TIDMHOC

RNS Number : 3741M

Hochschild Mining PLC

20 January 2016

20 January 2016

Production Report for the 12 months ended 31 December 2015

Strong 2015 operational delivery

-- Full year production of 24.7 million attributable silver

equivalent ounces exceeding 24.0 million target(1)

o 14.8 million ounces of silver

o 166.0 thousand ounces of gold

o 27.0 million silver equivalent ounces using 2015 average

gold/silver ratio

-- Inmaculada mine produced 7.1 million silver equivalent ounces

exceeding 6-7 million ounce forecast1

o 84.6 thousand ounces of gold

o 2.1 million ounces of silver

o 8.3 million silver equivalent ounces using 2015 average

gold/silver ratio

-- 2015 all-in sustaining costs per silver equivalent ounce on

track to meet $13-14 guidance

Improved financial position

-- $100 million equity rights issue completed

-- $105 million of debt repaid in Q4

-- Total cash of approximately $83 million as at 31 December

2015

-- Net debt of approximately $366 million as at 31 December

2015

-- Argentina macroeconomic & tax reforms expected to

significantly improve San Jose cash flows

-- Cashflow further strengthened by 2016 precious metal

hedges:

o 71,000 ounces of gold at $1,154 per ounce

o 29,000 ounces of gold at $1,145 per ounce

o 6.0 million ounces of silver at $15.93 per ounce

2016 guidance

-- Attributable production target of 32.0 million silver

equivalent ounces

-- All-in sustaining costs expected to be $12-13 per silver

equivalent ounce

o Inmaculada costs expected to be $9-10 per silver equivalent

ounce

-- Total sustaining and development capital expenditure expected

to be approximately $100 million including $10 million to develop

Pablo vein

-- Pablo vein preliminary economics indicate:

o NAV of $25-50 million

o All in sustaining costs to average $10-11 per silver

equivalent ounce

_____________________

(1) Calculated using the previous Company gold/silver ratio of

60x. All other equivalent figures assume the average gold/silver

ratio for 2015 of 74x.

Ignacio Bustamante, Chief Executive Officer commented:

"The operational performance during 2015 exceeded expectations

as we once again beat our annual production target and are

maintaining our guidance on full year costs. The mines delivered a

very solid fourth quarter with our new low cost Inmaculada mine

performing particularly strongly. We are building on this positive

momentum by focusing on delivering low cost production from Pablo

which we expect will further demonstrate our brownfield potential

and ability to deliver strong cash flow generation from our

existing assets. In addition, the recent regulatory and economic

policy changes in Argentina offer a promising future for our high

grade San Jose mine which, supported by the solid operational

performance, is now in a good position to improve its cashflow

contribution.

We have also made substantial progress in strengthening our

balance sheet through our own cash generation and the rights issue

completed in the fourth quarter of last year. Following large debt

repayments in the period, we have ended the year with net debt

reduced by approximately 20% versus the half year position. The

maturities of the bulk of the remaining debt are also adequately

profiled.

We enter 2016 with a renewed sense of excitement: a fourth

consecutive year of production increases and reduced costs; a low

risk organic project; a stronger balance sheet; and several

brownfield exploration targets with the potential to continue

improving the quality and quantity of our existing resources."

__________________________________________________________________________________

A conference call will be held at 2.30pm (London time) on

Wednesday 20 January 2016 for analysts and investors.

Dial in details as follows:

International Dial in: +44 (0) 20 3139 4830

UK Toll-Free Number: +44(0) 808 237 0030

Pin: 47755168#

A recording of the conference call will be available for one

week following its conclusion, accessible from the following

telephone number:

International: +44 (0) 20 3426 2807

UK Toll Free: +44(0) 808 237 0026

Pin: 666619#

__________________________________________________________________________________

Note: silver/gold equivalent production figures assume the

average gold/silver ratio for 2015 of 74:1.

Overview

In Q4 2015, the Company delivered attributable production of 9.4

million silver equivalent ounces, comprised of 4.3 million ounces

of silver and 68.4 thousand ounces of gold. This has brought the

total for 2015 to 27.0 million silver equivalent ounces (24.7

million ounces using the Company's previous gold/silver ratio of

60:1), comprising 14.8 million ounces of silver and 166 thousand

ounces of gold.

The Company reiterates that its all-in sustaining costs per

silver equivalent ounce for 2015 is expected to be between $13 and

$14.

Production

Inmaculada

Following a successful ramp-up in the third quarter, total

silver equivalent production in Q4 at Inmaculada reached 4.4

million silver equivalent ounces consisting of 45.1 thousand ounces

of gold and 1.1 million ounces of silver, driven by consistent gold

and silver grades and increased tonnage as the processing plant

operated at closer to 3,850 tonnes per day in the period.

Production therefore in 2015 slightly improved on the targeted

range, coming in at 8.3 million silver equivalent ounces consisting

of 84.6 thousand ounces of gold and 2.1 million ounces of

silver.

Arcata

At Arcata, total silver equivalent production in Q4 was 1.8

million ounces (Q4 2014: 1.9 million ounces) which brought the

year-to-date total to 6.8 million ounces (2014: 7.1 million

ounces). Despite introducing an adjusted mine plan at the start of

2015 to ensure the extraction of profitable ounces, Arcata has

delivered a much stronger year than expected. A successful

brownfield exploration programme has ensured considerable tonnage

at higher silver grades than expected.

Pallancata

At Pallancata, tonnage in the fourth quarter was lower due to

ongoing effects of the above-mentioned adjusted mine plans

resulting in production of 1.1 million silver equivalent ounces (Q4

2014: 2.0 million ounces), although grades continued to be

consistent. The total for the year, at 4.9 million silver

equivalent ounces (2014: 8.3 million ounces), reflects the adjusted

mining plan with the Selene plant expected to transition to the new

Pablo vein later in 2016. See further details of the Pablo vein

below.

San Jose

The San Jose operation once again delivered a strong fourth

quarter, as expected, with rising tonnage and strong grades,

delivering 4.2 million silver equivalent ounces (Q4 2014: 4.0

million ounces). For the whole of 2015, the operation produced a

record 13.9 million silver equivalent ounces (2014: 13.4 million

ounces) driven by better than projected silver and gold grades.

On 17 December 2015, the Argentinean peso fell by approximately

40% against the dollar following the decision by the government to

lift capital controls. With approximately 70% of operating costs at

San Jose incurred in pesos, the effect of this significant

devaluation is already having a material impact on the mine's cost

position.

The Argentinean government published a decree on 2 November 2015

restoring the right to receive a rebate from goods exported through

Patagonian ports (previously cancelled in 2009). This benefit is

applicable to Hochschild at a rate of approximately 9% of the FOB

value of its exports which amounts to approximately $15 million per

annum. The current estimate for collection is approximately two

years.

In late December 2015, following an announcement by the new

government that they would remove export taxes on agricultural and

industrial products, it was subsequently confirmed that the decree

included removal of the 5% export tax on finished mining products

such as dore (approximately 50% of the mine's output). Along with

the above-mentioned recent elimination of exchange controls and

import restrictions within the country as well as the resulting

devaluation of the peso, the Company expects overall economic and

operating environment in Argentina to improve significantly.

Average realisable prices and sales

Average realisable precious metal prices in Q4 2015 (which are

reported before the deduction of commercial discounts and include

the effects of the existing hedging agreements) were $1,116/ounce

for gold and $15.0/ounce for silver (Q4 2014: $1,222/ounce for gold

and $17.1/ounce for silver).

For 2015 as a whole, average realisable precious metal prices

were $1,159/ounce for gold and 16.0/ounce for silver (2014:

$1,279/ounce for gold and $18.9/ounce for silver).

Brownfield exploration(2)

Arcata

In Q4 2015, 5,956 metres were drilled in the Stephani, Macarena,

Tunel 3 & Tunel 4 veins. Some highlights are presented

below:

Vein Results

-------- ------------------------

Tunel 3 DDH871-GE15:1.2m @1.04

g/t Au & 1,135 g/t Ag

DDH872-GE15:1.3m @2.09

g/t Au & 1,196 g/t Ag

-------- ------------------------

Tunel 4 DDH878-GE15:1.0m @ 2.4

g/t Au & 3,479 g/t Ag

DDH883-GE15:1.7m @ 1.6

g/t Au & 1,729 g/t Ag

-------- ------------------------

Pallancata

(MORE TO FOLLOW) Dow Jones Newswires

January 20, 2016 02:00 ET (07:00 GMT)

Following the initial discovery of the Pablo vein during the

third quarter, drilling has continued and an initial inferred

resource has been achieved. The Company's preliminary economics for

a two year mine life for the Pablo vein are detailed below.

Resources (unaudited) are estimates based on a cut-off grade of

103g/t silver equivalent.

Pablo

------------------------- ------

Inferred resources (kt)

(unaudited) 1,251

Ag grade (g/t) 344

Au grade (g/t) 1.3

LOM production (M oz Ag

Eq) 12.6

LOM AISC ($/oz Ag Eq) 10.6

------------------------- ------

LOM Cashflows ($m)

----------------------------- --------

Revenue 161.4

Costs (108.5)

Selling expenses (3.0)

Capital expenditure (19.7)

Taxes (SMT & Royalties) (2.4)

Pre-tax total 27.9

----------------------------- --------

NAV @5% (spot metal prices) 24.3

NAV @5% (analyst consensus

prices) 51.8

----------------------------- --------

Spot metal prices: $14/oz Ag; $1,100/oz Au

Analyst Consensus: $17/oz Ag; $1,196/oz Au

Work has started on mine development to access the vein and the

Company currently expects to have initial production from Pablo

towards the end of 2016.

Drilling has continued at the deposit and 7,242 metres were

drilled at Pablo and Yurika veins during the quarter. Preliminary

results are below:

Vein Results

--------------- -----------------------

Pablo DLEP-A21: 9.0m @0.68

g/t Au & 225 g/t Ag

DLEP-A23: 7.1m @1.09

g/t Au & 389 g/t Ag

DLEP-A24: 2.9m @1.34

g/t Au & 334 g/t Ag

DLEP-A25: 9.0m @1.20

g/t Au & 324 g/t Ag

DLEP-A26: 4.7m @0.73

g/t Au & 290 g/t Ag

--------------- -----------------------

Yurika DLYU-A97: 2.8m @1.66

g/t Au & 438 g/t Ag

--------------- -----------------------

Yurika ceiling DLYU-A97: 1.5m @ 3.94

g/t Au & 748 g/t Ag

DLYU-A99: 1.0m @ 0.89

g/t Au & 231 g/t Ag

--------------- -----------------------

Financial position

During the period the Company repaid $105 million of debt

financed from the proceeds of the rights issue completed on 4

November 2015 and existing cash resources. $50 million of the $100

million Scotiabank medium term loan was repaid with the remaining

balance to now amortise on a quarterly basis in 2018 and 2019,

representing a maturity extension from the original terms at the

same interest rate. In addition, $55 million of the $350 million

Senior Notes due 2021 have been repurchased at a discount to par

and have been subsequently cancelled.

Furthermore, the terms of $25 million of short term debt due

December 2015 have been renegotiated such that this tranche of debt

has been rolled over for a further year at an interest rate of

1.35% per annum.

Following this debt repayment programme, total cash was

approximately $83 million as at 31 December 2015, resulting in net

debt of approximately $366 million.

On 6 October 2015, the Company signed agreements to hedge the

sale of 29,000 ounces of gold at $1,145 per ounce and 6.0 million

ounces of silver at $15.93 per ounce for 2016. This is in addition

to a previous agreement for 2016 to hedge the sale of 71,000 ounces

of gold at a price of $1,154 per ounce.

____________________

(2) Please note that in line with industry-wide standards, all

mineralised intersections in this release are quoted as calculated

true widths.

Outlook

The overall production target for 2016 is 32.0 million silver

equivalent ounces, assuming the average silver-to-gold ratio for

2015, which consists of just over 14 million ounces from

Inmaculada, approximately 7 million attributable ounces from the

51% owned San Jose and the balance from the remaining two Peruvian

operations.

The all-in sustaining cost per silver equivalent ounces in 2016

is expected to be between $12 and $13 (projected assuming the

average silver-to-gold ratio for 2015) with Inmaculada costs

forecast to be between $9 and $10 per ounce and San Jose at

approximately $13 per ounce with the remaining Peruvian mines at

approximately $14.5 per ounce.

The overall capital expenditure budget for 2016 is approximately

$100 million allocated to sustaining and development expenditure.

This consists of: approximately $35 million at Inmaculada; $10

million to develop the Pablo vein structure; $23 million at Arcata;

and the balance of $30 million at the San Jose operation.

__________________________________________________________________________________

Enquiries:

Hochschild Mining plc

Charles Gordon +44 (0)20 3714 9040

Head of Investor Relations

Hudson Sandler

Charlie Jack +44 (0)207 796 4133

Public Relations

__________________________________________________________________________________

About Hochschild Mining plc

Hochschild Mining plc is a leading precious metals company

listed on the London Stock Exchange (HOCM.L / HOC LN) with a

primary focus on the exploration, mining, processing and sale of

silver and gold. Hochschild has over fifty years' experience in the

mining of precious metal epithermal vein deposits and currently

operates four underground epithermal vein mines, three located in

southern Peru and one in southern Argentina. Hochschild also has

numerous long-term projects throughout the Americas.

PRODUCTION & SALES INFORMATION*

TOTAL GROUP PRODUCTION

Q4 Q3 Q4 2014 12 mths 12 mths

2014

2015 2015 2015

----------------------- ------- ------- ---------- -------- --------

Silver production

(koz) 5,322 5,014 5,075 18,037 19,357

Gold production

(koz) 82.87 69.18 37.72 213.37 147.03

Total silver

equivalent (koz) 11,454 10,133 7,866 33,827 30,237

Total silver

equivalent (koz)

(60:1) 10,294 9,165 7,338 30,840 28,179

Total gold equivalent

(koz) 154.78 136.93 106.30 457.12 408.61

Total gold equivalent

(koz) (60:1) 171.57 152.74 122.31 513.99 469.65

Silver sold

(koz) 5,866 3,612 5,236 17,263 18,981

Gold sold (koz) 96.61 32.78 40.00 187.39 142.77

----------------------- ------- ------- ---------- -------- --------

Total production includes 100% of all production, including

production attributable to Hochschild's joint venture partner at

San Jose.

ATTRIBUTABLE GROUP PRODUCTION

Q4 Q3 Q4 2014 12 mths 12 mths

2014

2015 2015 2015

------------------- ------- ------- ---------- -------- --------

Silver production

(koz) 4,345 4,142 4,115 14,752 16,187

Gold production

(koz) 68.44 56.97 24.38 166.02 100.89

Silver equivalent

(koz) 9,410 8,358 5,919 27,037 23,653

Silver equivalent

(koz) (60:1) 8,452 7,560 5,578 24,713 22,241

Gold equivalent

(koz) 127.16 112.94 79.99 365.37 319.64

Gold equivalent

(koz) (60:1) 140.86 126.00 92.96 411.88 370.68

------------------- ------- ------- ---------- -------- --------

Attributable production includes 100% of all production from

Arcata, Pallancata and Ares and 51% from San Jose.

QUARTERLY PRODUCTION BY MINE

ARCATA

Product Q4 Q3 Q4 2014 12 mths 12 mths

2014

2015 2015 2015

------------------- ------------ ------------ ------------ -------- ------------------

Ore production

(tonnes treated) 184,994 162,133 186,486 648,051 701,947

Average grade

silver (g/t) 288 331 307 323 286

Average grade

gold (g/t) 1.03 0.99 0.90 0.99 0.85

Silver produced

(koz) 1,453 1,434 1,579 5,613 5,827

Gold produced

(koz) 4.58 3.92 4.40 15.67 16.89

Silver equivalent

(koz) 1,792 1,725 1,904 6,772 7,077

Silver equivalent

(koz) (60:1) 1,728 1,670 1,843 6,553 6,841

Silver sold

(koz) 1,798 1,172 1,550 5,653 5,621

Gold sold (koz) 5.30 3.07 4.06 15.29 15.66

------------------- ------------ ------------ ------------ -------- ------------------

(MORE TO FOLLOW) Dow Jones Newswires

January 20, 2016 02:00 ET (07:00 GMT)

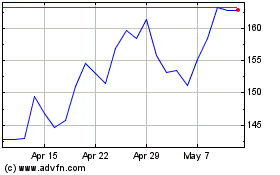

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Apr 2023 to Apr 2024