IBM Plans to Buy Promontory Financial Group

September 29 2016 - 1:40PM

Dow Jones News

International Business Machines Corp. plans to purchase

consultancy Promontory Financial Group LLC, the two companies said

Thursday, creating a new IBM offering called Watson Financial

Services.

The companies didn't disclose financial details of the deal,

which they said is subject to regulatory approvals and expected to

close by the end of the year. The idea, they said, is to combine

Promontory's financial regulatory expertise with Watson, IBM's

artificial intelligence computer system, to help banks meet

ever-rising regulatory expectations in areas such as

anti-money-laundering detection systems, consumer complaint

databases and so-called stress tests.

Financial regulatory requirements are "rapidly outstripping the

capacity of humans to keep up," a joint press release from the

companies said.

Privately held Promontory was founded in 2001 by Eugene Ludwig,

a former U.S. Comptroller of the Currency, and has hired a small

army of former senior regulators and government officials to advise

financial firms. It now has about 600 full-time employees and 19

offices, 14 outside the U.S. Promontory will keep its name and will

become an IBM subsidiary.

Banks and government agencies use Promontory as an adviser, but

also as a sort of outsourced regulator, which sometimes performs

jobs the government doesn't have the resources to do. For example,

regulators might hire Promontory to monitor a financial firm's

compliance with the terms of a settlement.

At times, the business has drawn controversy, with Promontory

facing accusations it is too close to financial firms. In August

2015, Promontory agreed to pay $15 million to settle allegations by

the New York Department of Financial Services that it watered down

reports about potential sanctions violations by Standard Chartered

PLC, the bank that had engaged the consultancy on an internal

review of its compliance.

The department accused Promontory of exhibiting "a lack of

independent judgment in the preparation and submission of certain

reports" from 2010 to 2011. Promontory admitted it didn't meet

certain standards.

Promontory previously took heat when regulators tapped it to

search for errors in mortgage foreclosures at big banks after the

financial crisis. It was paid more than $900 million for the work,

it disclosed in 2013, even as lawmakers and other critics said

wronged homeowners weren't being adequately compensated. The

company said at the time that it put in several million hours on

the project and stood by the quality of its work.

Promontory last year had briefly explored a sale to Boston

Consulting Group, according to a person briefed on the matter, but

both sides walked away. David Fondiller, a spokesman for BCG, had

no immediate comment.

Promontory spokesman Todd Davenport said the company "has

regularly received indications of interest and has on occasion

discussed potential strategic opportunities with various entities."

He said the company didn't proceed "until IBM approached us with a

transformational opportunity that stands to benefit our clients,

their customers and the financial system."

Mr. Ludwig, in an interview, said discussions with IBM had been

going on for about the past six months. "To get (regulatory

compliance) right for large institutions takes tremendous computing

power, but it also takes domain expertise" that Promontory has in

the regulatory space, he said.

Watson Financial Services will be part of IBM's Industry

Platforms unit, IBM Senior Vice President Bridget van Kralingen

said. IBM has run technology systems for financial institutions for

decades, but the acquisition announced Thursday represents a new

foray into regulatory compliance work.

Ms. Van Kralingen said the increasingly data-driven world of

financial regulation was a logical expansion of the Watson

cognitive computing technology, which the company is also applying

in cancer research and other areas.

"There is no way that professionals can keep up with critical

information growing at these rates," she said in an interview.

"Watson is going to learn…by continuously ingesting this regulatory

information as it is created."

One area where the companies expect Watson to help financial

firms is in anti-money-laundering compliance. Banks are expected to

track millions of customers and financial transactions, looking for

suspicious activity and reporting it to the government. If they

miss activity such as terrorism financing or sanctions evasion,

they can face multimillion-dollar or even billion- dollar

fines.

Promontory's experts and IBM's Watson team are looking to create

a smarter system for catching suspicious transactions and

customers, which then could be sold to banks, the two executives

said in the interview. Similar artificial intelligence could be

built to track banks' compliance with fair lending laws, model

financial risks in "stress tests," track customer complaints and

other areas.

Write to Ryan Tracy at ryan.tracy@wsj.com and Katy Burne at

katy.burne@wsj.com

(END) Dow Jones Newswires

September 29, 2016 13:25 ET (17:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

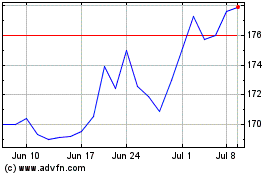

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

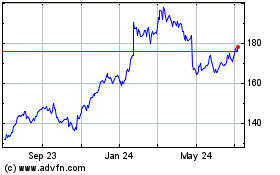

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024