TIDMHOC

RNS Number : 4565E

Hochschild Mining PLC

04 November 2015

______________________________________________________________________________

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE,

DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA,

JAPAN, NEW ZEALAND, THE REPUBLIC OF SOUTH AFRICA, RUSSIA OR ANY

OTHER JURISDICTION IN WHICH THE PUBLICATION, DISTRIBUTION OR

RELEASE WOULD BE UNLAWFUL. OTHER RESTRICTIONS ARE APPLICABLE.

PLEASE SEE THE IMPORTANT NOTICE IN THIS ANNOUNCEMENT.

4 November 2015

Results of Rights Issue & Changes in Directors' Share

Interests

Hochschild Mining plc (the "Company") today announces that the 3

for 8 rights issue of 137,883,138 new Ordinary Shares in the

Company ("New Ordinary Shares") at 47 pence per New Ordinary Share

announced on 15 October 2015 (the "Rights Issue") closed for

acceptances at 11:00 a.m. (London time) on 3 November 2015. The

Company received valid acceptances in respect of 134,888,835 New

Ordinary Shares, representing approximately 97.83% of the total

number of New Ordinary Shares to be issued pursuant to the Rights

Issue.

It is expected that the New Ordinary Shares in uncertificated

form will be credited to CREST accounts as soon as practicable

after 8.00 a.m. on 4 November 2015 and that definitive share

certificates in respect of New Ordinary Shares in certificated form

will be dispatched to shareholders by no later than 11 November

2015.

The New Ordinary Shares are expected to commence trading, fully

paid, on the London Stock Exchange plc's main market for listed

securities later today.

In accordance with their obligations as Joint Bookrunners in

respect of the Rights Issue pursuant to an Underwriting Agreement

dated 15 October 2015, J.P. Morgan Cazenove, BofA Merrill Lynch and

RBC Capital Markets will endeavour to procure subscribers for the

remaining 2,994,303 New Ordinary Shares not validly taken up in the

Rights Issue, failing which J.P. Morgan Cazenove, BofA Merrill

Lynch and RBC Capital Markets as underwriters have agreed to

acquire, on a several basis, any remaining New Ordinary Shares.

The net proceeds from the placing of such New Ordinary Shares

(after the deduction of the Issue Price of 47 pence per New

Ordinary Share and the expenses of the Rights Issue) will be paid

(without interest) to those persons whose rights have lapsed in

accordance with the terms of the Rights Issue, pro rata to their

lapsed provisional allotments, save that individual amounts of less

than GBP5 will not be paid to such persons but will be paid to the

Company.

A further announcement as to the number of New Ordinary Shares

for which subscribers have been procured will be made in due

course.

The Company also announces pursuant to paragraph 3.1.4R of the

Disclosure and Transparency Rules that, on 3 November 2015, it was

notified of the acquisitions detailed below of New Ordinary Shares

by certain of its Directors or their connected persons pursuant to

the Rights Issue.

Director New Ordinary Shares Total beneficial

acquired pursuant holdings of Ordinary

to the Rights Issue Shares following

the Rights Issue

------------------- -------------------- ---------------------

Mr E Hochschild(1) 74,745,101 274,065,373

Mr R Danino 75,000 275,000

Mr I Bustamante 45,466 166,710

Mr M Field 5,356 19,641

Mr N Moore 18,750 68,750

Mr G Birch 3,750 13,750

------------------- -------------------- ---------------------

_________________________________________________________________________________

Enquiries:

Hochschild Mining plc

Charles Gordon

+44 (0)20 3714 9040

Head of Investor Relations

Sponsor and Joint Bookrunner

J.P. Morgan Cazenove

Ben Davies/Virginia Khoo/Laurene Danon +44 (0)207 742 4000

Joint Bookrunner

BofA Merrill Lynch

Omar Davis/Edward Peel/Matthew Blawat +44 (0)207 628 1000

Joint Bookrunner

RBC Capital Markets

Tristan Lovegrove/Duncan Smith/Ema Jakasovic +44 (0)207 653

4000

__________________________________________________________________________________

About Hochschild Mining plc

Hochschild Mining plc is a leading precious metals company

listed on the London Stock Exchange (HOCM.L / HOC LN) with a

primary focus on the exploration, mining, processing and sale of

silver and gold. Hochschild has over fifty years' experience in the

mining of precious metal epithermal vein deposits and currently

operates four underground epithermal vein mines, three located in

southern Peru and one in southern Argentina. Hochschild also has

numerous long-term projects throughout the Americas.

IMPORTANT NOTICE

This announcement is for information purposes only and is not

intended to and does not constitute or form part of any offer or

invitation to purchase or subscribe for, or any solicitation to

purchase or subscribe for, New Ordinary Shares or to take up any

entitlements to New Ordinary Shares in any jurisdiction. This

announcement cannot be relied upon for any investment contract or

decision.

The information contained in this announcement is not for

release, publication or distribution to persons in the United

States, Australia, Japan, New Zealand, the Republic of South Africa

or Russia or any other Excluded Territory and should not be

distributed, forwarded to or transmitted in or into any

jurisdiction where to do so might constitute a violation of the

securities laws or regulations of such jurisdiction. There will be

no public offer of New Ordinary Shares in the United States,

Australia, Japan, New Zealand, the Republic of South Africa or

Russia or any other Excluded Territory.

J.P. Morgan Securities plc (which conducts its UK investment

banking activities as J.P. Morgan Cazenove) ("J.P. Morgan

Cazenove"), Merrill Lynch International and RBC Europe Limited, who

are each authorised in the United Kingdom by the Prudential

Regulation Authority ("PRA") and are regulated in the United

Kingdom by the PRA and the Financial Conduct Authority ("FCA"), are

acting for the Company and no one else in connection with the

Rights Issue, and will not be responsible to anyone other than the

Company for providing the protections afforded to its clients or

for providing advice in relation to the Rights Issue or any matters

referred to in this announcement.

Apart from the responsibilities and liabilities, if any, which

may be imposed on J.P. Morgan Cazenove, Merrill Lynch International

and RBC Europe Limited by FSMA or the regulatory regime established

thereunder or otherwise under law, J.P. Morgan Cazenove, Merrill

Lynch International and RBC Europe Limited do not accept any

responsibility whatsoever for the contents of this announcement,

and no representation or warranty, express or implied, is made by

J.P. Morgan Cazenove, Merrill Lynch International or RBC Europe

Limited in relation to the contents of this announcement, including

its accuracy, completeness or verification or regarding the

legality of any investment in the New Ordinary Shares by any person

under the laws applicable to such person or for any other statement

made or purported to be made by it, or on its behalf, in connection

with the Company, the New Ordinary Shares, the Rights Issue, and

nothing in this announcement is, or shall be relied upon as, a

promise or representation in this respect, whether as to the past

or the future. To the fullest extent permissible J.P. Morgan

Cazenove, Merrill Lynch International and RBC Europe Limited

accordingly disclaim all and any responsibility or liability

whether arising in tort, contract or otherwise (save as referred to

above) which they might otherwise have in respect of this

announcement.

The distribution of this announcement into jurisdictions other

than the United Kingdom may be restricted by law, and, therefore,

persons into whose possession this announcement comes should inform

themselves about and observe any such restrictions. Any failure to

comply with any such restrictions may constitute a violation of the

securities laws of such jurisdiction. In particular, subject to

certain exceptions, this announcement should not be distributed,

forwarded or transmitted in or into the United States, Australia,

Japan, New Zealand, the Republic of South Africa or Russia or any

other Excluded Territory.

This announcement does not constitute or form part of an offer

or solicitation to purchase or subscribe for securities of the

Company in the United States, Australia, Japan, New Zealand, the

Republic of South Africa or Russia or any other Excluded Territory.

The New Ordinary Shares have not been and will not be registered

under the U.S. Securities Act of 1933, as amended (the "U.S.

Securities Act"), or under any securities laws of any state or

other jurisdiction of the United States and may not be offered,

sold, pledged, taken up, exercised, resold, renounced, transferred

or delivered, directly or indirectly, within the United States

except pursuant to an applicable exemption from, or in a

transaction not subject to, the registration requirements of the

U.S. Securities Act and in compliance with any applicable

securities laws of any state or other jurisdiction of the United

States. The New Ordinary Shares have not been approved or

disapproved by the SEC, any state securities commission in the

United States or any other U.S. regulatory authority, nor have any

of the foregoing authorities passed upon or endorsed the merits of

the offering of the New Ordinary Shares or the accuracy or adequacy

of the Prospectus. Any representation to the contrary is a criminal

offence in the United States.

(MORE TO FOLLOW) Dow Jones Newswires

November 04, 2015 02:00 ET (07:00 GMT)

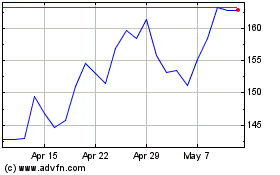

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Apr 2023 to Apr 2024