By Ryan Dezember and Corrie Driebusch

Home-improvement stocks are rising alongside booming U.S. house

prices and construction, making the shares a rare success story in

the depressed world of retailing.

Among the biggest gainers are big-box retailers Lowe's Cos. and

Home Depot Inc., which are up 20% and 16% this year, respectively.

Paint maker Sherwin-Williams Co. is up 24%, and tile and hardwood

retailer Floor & Decor Holdings Inc. last week rose 53% from

its initial public offering price on its first day of trading, the

largest IPO gain in 2017.

The S&P 500 is up 6.7% this year and the SPDR S&P Retail

exchange-traded fund, which doesn't include the home-improvement

chains, has lost 2.4%.

Behind the rally: rising home prices and booming construction,

as the housing market recovery from the 2008 crisis advances.

Rising home prices can give homeowners equity they tap to splurge

on cabinets, floors and appliances. Accelerating construction and

transactions can tempt sellers to spend on sprucing up properties,

while a shortage of new homes often prompts shoppers to renovate

instead of moving.

"We're finally at the stage of the housing recovery where

homeowners are taking on larger projects," said Brad Hunter, chief

economist with IAC's HomeAdvisor unit, which matches homeowners

with contractors and handymen. "Home improvement is the shining

star within retail."

Some on Wall Street believe the stocks will rise further. Credit

Suisse Group AG on Tuesday raised its price target for Lowe's

shares roughly 13% and those of Home Depot about 6%.

Both companies still have valuations below the S&P 500,

based on their price compared with their past 12 months of

earnings, according to FactSet.

Further gains are no sure thing. The shares could fall if home

buying and building fizzle, if, for instance, interest rates rise

faster than expected. Home-improvement firms also run the risk of

opening too many stores, something that has plagued retailers in

other segments.

Other U.S. retailers are closing stores at a record pace as

shoppers spend more of their money online. RadioShack Corp.,

Payless ShoeSource Inc., Hhgregg Inc. and J.C. Penney Co. are among

those that have announced closings.

Home-improvement retailers have proved resilient to the

migration to online shopping. For big-ticket items and major

renovations, like a revamped kitchen or new tile floors, customers

often prefer to see goods in person and may need help

installing.

"These are things that don't lend themselves to the internet,"

said Stifel analyst John Baugh, who estimates that home-improvement

retail sales rose 7% through March.

The good news for these firms is that the national

housing-market recovery continues to advance. In many markets home

prices have surpassed their 2006 peaks. Even those that haven't,

such as Cleveland and Chicago, have climbed more than 20% since

their 2012 lows, according to the S&P CoreLogic Case-Shiller

home price indexes.

Home equity, or a property's value minus mortgage debt, has more

than doubled since 2011, to roughly $13 trillion, according to a

CoreLogic analysis of federal data.

"If we see home price appreciation you can say that it's

creating wealth, " said Neal Austria, senior research analyst at

money manager ClearBridge Investments, which owns shares of Home

Depot and Lowe's.

Mr. Hunter of HomeAdvisor recently published a study that found

homeowners on average spent $5,157 on home repairs and renovations

during the 12 months that ended in February, up more than 50% from

the prior 12 months.

Home Depot has been opening new stores, and Floor & Decor

told investors it plans to add to its 72 locations at a clip of

about 20% a year, with a target of eventually reaching 400.

Analysts have warned in the past that rapidly expanding

home-improvement retailers risk running ahead of housing

development that could quickly ground to a halt.

Floor & Decor's same-store sales have grown by double-digit

percentages for eight consecutive years, fueling investor appetite

for its initial public offering last week.

Its shares priced at $21, above the high-end of its targeted

range, and have continued to climb, up 73% from its IPO price a

week ago, to $36.36.

At that price, Floor & Decor's private-equity owners Ares

Management LP, which owns more than half of its shares, and Freeman

Spogli & Co. are up more than eight times their 2010 purchase

of the retailer from other investors, according to a person

familiar with the matter. Neither firm sold shares in the

offering.

Write to Ryan Dezember at ryan.dezember@wsj.com and Corrie

Driebusch at corrie.driebusch@wsj.com

(END) Dow Jones Newswires

May 03, 2017 18:32 ET (22:32 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

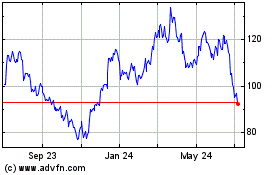

Floor and Decor (NYSE:FND)

Historical Stock Chart

From Mar 2024 to Apr 2024

Floor and Decor (NYSE:FND)

Historical Stock Chart

From Apr 2023 to Apr 2024