TIDMHOC

RNS Number : 4045M

Hochschild Mining PLC

13 October 2016

__________________________________________________________________________________

13 October 2016

Production Report for the 3 months ended 30 September 2016

Ignacio Bustamante, Chief Executive Officer said:

"The third quarter of 2016 has delivered a record performance

from our operations and continued the strong trend from the first

half with Inmaculada and Arcata in particular performing better

than expected. We are therefore pleased to announce that we have

raised our target for the year to 35 million silver equivalent

ounces. We have also continued to strengthen our balance sheet with

almost $123 million of debt repaid year-to-date and our cash

balance remaining close to $100 million.

Regarding exploration, we have reported some important progress

in Pallancata, with confirmation of several structures as well as a

high grade area within Pablo."

Operational highlights

-- Record attributable production in Q3 2016(1)

o 5.0 million ounces of silver

o 66.4 thousand ounces of gold

o 9.9 million silver equivalent ounces, up 19% versus Q3 2015

(8.4 million ounces)

o 133.9 thousand gold equivalent ounces

-- Q3 YTD 2016 attributable production driven by strong

Inmaculada performance

o 13.2 million ounces of silver

o 184.5 thousand ounces of gold

o 26.9 million silver equivalent ounces

o 363.0 thousand gold equivalent ounces

Exploration strategy

-- Significant brownfield exploration plan in place which is

expected to extend life of mine ("LOM") and deliver additional low

cost growth

-- Exploration progress at Pallancata delivering positive

results

o Presence of Pablo Pisos confirmed

o High grade area confirmed within Pablo Piso

Strengthening financial position

-- Further $58 million of debt repaid in Q3

-- $123 million of debt repaid to date in 2016

-- Total cash of approximately $96 million as at 30 September

2016 ($84 million as at 31 December 2015)

-- Net debt of approximately $230 million as at 30 September

2016 ($366 million as at 31 December 2015)

-- Current Net debt/LTM EBITDA of approximately 0.65x as of 30

September 2016

Outlook

-- Full year production forecast upgraded to 35 million silver

equivalent ounces (470 thousand gold equivalent ounces)

-- All-in sustaining costs per silver equivalent ounce on track

to be between $11.0-11.5 for 2016

__________________________________________________________________________________

A conference call will be held at 2.30pm (London time) on

Thursday 13 October 2016 for analysts and investors.

Dial in details as follows:

International Dial in: +44 (0) 20 3139 4830

UK Toll-Free Number: +44(0) 808 237 0030

Pin: 56197308#

A recording of the conference call will be available for one

week following its conclusion, accessible from the following

telephone number:

International: +44 (0) 20 3426 2807

UK Toll Free: +44(0) 808 237 0026

Pin: 677672#

_________________________________________________________________________________

Overview

In Q3 2016, the Company delivered a record attributable

production of 133.9 thousand gold equivalent ounces or 9.9 million

silver equivalent ounces. This comprised of 5.0 million ounces of

silver and 66.4 thousand ounces of gold. Overall, in the first nine

months of 2016, the Company delivered attributable production of

363.0 thousand gold equivalent ounces or 26.9 million silver

equivalent ounces, including 13.2 million ounces of silver and

184.5 thousand ounces of gold.

TOTAL GROUP PRODUCTION

Q3 2016 Q2 2016 Q3 2015 YTD 2016 YTD 2015

------------------- -------- -------- -------- --------- ---------

Silver production

(koz) 5,908 5,415 5,014 15,652 12,715

Gold production

(koz) 78.91 79.39 69.18 218.34 130.51

Total silver

equivalent

(koz) 11,747 11,290 10,133 31,810 22,373

Total gold

equivalent

(koz) 158.75 152.57 136.93 429.86 302.34

Silver sold

(koz) 6,011 5,614 3,612 16,095 11,397

Gold sold

(koz) 77.85 83.55 32.78 223.95 90.78

------------------- -------- -------- -------- --------- ---------

Total production includes 100% of all production, including

production attributable to Hochschild's joint venture partner at

San Jose.

ATTRIBUTABLE GROUP PRODUCTION

Q3 2016 Q2 2016 Q3 2015 YTD 2016 YTD 2015

------------------- -------- -------- -------- --------- ---------

Silver production

(koz) 4,999 4,548 4,142 13,209 10,407

Gold production

(koz) 66.38 67.04 56.97 184.50 97.58

Silver equivalent

(koz) 9,911 9,509 8,358 26,862 17,627

Gold equivalent

(koz) 133.94 128.50 112.94 363.00 238.21

------------------- -------- -------- -------- --------- ---------

Attributable production includes 100% of all production from

Arcata, Inmaculada, Pallancata and 51% from San Jose.

Production

Inmaculada

Product Q3 2016 Q2 2016 Q3 2015 YTD 2016 YTD 2015

------------------- ------------ -------- ------------ ----------------- ------------------

Ore production

(tonnes treated) 343,247 338,630 277,486 962,407 329,811

Average grade

silver (g/t) 132 142 116 132 112

Average grade

gold (g/t) 4.09 4.42 4.39 4.19 4.15

Silver produced

(koz) 1,318 1,396 875 3,688 970

Gold produced

(koz) 42.48 45.18 36.12 121.68 39.53

Silver equivalent

(koz) 4,461 4,739 3,547 12,692 3,896

Gold equivalent

(koz) 60.29 64.04 47.94 171.52 52.65

Silver sold

(koz) 1,270 1,585 92 3,738 92

Gold sold (koz) 40.66 50.26 3.64 122.83 3.64

------------------- ------------ -------- ------------ ----------------- ------------------

Inmaculada delivered another strong quarter with gold production

at 42,480 ounces and silver production of 1.3 million ounces (gold

equivalent production of 60 thousand ounces) although grades were

moderately lower than the second quarter due to the higher

proportion of ore from stopes versus developments. Throughout the

first nine months, grades and silver recoveries have been better

than expected in the original mine plan and, combined with the

improved tonnage per day rates, Q3 YTD production has been able to

reach 171.5 thousand gold equivalent ounces (12.7 million silver

equivalent ounces).

Arcata

Product Q3 2016 Q2 2016 Q3 2015 YTD 2016 YTD 2015

------------------- ------------ ------------ ------------ --------- ---------

Ore production

(tonnes treated) 173,784 172,305 162,133 507,181 463,057

Average grade

silver (g/t) 348 345 331 334 337

Average grade

gold (g/t) 1.30 1.31 0.99 1.25 0.97

Silver produced

(koz) 1,705 1,592 1,434 4,675 4,160

Gold produced

(koz) 6.33 5.68 3.92 16.69 11.09

Silver equivalent

(koz) 2,174 2,013 1,725 5,910 4,981

Gold equivalent

(koz) 29.37 27.20 23.31 79.87 67.31

Silver sold

(koz) 1,751 1,572 1,172 4,672 3,855

Gold sold (koz) 6.26 5.70 3.07 16.39 9.99

------------------- ------------ ------------ ------------ --------- ---------

At Arcata, silver production in the second quarter was 1.7

million ounces with gold production of 6,330 ounces which results

in silver equivalent production of 2.2 million ounces, a 26%

improvement on the third quarter of 2015 (Q3 2015: 1.7 million

ounces). As has been the case in the first two quarters of 2016,

this has been driven by better than expected mined tonnage in

addition to higher silver recoveries. Year-to-date Arcata has

produced a very solid 5.9 million silver equivalent ounces, a 19%

improvement on the same period of 2015 (Q3 YTD 2015: 5.0 million

ounces).

Pallancata

Product Q3 2016 Q2 2016 Q3 2015 YTD 2016 YTD 2015

------------------- ------------- ------------- ------------- --------- ---------

Ore production

(tonnes treated) 82,147 66,313 125,560 217,884 415,111

Average grade

silver (g/t) 438 358 272 377 255

Average grade

gold (g/t) 1.98 1.85 1.36 1.85 1.24

Silver produced

(koz) 1,030 658 925 2,303 2,873

Gold produced

(koz) 4.54 3.32 4.23 10.91 12.68

Silver equivalent

(koz) 1,365 903 1,238 3,110 3,811

Gold equivalent

(koz) 18.45 12.21 16.73 42.03 51.50

Silver sold

(koz) 1,023 757 729 2,338 2,715

Gold sold (koz) 4.46 3.76 3.2 10.96 11.53

------------------- ------------- ------------- ------------- --------- ---------

At Pallancata, production in Q3 was 1.0 million ounces of silver

and 4,540 ounces of gold bringing the silver equivalent total to

1.4 million ounces, a slight improvement on the third quarter of

2015 (Q3 2015: 1.2 million). Pallancata itself remains in a

transitional period before the introduction of commercial

production from the Pablo vein in 2017.

San Jose

Product Q3 2016 Q2 2016 Q3 2015 YTD 2016 YTD 2015

------------------- ------------ ------------ ------------ --------- ---------

Ore production

(tonnes treated) 140,366 146,829 144,851 389,132 377,846

Average grade

silver (g/t) 469 428 441 454 445

Average grade

gold (g/t) 6.44 6.09 6.09 6.26 6.25

Silver produced

(koz) 1,855 1,770 1,780 4,987 4,712

Gold produced

(koz) 25.57 25.21 24.90 69.06 67.20

Silver equivalent

(koz) 3,747 3,635 3,623 10,097 9,685

Gold equivalent

(koz) 50.64 49.12 48.96 136.45 130.88

Silver sold

(koz) 1,967 1,699 1,620 5,347 4,735

Gold sold (koz) 26.47 23.83 22.87 73.77 65.62

------------------- ------------ ------------ ------------ --------- ---------

The Company has a 51% interest in San Jose.

San Jose again delivered a strong performance with production of

3.7 million silver equivalent ounces, a 3% improvement on the

corresponding period of 2015, resulting from increased grades (gold

and silver). Silver production in the first nine months totalled

5.0 million ounces and gold production was 69,060 ounces resulting

in silver equivalent production of 10.1 million ounces, a 4%

improvement on the first nine months of 2015 (9.7 million

ounces).

Average realisable prices and sales

Average realisable precious metal prices in Q3 2016 (which are

reported before the deduction of commercial discounts and include

the effects of the existing hedging agreements) were $1,254/ounce

for gold and $18.6/ounce for silver (Q3 2015: $1,165/ounce for gold

and $15.5/ounce for silver). For the first nine months of 2016,

average realisable precious metal prices were $1,242/ounce for gold

and $17.7/ounce for silver (Q3 YTD 2015: $1,205/ounce for gold and

$16.4/ounce for silver).

Brownfield exploration (2)

On 6 September 2016, the Company announced details of a new five

year brownfield exploration plan. Significant brownfield potential

has been identified which is expected to extend LOM at all

operations and deliver additional low cost growth.

Drilling has continued in the third quarter at the Pablo vein in

Pallancata. The results indicate the presence of several

extensional vein sets adjacent to the main Pablo structure - Pablo

Pisos (See figure 1 below). The full extension of these veins will

be determined in the next few months pending further planned

exploration in the fourth quarter. In addition, the Company has

identified an area in Pablo Piso that appears to host higher grade

mineralisation (See table 2).

Updated mineral resources for Pablo and associated structures

will be included at the end of the year within the Company's annual

reserve and resource statement.

Figure 1: Plan view of Pablo Area drill holes showing associated

structures

Table 1 - Drill results in the Pablo Area

Vein Results

------------- ------------------------------

Pablo Piso 1 DLPP-A06: 0.8m @ 0.4g/t Au &

126g/t Ag

DLPP-A01: 1.1m @ 1.3g/t Au &

176g/t Ag

------------- ------------------------------

Pablo Piso 2 DLPP-A01: 0.9m @ 2.4g/t Au &

721g/t Ag

DLEP-A23: 1.4m @ 7.1g/t Au &

3,416g/t Ag

DLEP-A05: 2.3m @ 0.9g/t Au &

291g/t Ag

DLEP-A19: 1.3m @ 0.5g/t Au &

196g/t Ag

DLEP-A12: 1.4m @ 0.9g/t Au &

299g/t Ag

------------- ------------------------------

Pablo Piso 3 DLPP-A01: 1.1m @ 0.6g/t Au &

207g/t Ag

DLEP-A12: 1.3m @ 2.8g/t Au &

795g/t Ag

DLPP-A08: 1.3m @ 1.0g/t Au &

268g/t Ag

------------- ------------------------------

Pablo Piso 4 DLPP-A01: 0.2m @ 0.7g/t Au &

222g/t Ag

DLEP-A12: 0.8m @ 1.4g/t Au &

493g/t Ag

DLEP-A04: 5.2m @ 4.1g/t Au &

1,285g/t Ag

DLEP-A08: 0.9m @ 0.2g/t Au &

134g/t Ag

------------- ------------------------------

Yurika Piso DLYU-A96: 2.1m @ 1.4g/t Au &

248g/t Ag

------------- ------------------------------

Table 2: Selected Drill Hole Results from Pablo Piso

Hole Results

--------- --------------------------------

DLEP-A16 2.1m @ 11.0g/t Au & 3,395g/t

Ag including 1.5m @ 14.6g/t Au

& 4,581g/t Ag

--------- --------------------------------

DLEP-A21 4.2m @ 2.8g/t Au & 579g/t Ag

including 2.2m @ 2.6g/t Au &

842g/t Ag

--------- --------------------------------

DLEP-A24 3.2m @ 1.6g/t Au & 606g/t Ag

including 2.0m @ 2.2g/t Au &

860g/t Ag

--------- --------------------------------

DLPP-A05 6.6m @ 1.1g/t Au & 322g/t Ag

including 1.8m @ 2.7g/t Au &

782g/t Ag

--------- --------------------------------

DLPP-A06 4.6m @ 2.6g/t Au & 813g/t Ag

including 2.8m @ 3.6g/t Au &

1,140g/t Ag

--------- --------------------------------

DLPP-A07 4.1m @ 1.4g/t Au & 483g/t Ag

including 2.3m @ 1.8g/t Au &

644g/t Ag

--------- --------------------------------

DLYU-A31 1.8m @ 1.6g/t Au & 471g/t Ag

including 0.9m @ 2.1g/t Au &

590g/t Ag

--------- --------------------------------

At Arcata, 2,586 metres have been drilled in the third quarter

with results currently pending. In Q4, the Company is planning to

drill 1,400 metres in the Ramal Marion, Roxana and Tunel 4

structures.

At San Jose, no drilling was possible due to the winter season

but in Q4 5,000 metres will be drilled in the Cerro Colorado Grande

area as well as 1,500 metres to the south of the mine.

Financial position

Total cash of approximately $96 million as at 30 September 2016

resulting in net debt of approximately $230 million.

During the period $35 million of short term debt was repaid to

local banks in Peru whilst a further $3 million of short term debt

was repaid in Argentina. All payments were financed from existing

cash resources.

In addition, on 29 September 2016, Hochschild paid the remaining

$20 million to Graña y Montero (GyM), the Inmaculada EPC

contractor, representing additional amounts payable in final

settlement of all claims made by GyM for additional costs under the

EPC Contract.

Outlook

The flagship Inmaculada mine as well as the Arcata and San Jose

operations are delivering a consistently better than expected

production performance and, with Pallancata beginning to improve

its production outlook, the Company is increasing its overall 2016

production forecast from 34 million to 35 million silver equivalent

ounces.

The all-in sustaining cost per silver equivalent ounce target

for 2016 remains on track to be between $11.0 to $11.5 with the

positive impact on mining costs of the increased production

expected to be offset by one-off increases in capital expenditure

at Inmaculada, Pallancata and San Jose.

__________________________________________________________________________________

Enquiries:

Hochschild Mining plc

Charles Gordon +44 (0)20 3714 9040

Head of Investor Relations

Hudson Sandler

Charlie Jack +44 (0)207 796 4133

Public Relations

__________________________________________________________________________________

About Hochschild Mining plc

Hochschild Mining plc is a leading precious metals company

listed on the London Stock Exchange (HOCM.L / HOC LN) with a

primary focus on the exploration, mining, processing and sale of

silver and gold. Hochschild has over fifty years' experience in the

mining of precious metal epithermal vein deposits and currently

operates four underground epithermal vein mines, three located in

southern Peru and one in southern Argentina. Hochschild also has

numerous long-term projects throughout the Americas.

__________________________________________________________________________________

Forward looking statements

This announcement may contain forward looking statements. By

their nature, forward looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that will or may occur in the future. Actual results,

performance or achievements of Hochschild Mining plc may, for

various reasons, be materially different from any future results,

performance or achievements expressed or implied by such forward

looking statements.

The forward looking statements reflect knowledge and information

available at the date of preparation of this announcement. Except

as required by the Listing Rules and applicable law, the Board of

Hochschild Mining plc does not undertake any obligation to update

or change any forward looking statements to reflect events

occurring after the date of this announcement. Nothing in this

announcement should be construed as a profit forecast.

This announcement contains information which prior to its

release could be considered inside information.

- ends -

(1) All equivalent figures assume the average gold/silver ratio

for 2015 of 74x.

(2) Please note that in line with industry-wide standards, all

mineralised intersections in this release are quoted as calculated

true widths subject to error

This information is provided by RNS

The company news service from the London Stock Exchange

END

QRTDLLFFQBFEFBQ

(END) Dow Jones Newswires

October 13, 2016 02:00 ET (06:00 GMT)

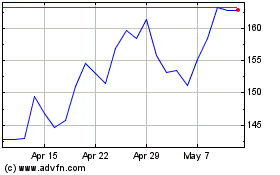

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Apr 2023 to Apr 2024