intelligent apps, and

specialized AI applications in industries including health care,

finance, insurance, and automotive.

IBM doesn't disclose revenue from Watson-branded operations, but

Ms. Rometty has forecast that the multifaceted

artificial-intelligence technology would have 1 billion users by

the end of 2017.

Even if revenue from new businesses overtakes that from the old,

core revenue, profit growth might remain elusive. Some analysts are

concerned that the new businesses are cannibalizing older

businesses, accelerating their decline.

Credit Suisse analysts in a recent research note wrote, "The

concern we have is the faster [revenue from strategic initiatives]

grows, the quicker Core declines."

Write to Ted Greenwald at Ted.Greenwald@wsj.com

(END) Dow Jones Newswires

January 20, 2017 02:48 ET (07:48 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

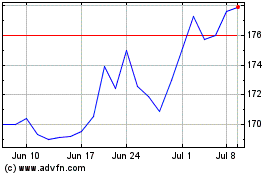

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

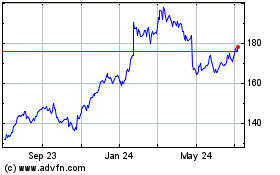

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024