IBC Reports Strong 2014 Earnings

August 11 2014 - 3:43PM

Business Wire

International Bancshares Corporation (NASDAQ: IBOC), one of the

largest independent bank holding companies in Texas, today reported

net income for the six months ended June 30, 2014 of $81.4

million, or $1.21 diluted earnings per common share and

$1.21 basic earnings per common share, compared to

$55.6 million or $.83 diluted earnings per common

share and $.83 basic earnings per common share for the same

period of 2013, representing an increase of 46 percent in

net income and 46 percent diluted earnings per common share.

Net income for the three months ended June 30, 2014 was

$37.7 million, or $.56 diluted earnings per common

share and $.56 basic earnings per common share, compared to

$27.5 million or $.41 diluted earnings per common

share and $.41 basic earnings per common share for the same

period in 2013, representing an increase of 37 percent in

net income and an increase of 37 percent in diluted earnings

per common share.

Net income for the three and six months ended June 30, 2014 was

positively impacted by an increase in the Company’s net interest

margin, as well as a 51% decrease in the provision for probable

loan losses for the six months ended June 30, 2014. The increase in

the net interest margin can be primarily attributed to increased

levels of interest income arising from the Company’s repositioning

of its investment portfolio in 2013, an increase in loans

outstanding, and a decrease in interest expense on securities sold

under repurchase agreements arising from the early termination of

some of the long-term repurchase agreements by the Company’s lead

bank subsidiary.

“I’m pleased with the Company’s earnings for the first six

months of 2014. The earnings continue to reflect the Company’s

commitment to superior earnings, especially in light of the

continued regulatory challenges facing the industry, as well as the

still unsettled economic environment in the U.S. The Company

continues to maintain strong liquidity, focused expense control,

sound credit underwriting standards and a healthy investment

strategy. We are confident in the strength of our balance sheet and

our strong capital position,” said Dennis E. Nixon, President and

CEO.

Total assets at June 30, 2014 were $12.4 billion compared

to $12.1 billion at December 31, 2013. Net loans were

$5.4 billion at June 30, 2014 compared to $5.1

billion at December 31, 2013. Deposits were $8.4

billion at June 30, 2014 and $8.2 billion at

December 31, 2013.

IBC is a multi-bank financial holding company headquartered in

Laredo, Texas, with 217 facilities and more than 315 ATMs serving

88 communities in Texas and Oklahoma.

“Safe Harbor” statement under the Private Securities Litigation

Reform Act of 1995: The statements contained in this release which

are not historical facts contain forward-looking information with

respect to future developments or events, expectations, plans,

projections or future performance of IBC and its subsidiaries, the

occurrence of which involve certain risks and uncertainties,

including those detailed in IBC’s filings with the Securities and

Exchange Commission.

Copies of IBC’s SEC filings and Annual Report (as an exhibit to

the 10-K) may be downloaded from the SEC filings site located at

http://www.sec.gov/edgar.shtml

International Bancshares CorporationJudith Wawroski,

956-722-7611First Vice President

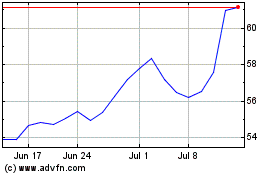

International Bancshares (NASDAQ:IBOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

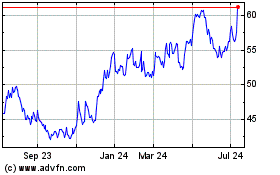

International Bancshares (NASDAQ:IBOC)

Historical Stock Chart

From Apr 2023 to Apr 2024