TIDMHOC

RNS Number : 7965E

Hochschild Mining PLC

21 July 2016

__________________________________________________________________________________

21 July 2016

Production Report for the 6 months ended 30 June 2016

Ignacio Bustamante, Chief Executive Officer said:

"The first half of 2016 has proved to be pivotal in Hochschild's

recent history with the delivery of strong production results,

continued cost reduction, further debt repayments and recently,

re-entry into the FTSE 250 Index. Our Inmaculada operation has

performed above expectations and is on track to exceed its

production and cost targets for the year emphasising its world

class competitive position. We are now raising our target for

overall 2016 production by 6% to 34 million silver equivalent

ounces whilst at revising our all all-in sustaining cost down to

between $11.0 and $11.5 per silver equivalent ounce. Furthermore,

despite additional debt repayment, our cash position remains very

strong at over $100 million."

Operational highlights

-- Q2 2016 attributable production exceeded expectations(1)

o 4.5 million ounces of silver

o 67.0 thousand ounces of gold

o 9.5 million silver equivalent ounces, up 86% versus Q2 2015

(5.1 million ounces)

o 128.5 thousand gold equivalent ounces

-- H1 2016 attributable production driven by strong Inmaculada

performance

o 8.2 million ounces of silver

o 118.1 thousand ounces of gold

o 17.0 million silver equivalent ounces

o 229.1 thousand gold equivalent ounces

o Inmaculada produced 111.2 thousand gold equivalent ounces

Strengthening financial position

-- $70m of debt repaid to date in 2016

-- Total cash of approximately $103 million as at 30 June 2016

($84 million as at 31 December 2015)

-- Net debt of approximately $280 million as at 30 June 2016

($366 million as at 31 December 2015)

Revised outlook

-- Full year production now forecast to be 34 million silver

equivalent ounces (460 thousand gold equivalent ounces) from 32

million ounces

-- All-in sustaining costs per silver equivalent ounce now

expected to be between $11.0-11.5 for 2016 (previously $12.0-

12.5)

Capital Markets Event

-- Capital Markets Event to be held on 6th September 2016 in

London

__________________________________________________________________________________

A conference call will be held at 2.30pm (London time) on

Thursday 21 July 2016 for analysts and investors.

Dial in details as follows:

International Dial in: +44 (0) 20 3139 4830

UK Toll-Free Number: +44(0) 808 237 0030

Pin: 38264089#

A recording of the conference call will be available for one

week following its conclusion, accessible from the following

telephone number:

International: +44 (0) 20 3426 2807

UK Toll Free: +44(0) 808 237 0026

Pin: 674714#

________________

(1) All equivalent figures assume the average gold/silver ratio

for 2015 of 74x.

_________________________________________________________________________________

Overview

In Q2 2016, the Company delivered attributable production of

128.5 thousand gold equivalent ounces or 9.5 million silver

equivalent ounces. This comprised of 4.5 million ounces of silver

and 67.0 thousand ounces of gold. Overall, in the first half of

2016, the Company delivered attributable production of 229.1

thousand gold equivalent ounces or 17.0 million silver equivalent

ounces, including 8.2 million ounces of silver and 118.1 thousand

ounces of gold.

TOTAL GROUP PRODUCTION

Q2 2016 Q1 2016 Q2 2015 H1 2016 H1 2015

------------------- -------- -------- -------- -------- --------

Silver production

(koz) 5,415 4,329 4,178 9,744 7,701

Gold production

(koz) 79.39 60.04 34.67 139.43 61.33

Total silver

equivalent

(koz) 11,290 8,772 6,744 20,062 12,240

Total gold

equivalent

(koz) 152.57 118.54 91.13 271.11 165.40

Silver sold

(koz) 5,614 4,471 4,437 10,085 7,785

Gold sold

(koz) 83.55 62.54 32.36 146.10 58.01

------------------- -------- -------- -------- -------- --------

Total production includes 100% of all production, including

production attributable to Hochschild's joint venture partner at

San Jose.

ATTRIBUTABLE GROUP PRODUCTION

Q2 2016 Q1 2016 Q2 2015 H1 2016 H1 2015

------------------- -------- -------- -------- -------- --------

Silver production

(koz) 4,548 3,662 3,386 8,210 6,265

Gold production

(koz) 67.04 51.08 23.40 118.12 40.60

Silver equivalent

(koz) 9,509 7,442 5,117 16,951 9,269

Gold equivalent

(koz) 128.50 100.56 69.15 229.06 125.26

------------------- -------- -------- -------- -------- --------

Attributable production includes 100% of all production from

Arcata, Inmaculada, Pallancata and 51% from San Jose.

Production

Inmaculada

Product Q2 2016 Q1 2016 Q2 2015 H1 2016 H1 2015

------------------- -------- ------------------ --------- ------------------ ------------

Ore production

(tonnes treated) 338,630 280,530 52,325 619,161 52,325

Average grade

silver (g/t) 142 121 89.16 132 89.16

Average grade

gold (g/t) 4.42 4.05 2.92 4.25 2.92

Silver produced

(koz) 1,396 974 95 2,370 95.45

Gold produced

(koz) 45.18 34.02 3.42 79.20 3.42

Silver equivalent

(koz) 4,739 3,492 348 8,231 348

Gold equivalent

(koz) 64.04 47.19 4.71 111.23 4.71

Silver sold

(koz) 1,585 882 - 2,468 -

Gold sold (koz) 50.26 31.91 - 82.17 -

------------------- -------- ------------------ --------- ------------------ ------------

Inmaculada delivered its strongest quarter since commissioning

with gold production at 45,000 ounces and silver production of1.4

million ounces (gold equivalent production of 64 thousand ounces).

Throughout the first half, grades and silver recoveries have been

better than expected in the original mine plan and, combined with

the ongoing improved tonnage per day rates, H1 production was able

to reach 111 thousand gold equivalent ounces (8.2 million silver

equivalent ounces).

Arcata

Product Q2 2016 Q1 2016 Q2 2015 H1 2016 H1 2015

------------------- ------------ -------- ------------ -------- --------

Ore production

(tonnes treated) 172,305 161,092 155,373 333,397 300,924

Average grade

silver (g/t) 345 309 349.56 327 340

Average grade

gold (g/t) 1.31 1.13 0.97 1.22 0.97

Silver produced

(koz) 1,592 1,377 1,439 2,970 2,726

Gold produced

(koz) 5.68 4.68 3.69 10.36 7.17

Silver equivalent

(koz) 2,013 1,724 1,713 3,736 3,256

Gold equivalent

(koz) 27.20 23.29 23.14 50.49 44.00

Silver sold

(koz) 1,572 1,349 1,626 2,922 2,683

Gold sold (koz) 5.70 4.43 4.07 10.14 6.92

------------------- ------------ -------- ------------ -------- --------

At Arcata, silver production in the second quarter was 1.6

million ounces with gold production of 5,700 ounces which results

in silver equivalent production of 2.0 million ounces, an 18%

improvement on the first quarter of 2015 (Q2 2015: 1.7 million

ounces). As in the first quarter this has been driven by better

than expected mined tonnage resulting from the success of the

Company's 2015 brownfield exploration programme in addition to

higher silver recoveries. Overall in the first half Arcata has

produced a very solid 3.7 million silver equivalent ounces (H1

2015: 3.3 million ounces).

Pallancata

Product Q2 2016 Q1 2016 Q2 2015 H1 2016 H1 2015

------------------- ------------- -------- ------------- -------- --------

Ore production

(tonnes treated) 66,313 69,423 140,829 135,736 289,551

Average grade

silver (g/t) 358 324 268 341 248

Average grade

gold (g/t) 1.85 1.69 1.32 1.77 1.19

Silver produced

(koz) 658 615 1,026 1,273 1,948

Gold produced

(koz) 3.32 3.05 4.55 6.37 8.44

Silver equivalent

(koz) 903 841 1,363 1,745 2,573

Gold equivalent

(koz) 12.21 11.37 18.42 23.58 34.77

Silver sold

(koz) 757 559 1,135 1.315 1,986

Gold sold (koz) 3.76 2.74 4.85 6.50 8.33

------------------- ------------- -------- ------------- -------- --------

At Pallancata, as expected, tonnage through the plant in the

first half was lower than the average 2015 rate with operations in

a transitionary period before the introduction of feed from the new

Pablo vein towards the end of the year. Production in Q2 was

658,000 ounces of silver and 3,320 ounces of gold bringing the

silver equivalent total to 903,000 ounces (Q2 2015: 1.1

million).

The 950 metre ramp to reach the Pablo vein has now been

completed and approximately 600 metres of further mine

infrastructure has also been developed. Currently work is advancing

on the vein gallery. The Company remains on track to start

production at the end of 2016.

San Jose

Product Q2 2016 Q1 2016 Q2 2015 H1 2016 H1 2015

------------------- ------------ -------- -------- -------- --------

Ore production

(tonnes treated) 146,829 101,937 124,224 248,766 232,995

Average grade

silver (g/t) 428 470 466 446 448

Average grade

gold (g/t) 6.09 6.27 6.47 6.16 6.34

Silver produced

(koz) 1,770 1,362 1,617 3,132 2,932

Gold produced

(koz) 25.21 18.28 23.01 43.49 42.30

Silver equivalent

(koz) 3,635 2,715 3,320 6,350 6,062

Gold equivalent

(koz) 49.12 36.39 44.86 85.81 81.92

Silver sold

(koz) 1,699 1,681 1,676 3,380 3,115

Gold sold (koz) 23.83 23.46 23.45 47.29 42.75

------------------- ------------ -------- -------- -------- --------

The Company has a 51% interest in San Jose.

The San Jose operation delivered yet another solid quarter at

3.6 million silver equivalent ounces, slightly ahead of the

corresponding period of 2015, resulting from better than planned

grades (gold and silver) and higher than expected tonnage. Silver

production in the first half totalled 3.1 million ounces and gold

production was 43,490 ounces resulting in silver equivalent

production of 6.4 million ounces, a 5% improvement on the H1 2015

(6.1 million ounces).

Average realisable prices and sales

Average realisable precious metal prices in Q2 2016 (which are

reported before the deduction of commercial discounts and include

the effects of the existing hedging agreements) were $1,213/ounce

for gold and $17.9/ounce for silver (Q2 2015: $1,212/ounce for gold

and $16.3/ounce for silver). For H1 2016, average realisable

precious metal prices were $1,236/ounce for gold and $17.1/ounce

for silver (H1 2015: $1,227/ounce for gold and $16.9/ounce for

silver).

Brownfield exploration

Due to the rainy season in Peru, exploration programmes only

commenced in the second quarter.

At Arcata 2,135 metres were drilled in the first half to test

North-South structures in the central area of the mine. The plan

for the remainder of the year is to drill in the Tunel 4 zone to

extend existing structures and identify new ones. Some highlights

are presented below:

Vein Results

----------------- -------------------------

Ramal Marion Sur DDH-941-GE16:1.3m @ 1.8

g/t Au & 576 g/t Ag

DDH-943-GE16:1.3m @ 4.1

g/t Au & 2,157 g/t Ag

----------------- -------------------------

Tunel 4 DDH-912-GE16:7.8m @ 1.1

g/t Au & 205 g/t Ag

DDH-939-LM16:1.3m @ 3.6

g/t Au & 2,655 g/t Ag

----------------- -------------------------

At Pallancata, a drilling campaign has just begun to the north

and south of the Pablo structure to test anomalies and add

potential resources (potentially an extension of the Luisa vein).

So far, 698m have been drilled with results pending.

At San Jose 1,240m has been drilled mainly in the Aguas Vivas

area with the programme ongoing.

Financial position

Total cash was approximately $103 million with net debt of

approximately $280 million as at 30 June 2016.

On 8 June 2016, the remaining $50 million of the original $100

million Scotiabank medium term loan was prepaid with no penalties.

In addition, on 17 June 2016 and 4 July 2016, a further $15 million

and $5 million respectively of short term debt was repaid to BBVA

in Peru. All payments were financed from existing cash

resources.

Outlook

Following better than expected performances from the Inmaculada

and Arcata mines, Hochschild has increased its full year production

guidance from 32.0 million to 34 million of attributable silver

equivalent ounces.

The all-in sustaining cost per silver equivalent ounce target

has also been revised and is now expected to be between $11.0 to

$11.5, a significant improvement on the previous guidance of $12.0

to $12.5 per ounce.

__________________________________________________________________________________

Enquiries:

Hochschild Mining plc

Charles Gordon +44 (0)20 3714 9040

Head of Investor Relations

Hudson Sandler

Charlie Jack +44 (0)207 796 4133

Public Relations

__________________________________________________________________________________

About Hochschild Mining plc

Hochschild Mining plc is a leading precious metals company

listed on the London Stock Exchange (HOCM.L / HOC LN) with a

primary focus on the exploration, mining, processing and sale of

silver and gold. Hochschild has over fifty years' experience in the

mining of precious metal epithermal vein deposits and currently

operates four underground epithermal vein mines, three located in

southern Peru and one in southern Argentina. Hochschild also has

numerous long-term projects throughout the Americas.

__________________________________________________________________________________

Forward looking statements

This announcement may contain forward looking statements. By

their nature, forward looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that will or may occur in the future. Actual results,

performance or achievements of Hochschild Mining plc may, for

various reasons, be materially different from any future results,

performance or achievements expressed or implied by such forward

looking statements.

The forward looking statements reflect knowledge and information

available at the date of preparation of this announcement. Except

as required by the Listing Rules and applicable law, the Board of

Hochschild Mining plc does not undertake any obligation to update

or change any forward looking statements to reflect events

occurring after the date of this announcement. Nothing in this

announcement should be construed as a profit forecast.

This announcement contains information which prior to its

release could be considered inside information.

- ends -

This information is provided by RNS

The company news service from the London Stock Exchange

END

DRLQBLFLQDFEBBE

(END) Dow Jones Newswires

July 21, 2016 02:00 ET (06:00 GMT)

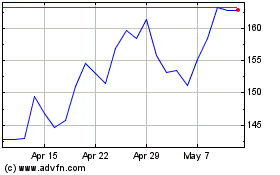

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hochschild Mining (LSE:HOC)

Historical Stock Chart

From Apr 2023 to Apr 2024