Huawei Technologies 2016 Net Profit Rises 0.4% to CNY37.1 Billion

March 30 2017 - 11:29PM

Dow Jones News

By Dan Strumpf

SHENZHEN, China--Huawei Technologies Co. said its profit growth

slowed last year as margins fell and it invested more money in its

consumer business.

The Chinese telecommunications company is the world's

third-largest smartphone maker by sales after Samsung Electronics

Co. and Apple Inc. It also is a major producer of wireless

equipment, competing with Ericsson and Nokia Corp.

Despite its large footprint globally, Huawei has only a small

presence in the U.S., where its networking equipment is effectively

locked out due to concerns that the equipment could be used by

Beijing to spy on Americans. The company has repeatedly denied the

accusations.

Huawei, founded by former Chinese army engineer Ren Zhengfei,

has still sought a foothold in the U.S. It has been stepping up

efforts to sell its phones in the country, and this year launched

its high-end Mate 9 smartphone there for the first time.

But cracking the American market is a challenge for Huawei

because it lacks partnerships with major carriers, which distribute

the vast majority of phones in the U.S. The Americas region

accounted for 8% of revenue last year, Huawei said Friday, while

China accounted for 45% and Europe, the Middle East and Africa made

up nearly a third.

The company said Friday its full-year net profit edged up 0.4%

to 37.1 billion yuan, or about $5.39 billion, from 36.9 billion

yuan in 2015. Revenue jumped 32% to 521.6 billion yuan, as all

three of its major business lines saw growth.

Revenue at Huawei's consumer business segment, which includes

its smartphone business, rose 44% to 179.8 billion yuan, accounting

for more than a third of all revenue.

The company shipped more than 139 million smartphones last

year.

"In 2016, Huawei maintained its strategic focus and achieved

solid growth," said Eric Xu, Huawei's current CEO.

A higher share of profits from its consumer business group and

increased investment in that area led to lower overall margins last

year, Huawei said. Its profit margin fell to 7.1% from 9.3% in

2015. The company says it doesn't pursue high profitability.

Huawei's biggest revenue generator remained its

networking-equipment business, where revenue rose 24%. Revenue in

its enterprise business division, which supplies internet

infrastructure such as data centers, rose 47%.

Write to Dan Strumpf at daniel.strumpf@wsj.com

(END) Dow Jones Newswires

March 30, 2017 23:14 ET (03:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

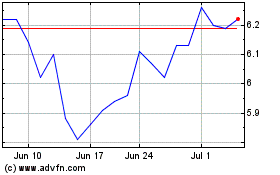

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

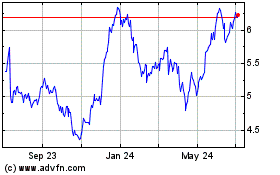

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Apr 2023 to Apr 2024