TIDMHOC

RNS Number : 8783T

Hochschild Mining PLC

18 October 2017

__________________________________________________________________________________

18 October 2017

Production Report for the 9 months ended 30 September 2017

Please click on the link below to open a PDF version of this

announcement:

http://www.rns-pdf.londonstockexchange.com/rns/8783T_1-2017-10-17.pdf

Ignacio Bustamante, Chief Executive Officer said:

"Hochschild achieved record production levels in Q3 2017 driven

by a strong performance from Inmaculada and we are firmly on track

to hit our 37 million silver equivalent ounce target for the year.

Costs remain under control and we can look forward to our financial

position improving in the near future with good cashflow generation

and a planned debt re-financing in the first quarter of next

year.

The Pablo permitting process continues as expected with no major

issues encountered so far. We are currently in the final stages and

we expect to receive the environmental permit by the end of the

month.

We are now in the middle of our brownfield exploration campaign

and have seen some encouraging results from Arcata, San Jose and

also at Inmaculada where underground drilling has already revealed

a number of new veins close to the original Angela vein.

Furthermore, with the permit recently received from the Peruvian

government, we can now begin the surface drilling campaign at the

deposit."

Operational highlights

-- Record quarterly attributable production([1])

o 5.3 million ounces of silver

o 67,234 ounces of gold

o 10.3 million silver equivalent ounces

o 139,388 gold equivalent ounces

-- Q3 YTD 2017 attributable production in line with

expectations

o 14.3 million ounces of silver

o 188,664 ounces of gold

o 28.2 million silver equivalent ounces (Q3 YTD 2016: 26.9

million silver equivalent ounces)

o 381,596 gold equivalent ounces (Q3 YTD 2016: 363,001 gold

equivalent ounces)

-- On track to deliver overall 2017 production target of 37

million silver equivalent ounces

-- 2017 all-in sustaining costs per silver equivalent ounce

expected to meet $12.2-12.7 guidance

Exploration highlights

-- Inmaculada surface drilling permit received for all planned

exploration campaigns in 2017/2018

-- All drilling permits secured for Arcata's 2017/2018

brownfield exploration programme

-- Encouraging results year-to-date from brownfield exploration

programme at all operations

Strengthening financial position

-- Total cash of approximately $156 million as at 30 September

2017 ($140 million as at 31 December 2016)

-- Net debt of approximately $147 million as at 30 September

2017 ($187 million as at 31 December 2016)

-- Current Net Debt/LTM EBITDA of approximately 0.54x as of 30

September 2017

__________________________________________________________________________________

A conference call will be held at 2.30pm (London time) on

Wednesday 18 October 2017 for analysts and investors.

Dial in details as follows:

International Dial in: +44 333 300 0804

UK Toll-Free Number: 0800 358 9473

Pin: 57446849#

A recording of the conference call will be available for one

week following its conclusion, accessible from the following

telephone number:

International: +44 333 300 0819

UK Toll Free: 0800 358 2049

Pin: 301205236#

__________________________________________________________________________________

Overview

In Q3 2017, the Company delivered record attributable production

of 10.3 million silver equivalent ounces (139,388 gold equivalent

ounces) with Pallancata continuing to deliver tonnage and grades

above expectations whilst Inmaculada recorded its second strongest

quarter to date. Overall year-to-date production is a record 28.2

million silver equivalent ounces (381,596 gold equivalent ounces),

placing the Company firmly on course to reach its 37 million ounce

target for the year.

The Company reiterates that its all-in sustaining cost per

silver equivalent ounce for 2017 is on track to be between $12.2

and $12.7.

TOTAL GROUP PRODUCTION

Q3 2017 Q2 2017 Q3 2016 YTD 2017 YTD 2016

----------------------- -------- -------- -------- --------- ---------

Silver production

(koz) 6,087 5,599 5,908 16,516 15,652

Gold production

(koz) 79.10 73.29 78.91 223.37 218.34

Total silver

equivalent (koz) 11,940 11,022 11,747 33,046 31,810

Total gold equivalent

(koz) 161.36 148.95 158.75 446.56 429.86

Silver sold

(koz) 5,726 5,908 6,011 16,234 16,095

Gold sold (koz) 73.99 75.70 77.85 217.41 223.95

----------------------- -------- -------- -------- --------- ---------

Total production includes 100% of all production, including

production attributable to Hochschild's joint venture partner at

San Jose.

ATTRIBUTABLE GROUP PRODUCTION

Q3 2017 Q2 2017 Q3 2016 YTD 2017 YTD 2016

------------------- -------- -------- -------- --------- ---------

Silver production

(koz) 5,339 4,824 4,999 14,277 13,209

Gold production

(koz) 67.23 60.81 66.38 188.66 184.50

Silver equivalent

(koz) 10,315 9,324 9,911 28,238 26,862

Gold equivalent

(koz) 139.39 126.01 133.94 381.60 363.00

------------------- -------- -------- -------- --------- ---------

Attributable production includes 100% of all production from

Arcata, Inmaculada, Pallancata and 51% from San Jose.

Production

Inmaculada

Product Q3 2017 Q2 2017 Q3 2016 YTD 2017 YTD 2016

------------------- ------------ -------- ------------ --------- -----------------

Ore production

(tonnes treated) 343,990 330,393 343,247 958,343 962,407

Average grade

silver (g/t) 149 148 132 145 132

Average grade

gold (g/t) 4.19 3.80 4.09 4.10 4.19

Silver produced

(koz) 1,499 1,405 1,318 4,143 3,688

Gold produced

(koz) 43.72 38.03 42.48 123.54 121.68

Silver equivalent

(koz) 4,735 4,219 4,461 13,285 12,692

Gold equivalent

(koz) 63.98 57.01 60.29 179.53 171.52

Silver sold

(koz) 1,410 1,448 1,270 4,052 3,738

Gold sold (koz) 40.52 38.35 40.66 118.84 122.83

------------------- ------------ -------- ------------ --------- -----------------

Inmaculada's third quarter production was 43,722 ounces of gold

and 1.5 million ounces of silver which amounts to gold equivalent

production of 63,981 ounces and was principally driven by higher

than expected extracted grades. Year-to-date, Inmaculada has

delivered gold equivalent production of 179,528 ounces, which

represents a 5% improvement on the same period of 2016 (Q3 YTD

2016: 171,520 ounces). Inmaculada is on track to meet its full year

forecast of approximately 230,000 gold equivalent ounces (17

million silver equivalent ounces).

Arcata

Product Q3 2017 Q2 2017 Q3 2016 YTD 2017 YTD 2016

------------------- ------------ -------- ------------ --------- ---------

Ore production

(tonnes treated) 117,358 129,215 173,784 379,001 507,181

Average grade

silver (g/t) 300 308 348 306 334

Average grade

gold (g/t) 1.05 1.06 1.30 1.08 1.25

Silver produced

(koz) 1,003 1,138 1,705 3,306 4,675

Gold produced

(koz) 3.52 3.90 6.33 11.56 16.69

Silver equivalent

(koz) 1,264 1,427 2,174 4,162 5,910

Gold equivalent

(koz) 17.08 19.28 29.37 56.24 79.87

Silver sold

(koz) 990 1,139 1,751 3,250 4,672

Gold sold (koz) 3.41 3.71 6.26 11.35 16.39

------------------- ------------ -------- ------------ --------- ---------

At Arcata, silver production in the third quarter was 1.0

million ounces with gold production of 3,516 ounces which resulted

in silver equivalent production of 1.3 million ounces. Production

for the first nine months of 2017 was 4.2 million silver equivalent

ounces (Q3 YTD 2016: 5.9 million ounces) which reflected reduced

tonnage and silver grades following a revision of the mine plan to

accommodate a lower number of stopes and narrower veins.

Pallancata

Product Q3 2017 Q2 2017 Q3 2016 YTD 2017 YTD 2016

------------------- ------------- -------- ------------- --------- ---------

Ore production

(tonnes treated) 152,087 121,282 82,147 345,031 217,884

Average grade

silver (g/t) 471 424 438 454 377

Average grade

gold (g/t) 1.80 1.75 1.98 1.81 1.85

Silver produced

(koz) 2,058 1,475 1,030 4,497 2,303

Gold produced

(koz) 7.65 5.90 4.54 17.44 10.91

Silver equivalent

(koz) 2,624 1,912 1,365 5,788 3,110

Gold equivalent

(koz) 35.46 25.83 18.45 78.21 42.03

Silver sold

(koz) 1,838 1,558 1,023 4,275 2,338

Gold sold (koz) 6.85 6.23 4.46 16.57 10.96

------------------- ------------- -------- ------------- --------- ---------

The Pallancata operation produced 2.1 million ounces of silver

and 7,650 ounces of gold bringing the silver equivalent total to

2.6 million ounces. For the first nine months this has led to a

better-than-expected 5.8 million silver equivalent ounces (Q3 YTD

2016: 3.1 million ounces) driven by better than forecast tonnage

and grades.

San Jose (the Company has a 51% interest in San Jose)

Product Q3 2017 Q2 2017 Q3 2016 YTD 2017 YTD 2016

------------------- ------------ -------- ------------ --------- ---------

Ore production

(tonnes treated) 137,548 135,439 140,366 387,943 389,132

Average grade

silver (g/t) 406 418 469 425 454

Average grade

gold (g/t) 6.35 6.68 6.44 6.51 6.26

Silver produced

(koz) 1,526 1,581 1,855 4,570 4,987

Gold produced

(koz) 24.21 25.46 25.57 70.83 69.06

Silver equivalent

(koz) 3,318 3,465 3,747 9,811 10,097

Gold equivalent

(koz) 44.84 46.82 50.64 132.59 136.45

Silver sold

(koz) 1,489 1,763 1,967 4,657 5,347

Gold sold (koz) 23.22 27.41 26.47 70.65 73.77

------------------- ------------ -------- ------------ --------- ---------

The San Jose mine in Argentina has continued to be a solid

performer with consistent tonnage offsetting slightly lower gold

grades and resulting in production of 1.5 million ounces of silver

and 24,208 ounces of gold (3.3 million silver equivalent ounces).

The first nine months' overall production was 4.6 million ounces of

silver and 70,825 ounces of gold which is 9.8 million silver

equivalent ounces, broadly in line with the same of 2016.

Average realisable prices and sales

Average realisable precious metal prices in Q3 2017 (which are

reported before the deduction of commercial discounts) were

$1,293/ounce for gold and $16.9/ounce for silver (Q3 2016:

$1,254/ounce for gold and $18.6/ounce for silver). For the first

nine months of 2017, average realisable precious metal prices were

$1,265/ounce for gold and $17.1/ounce for silver (Q3 YTD 2016:

$1,205/ounce for gold and $16.4/ounce for silver).

Brownfield exploration

At Arcata, in the third quarter over 5,000m of resource drilling

has been carried out at the Ramal Marion and Paralelas veins whilst

6,200m of potential drilling has been executed in the Tunel 3,

Tunel 4, Pamela and Veta Paralelas veins. The outcome of drilling

year-to-date is promising with selected results below:

Vein Results

------------- --------------------------------

Ramal Marion DDH-018-GE-17: 1.0m @ 1.0g/t

Au & 326g/t Ag

DDH-023-GE-17: 0.8m @ 0.6g/t

Au & 154g/t Ag

DDH-049-EX-17: 0.8m @ 0.6g/t

Au & 146g/t Ag

DDH-054-EX-17: 0.8m @ 0.4g/t

Au & 201g/t Ag

DDH-023-GE-17: 0.8m @ 0.9g/t

Au & 246g/t Ag

DDH-043-EX-17: 1.2m @ 0.3g/t

Au & 159g/t Ag

DDH-058-EX-17: 1.0m @ 2.1g/t

Au & 712g/t Ag

DDH-066-EX-17: 1.3m @ 0.4g/t

Au & 167g/t Ag

DDH-018-GE-17: 1.2m @ 2.6g/t

Au & 1,229g/t Ag

DDH-023-GE-17: 0.8m @ 1.0g/t

Au & 227g/t Ag

DDH-043-EX-17: 0.8m @ 0.2g/t

Au & 477g/t Ag

DDH-058-EX-17: 0.9m @ 0.5g/t

Au & 309/t Ag

DDH-043-EX-17: 0.8m @ 0.2g/t

Au & 132g/t Ag

DDH-052-EX-17: 0.8m @ 0.4g/t

Au & 106g/t Ag

DDH-066-EX-17: 1.2m @ 1.1g/t

Au & 408g/t Ag

DDH-018-GE-17: 0.8m @ 0.9g/t

Au & 303g/t Ag

DDH-023-GE-17: 1.1m @ 3.8g/t

Au & 1,025g/t Ag

------------- --------------------------------

Paralela DDH-036-GE-17: 0.8m @ 4.9g/t

Au & 605g/t Ag

DDH-038-GE-17: 0.8m @ 1.5g/t

Au & 198g/t Ag

DDH-048-DI-17: 0.4m @ 3.9g/t

Au & 389g/t Ag

DDH-074-DI-17: 1.2m @ 1.8g/t

Au & 176g/t Ag

DDH-056-DI-17: 0.8m @ 1.5g/t

Au & 177g/t Ag

------------- --------------------------------

Paralela 1 DDH-036-GE-17: 0.8m @ 5.2g/t

Au & 692g/t Ag

DDH-038-GE-17: 0.8m @ 1.4g/t

Au & 240g/t Ag

DDH-048-DI-17: 0.8m @ 6.6g/t

Au & 765g/t Ag

------------- --------------------------------

Paralela 2 DDH-057-DI-17: 1.1m @ 3.0g/t

Au & 244g/t Ag

DDH-028-GE-17: 0.9m @ 2.6g/t

Au & 226g/t Ag

------------- --------------------------------

Paralela 3 DDH-056-DI-17: 1.1m @ 2.1g/t

Au & 331g/t Ag

DDH-074-DI-17: 1.8m @ 12.2g/t

Au & 1,339g/t Ag

DDH-041-DI-17: 1.3m @ 1.4g/t

Au & 173g/t Ag

DDH-038-GE-17: 0.8m @ 1.7g/t

Au & 117g/t Ag

------------- --------------------------------

Socorro+800 DDH-074-DI-17: 2.5m @ 12.2g/t

Au & 399g/t Ag

------------- --------------------------------

Tunel 4 DDH-087-GE-17: 0.8m @ 1.6g/t

Au & 850g/t Ag

DDH-097-DI-17: 1.8m @ 0.9g/t

Au & 397g/t Ag

DDH-103-DI-17: 0.8m @ 0.8g/t

Au & 126g/t Ag

DDH-109-DI-17: 1.3m @ 4.2g/t

Au & 636g/t Ag

DDH-555-S-17: 0.4m @ 1.6g/t Au

& 516g/t Ag

DDH-557-S-17: 1.9m @ 1.5g/t Au

& 205g/t Ag

------------- --------------------------------

In addition, long horizontal drilling for potential resources

has continued during the quarter having started in the Pamela and

Paralelas vein systems in the second quarter with results still

pending. During the fourth quarter drilling, will be carried out at

the Michele, Soledad, Baja and Ramal 4 veins.

At Inmaculada, following the recent receipt from the Peruvian

government of the exploration permit, the 3,600m surface drilling

programme at the Millet vein will commence shortly. In addition,

the permit also encompasses resource drilling that is expected to

start by the end of the first quarter of 2018 at the Millet and

Olinda structures. In addition, mine development during the third

quarter has allowed a reinterpretation of the geological model at

the deposit and has so far identified a further 9.7 million silver

equivalent ounces of resources. Exploratory underground drilling

has also already confirmed the presence of the Millet vein as well

as discovering new structures, Barbara, Thalia and Alessandra.

Supporting intercepts and diagram are provided below.

Vein Results

-------------- -------------------------------

Thalia MIL-17-001: 1.1m @ 3.0g/t Au

& 125g/t Ag

BAR17-017: 1.5m @ 11.0g/t Au

& 67g/t Ag

-------------- -------------------------------

Alessandra MIL-17-001: 1.2m @ 2.9g/t Au

& 227g/t Ag

MIL-17-001: 1.5m @ 1.5g/t Au

& 82g/t Ag

-------------- -------------------------------

Millet MIL-17-001: 3.0m @ 0.7g/t Au

& 35g/t Ag

-------------- -------------------------------

Barbara BAR17-001: 3.9m @ 1.6g/t Au &

235g/t Ag

BAR17-003: 1.3m @ 2.4g/t Au &

419g/t Ag

BAR17-004: 3.0m @ 2.6g/t Au &

175g/t Ag

BAR17-008: 4.3m @ 10.0g/t Au

& 751g/t Ag

BAR17-009: 3.6m @ 1.9g/t Au &

348g/t Ag

BAR17-010: 6.0m @ 15.2g/t Au

& 3,049g/t Ag

BAR17-011: 2.7m @ 6.6g/t Au &

780g/t Ag

BAR17-012: 3.8m @ 6.5g/t Au &

692g/t Ag

BAR17-013: 4.1m @ 11.1g/t Au

& 1,449g/t Ag

BAR17-014: 3.5m @ 16.2g/t Au

& 1,227g/t Ag

BAR17-017: 2.4m @ 1.2g/t Au &

70g/t Ag

BAR17-018: 3.6m @ 3.5g/t Au &

132g/t Ag

BAR 17-019: 1.9m @ 3.9g/t Au

& 259g/t Ag

-------------- -------------------------------

Ramal Barbara BAR 17-019: 1.0m @ 1.7g/t Au

& 314g/t Ag

-------------- -------------------------------

View of underground drill holes showing newly discovered

structures close to the Angela vein - please see PDF at top of

announcement

At San Jose, a further 1,846m of drilling for potential

resources was carried out in the third quarter at the Aguas Vivas

zone with the results pending whilst resource drilling has been

carried out close to the San Jose operation with results from the

Molle vein shown below.

Vein Results

------ ------------------------------------

Molle SJD-1651: 0.8m @ 8.4g/t Au &

141g/t Ag

SJM-320: 2.5m @ 5.2g/t Au & 427g/t

Ag

SJM-320: 1.2m @ 46.7g/t Au &

2,256g/t Ag

------ ------------------------------------

Financial position

Total cash was approximately $156 million as at 30 September

2017 following interest and equity dividend payments in the third

quarter resulting in net debt of approximately $147 million. The

Company's cash balance is expected to rise in the fourth

quarter.

Outlook

The Company remains on track to deliver its overall production

target for 2017 of 37.0 million silver equivalent ounces or 500

thousand gold equivalent ounces and also reaffirms its all-in

sustaining cost per silver equivalent ounce forecast of between

$12.2 and $12.7.

__________________________________________________________________________________

Enquiries:

Hochschild Mining plc

Charles Gordon +44 (0)20 3709 3264

Head of Investor Relations

Hudson Sandler

Charlie Jack +44 (0)207 796 4133

Public Relations

__________________________________________________________________________________

About Hochschild Mining plc

Hochschild Mining plc is a leading precious metals company

listed on the London Stock Exchange (HOCM.L / HOC LN) with a

primary focus on the exploration, mining, processing and sale of

silver and gold. Hochschild has over fifty years' experience in the

mining of precious metal epithermal vein deposits and currently

operates four underground epithermal vein mines, three located in

southern Peru and one in southern Argentina. Hochschild also has

numerous long-term projects throughout the Americas.

__________________________________________________________________________________

Forward looking statements

This announcement may contain forward looking statements. By

their nature, forward looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that will or may occur in the future. Actual results,

performance or achievements of Hochschild Mining plc may, for

various reasons, be materially different from any future results,

performance or achievements expressed or implied by such forward

looking statements.

The forward looking statements reflect knowledge and information

available at the date of preparation of this announcement. Except

as required by the Listing Rules and applicable law, the Board of

Hochschild Mining plc does not undertake any obligation to update

or change any forward looking statements to reflect events

occurring after the date of this announcement. Nothing in this

announcement should be construed as a profit forecast.

This announcement contains information which prior to its

release could be considered inside information.

Note

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (Regulation (EU) No.596/2014). Upon the

publication of this announcement via a Regulatory Information

Service, this inside information is now considered to be in the

public domain.

LEI: 549300JK10TVQ3CCJQ89

- ends -

[1] All equivalent figures assume a gold/silver ratio of

74x.

This information is provided by RNS

The company news service from the London Stock Exchange

END

DRLDDLFFDBFZFBF

(END) Dow Jones Newswires

October 18, 2017 02:00 ET (06:00 GMT)

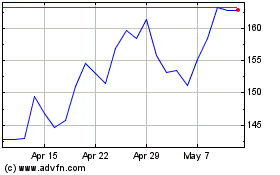

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Apr 2023 to Apr 2024